Vanessa lives in Eugene, Oregon along with her boyfriend and three cats, Freya, Orpheus and Gandalf. Vanessa works because the Licensing & Contracts Officer for the College of Oregon and is an lawyer by coaching. In 2018, she purchased her first residence and is now going through the prospect of some expensive renovations or the potential of promoting this residence and shopping for a distinct place. She and her boyfriend are additionally within the technique of discerning whether or not or not they wish to keep collectively for the long-term, which is able to understandably affect her funds. We’re off to the Pacific Northwest immediately to assist Vanessa type via these attainable life adjustments.

What’s a Reader Case Examine?

Case Research tackle monetary and life dilemmas that readers of Frugalwoods ship in requesting recommendation. Then, we (that’d be me and YOU, expensive reader) learn via their scenario and supply recommendation, encouragement, perception and suggestions within the feedback part.

For an instance, try the last case study. Case Research are up to date by contributors (on the finish of the submit) a number of months after the Case is featured. Go to this page for hyperlinks to all up to date Case Research.

The Purpose Of Reader Case Research

Reader Case Research intend to spotlight a various vary of economic conditions, ages, ethnicities, places, objectives, careers, incomes, household compositions and extra!

The Case Examine collection started in 2016 and, thus far, there’ve been 77 Case Studies. I’ve featured people with annual incomes starting from $17k to $200k+ and internet worths starting from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured homosexual, straight, queer, bisexual and polyamorous individuals. I’ve featured girls, non-binary people and males. I’ve featured transgender and cisgender individuals. I’ve had cat individuals and canine individuals. I’ve featured people from the US, Australia, Canada, England, South Africa, Spain, Finland, Germany and France. I’ve featured individuals with PhDs and folks with highschool diplomas. I’ve featured individuals of their early 20’s and folks of their late 60’s. I’ve featured people who dwell on farms and people who dwell in New York Metropolis.

The purpose is range and solely YOU might help me obtain that by emailing me your story! In the event you haven’t seen your circumstances mirrored in a Case Examine, I encourage you to use to be a Case Examine participant by emailing your transient story to me at mrs@frugalwoods.com.

Reader Case Examine Pointers

I most likely don’t have to say the next since you people are the kindest, most well mannered commenters on the web, however please observe that Frugalwoods is a judgement-free zone the place we endeavor to assist each other, not condemn.

There’s no room for rudeness right here. The purpose is to create a supportive surroundings the place all of us acknowledge we’re human, we’re flawed, however we select to be right here collectively, workshopping our cash and our lives with optimistic, proactive strategies and concepts.

A disclaimer that I’m not a educated monetary skilled and I encourage individuals to not make critical monetary choices primarily based solely on what one particular person on the web advises.

I encourage everybody to do their very own analysis to find out the most effective plan of action for his or her funds. I’m not a monetary advisor and I’m not your monetary advisor.

With that I’ll let Vanessa, immediately’s Case Examine topic, take it from right here!

Vanessa’s Story

Hello Frugalwoods, my title is Vanessa! I’m 37 and presently dwell with my boyfriend, age 36, and three cats–Freya, Orpheus, and Gandalf–in Eugene, OR. I work because the Licensing & Contracts Officer for the College of Oregon. I’m an lawyer and use a number of my authorized coaching in my job however am not an lawyer on behalf of the college–the college’s know-how switch workplace handles lots of the mental property issues for the College in its analysis administration workplace.

Vanessa’s Profession

In school, I studied science and thought I might be a analysis scientist, however a quarter-life disaster took me from science to regulation (considering I might go into patent regulation, which requires a science/technical background). I used to be in personal observe for a couple of years, however a few unhealthy agency companions and a third-of-life disaster led me to know-how switch. So I’m nonetheless within the authorized and scientific fields, however working for an academic establishment. That selection introduced me to Eugene and my present place the place I’ve been for about 5 years. I even have a aspect hustle as an IP marketing consultant and I donate plasma for added revenue.

Settled in Eugene, Oregon

After spending my 20’s shifting and reinventing myself and my profession, I’m very blissful being settled in Eugene. I purchased my home in September 2018 and began growing roots. I don’t intend to maneuver once more except my circumstances drastically change (e.g., it’s for the job of my goals, I change into destitute and have to maneuver in with my mother, and so forth.). I like to backyard and one of many causes I purchased my home is that it has a big space to backyard. My grandmother taught me to stitch block quilts and I’m slowly instructing myself the way to sew extra intricate patterns.

I additionally inadvertently received concerned in cat rescue this previous fall when my boyfriend discovered a feral mama cat and her litter. I helped foster and get these kittens adopted and wish to work extra in spay/neuter and Lure-Neuter-Launch (TNR) applications to assist forestall and cut back the cat inhabitants in my space.

Getting concerned in cat rescue made me notice that lots of people who work in TNR are spending their very own cash out-of-pocket to offer these providers. Sadly, our native county shelter shut down its TNR program with the beginning of the pandemic and the rescue I beforehand labored with focuses extra on rescue/adoption. I’ve thought-about establishing a non-profit to permit these volunteers a possibility to at the least obtain a tax deduction for his or her bills.

What feels most urgent proper now? What brings you to submit a Case Examine?

My life is in a transition stage!

#1: Essentially the most important factor is that I consider my boyfriend and I will probably be breaking apart quickly.

We’ve been collectively for about 4 years and are going through a number of challenges about whether or not or not our lives and values are actually suitable. We’re on a probationary interval till Might after we will resolve, however I don’t suppose we will work out the problems we have now. My boyfriend is a non-traditional pupil who went again for his diploma in 2019. He’s neurodivergent and it took him three years to get his Associates, and it’ll doubtless take him the same period of time for his Bachelor’s.

Financially, he contributes $500 every month in direction of the mortgage and payments (I purchased the home and the mortgage is in my title solely); we cut up a few of the home bills, like meals and pet bills at roughly 50%, however many of the different family bills (e.g., chimney cleansing, stump removing, and so forth.) I pay for myself. I’m not fully positive how the lack of that $500 will have an effect on my general finances or if prices will proportionally go down.

#2: A couple of month in the past, I used to be the sufferer of a hit-and-run.

The opposite driver left his bumper and license, so my insurance coverage and the police have been in a position to find him. My automobile (a paid-off 2010 Honda Civic) was thought-about a complete loss. My automobile was an superior automobile, and I assumed I might drive her till she died from pure causes. In fact, this all occurred throughout what might probably be the worst time in historical past to purchase a automobile. I went to probably the most respected used automobile vendor I may discover, however the vehicles I check drove for the quantity I may get from my automobile settlement have been questionable (over 150+ miles, over a decade outdated, some with damaged elements).

I subsequent turned to purchasing a pre-certified used automobile (like my outdated automobile), however these have been $20K+ to purchase the same automobile when it comes to years outdated/milage. I in the end determined to purchase a brand new 2021 Volkswagen Jetta. For a couple of thousand extra, I’ve extra peace of thoughts with the warranties and high quality of the automobile. It was an enormous splurge for me and a weight on my thoughts and soul. Please no commentary in regards to the knowledge of this selection–I actually consider that regardless of the price, this was the most effective determination for me on this whackadoodle market. This was all two days after I purchased my first matching bed room set and upgraded to a queen mattress. I purchased the ground samples at a reduction and I really like the set. The funds are at 0% for 12 months and I’m utilizing my tax refund however nonetheless paying over the 12 months. Between the automobile and the furnishings, this would be the first time in years I’ve had debt.

#3: Lastly, my authentic purpose for my making use of is for recommendation about my home. Ought to I transform or promote it and purchase a distinct home?

My home has an upstairs room (about 15ft x 25 ft) that appears straight out of the 70’s with fake wooden paneling, colonial American-style wallpaper, ceiling panel tiles, and fluorescent lighting. I purchased the home understanding I might at the least clean up this room, nonetheless, it’s now evident that the staircase isn’t protected. The steps lead as much as a half touchdown the place the one attic entry is situated. It is rather troublesome to get out and in of attic on the half touchdown. It additionally looks like the steps on the steps could also be uneven. Each my boyfriend and I’ve fallen (not critically), however I wish to get the steps redone and positioned on a distinct aspect of the room. I began to gather bids for the transform and was informed by contractors that they suppose the work to place within the upstairs room was un-permitted. I did a allow search with town, and there’s no allow on file (though that’s not an absolute assure the work was un-permitted).

After I purchased the home, nobody–not my realtor, the vendor/realtor, or the house inspector–mentioned something about un-permitted work. Of the contractors I’ve had have a look at the job: one ghosted me and not using a bid, one needed to do “exploratory development” to see what was taking place, and one mentioned his firm didn’t need the work however his finest guess was that to get the work as much as code could be $100k-$150k and steered a smaller development firm could be keen to do the work for much less. I don’t know if that quantity features a premium (I do know there’s a number of work for development firms now), however I do know supplies have gone up considerably within the pandemic, and there have been a number of wildfires in my space in September 2020, which destroyed many properties, which means development firms are in excessive demand proper now.

The choice to investing a lot into this home (actually at the least half the quantity of the mortgage) is to promote the home and get one other one.

This query is much less urgent proper now, particularly due to the automobile scenario, and since every little thing is a lot costly proper now; my very own fairness has gone up over 50% since I purchased. I really feel that whichever path I select–reworking or promoting/shopping for–will probably be higher completed in a couple of years. I’m very sentimental about my home as a result of it’s my first residence and I’ve already put a number of sweat fairness into this home. There are additionally some distinctive options about this home that I like together with important backyard house and a sizzling tub (got here with the home), which I don’t know if I may get in a distinct home. I additionally don’t wish to commerce one set of issues for an additional in a distinct home.

What’s the most effective a part of your present life-style/routine?

What I really like most about my present life-style is its regularity and consistency. Shifting round in my 20’s made me lonely and remoted. Ranging from scratch yearly or two left me very weak and unhappy. Being in Eugene has allowed me to develop friendships and group and let me begin exploring hobbies like gardening and stitching that I couldn’t do earlier than. I additionally consider it is extremely necessary to donate and volunteer for charity and it’s solely with the steadiness of my present life-style that I’ve been in a position to begin doing this.

What’s the worst a part of your present life-style/routine?

The worst a part of my present life-style is the nervousness in regards to the future, particularly with regard to my boyfriend. Moreover, whereas my job is tremendous safe, there’s completely a ceiling to development; my group is a small one (six individuals), so there isn’t room for job development and growth except somebody leaves, which is unlikely. I get burned out on this job as a result of it’s not difficult or attention-grabbing. I’m good at it, simply bored. Eugene and its sister metropolis Springfield are a medium-ish market, and I don’t know if I’d have the ability to discover one other job that pays in addition to my present place. If I ever needed to discover a new job, it could most likely need to be distant.

I’m additionally discovering it troublesome to steadiness the bills of homeownership and frugality. I wish to be a superb steward of the house and maintain it in good restore, however discover there are continually issues I want/may spend cash on. For instance, I had a stump that wanted to be eliminated. I purchased a mini-chainsaw to assist eliminate the branches and can use it sooner or later for pruning, however it at all times appears like there’s a a number of hundred greenback buy that “wants” to be made. Together with my objectives of reworking/promoting the home and customarily saving, it’s arduous to seek out what a “good” steadiness is.

The place Vanessa Desires to be in Ten Years:

After the final two years of pandemic, 10 years from now looks like an eternity…

Funds:

-

I would love my mortgage to be nearly fully paid off. I not too long ago stopped paying additional (which hurts, as a result of I hate debt however I heeded Mrs. FW’s earlier Case Examine recommendation that there are higher makes use of of cash when rates of interest are low, however I don’t suppose I’d in any other case have a selection with the brand new month-to-month funds).

- I feel I’m doing superb with retirement contributions (please let me know if I’m not!) and can obtain a pension after I retire primarily based on wage on the time and years of service.

- I would love the chance to give you the option dwell comfy (completely inside my means) and have discretionary cash to spend on charity, journey, and so forth. with out worrying if it needs to be spent elsewhere.

Life-style:

Profession:

- The profession query is difficult as a result of I don’t know what alternatives there could be for me. My reply is that I would love a job that’s difficult and attention-grabbing however doesn’t occupy all my time or psychological/emotional wherewithal.

- If attainable, I wish to stick with my present group for at the least the following few years, except one thing drastic adjustments within the management or circumstances of my job.

Vanessa’s Funds

Revenue

| Merchandise | Quantity | Notes |

| Vanessa’s Internet Revenue | $4,428 | Vanessa’s internet wage after well being/imaginative and prescient/dental insurance coverage; life insurance coverage; retirement contribution; taxes; parking. |

| Plasma Donation | $547 | I donate plasma twice per week. The donation middle “compensates for my time.” The compensation varies each month and has been greater over the course of the pandemic. It is rather troublesome to foretell how the compensation will change sooner or later. |

| Boyfriend’s lease cost | $500 | My boyfriend contributes this quantity to the mortgage and utilities |

| Aspect Hustle | $500 | I do some IP consulting on the aspect. The revenue is irregular primarily based on my shopper’s finances. |

| Month-to-month subtotal: | $5,975 | |

| Annual whole: | $71,700 |

Mortgage Particulars

| Merchandise | Excellent mortgage steadiness | Curiosity Charge | Mortgage Interval and Phrases | Fairness | Buy worth and 12 months |

| Mortgage | $182,923 | 1.99% | 15-year fixed-rate mortgage | $62,090.47 | $245,013; bought September 2018 |

Money owed

| Merchandise | Excellent mortgage steadiness | Curiosity Charge | Mortgage Interval/Phrases | Notes |

| Automotive | $12,000 | 0.90% | 4 years; this works out to be about $246/month | |

| Furnishings | $2,729 | 0% | I pay 1/twelfth the preliminary quantity to get the 0% promotional financing; this works out to be about $230/month | I purchased my first bed room set and mattress after I received my tax refund this 12 months. This was naturally three days earlier than my automobile was murdered. |

| Affirm mattress | $659 | 0% | I pay 1/twelfth the preliminary quantity to get the 0% promotional financing; this works out to be about $60/month | |

| Whole: | $15,388 |

Belongings

| Merchandise | Quantity | Notes | Curiosity/kind of securities held | Title of financial institution/brokerage | Expense Ratio |

| Rollover IRA | $103,324 | This account has all my rollover accounts from previous jobs | FFFHX; TRRMX | Constancy | 0.75%; 0.71% |

| 403(b) Account | $50,831 | I contribute 12%/month | FFOPX | Constancy | 0.81% |

| Particular person Account Program (IAP) | $22,285 | My college matches as much as 5.25%/month | |||

| Brokerage Account | $21,777 | That is extra of a glorified financial savings account. It has ETF funds primarily based on an aggressive funding technique. The thought was that given sufficient time, it could present a greater return than purely a financial savings account. It has additionally misplaced about 10% over the previous few months. | ETF | SoFi | N/A; SoFi doesn’t cost charges |

| Financial savings Account | $15,000 | That is what I take into account to be my emergency fund. I usually switch $500 each month and each few months switch cash into my SoFi brokerage account as financial institution. | N/A | Chase | N/A |

| Brokerage Account | $10,951 | That is the place I put money into particular person shares. I had completed effectively and at the least have been in a position to maintain on to any funding lengthy sufficient to at the least break even. It has misplaced about half its worth over the past 6 months as a result of I’m invested in biotech shares and so they have taken a extreme beating. | Particular person shares | Charles Schwab | N/A |

| Checking Account | $8,363 | That is the place most of my transactions happen | N/A | Chase | N/A |

| Second Financial savings Account | $950 | That is my slush fund. I began it awhile again for mid-range home tasks/purchases (up to a couple thousand {dollars}). It has additionally change into my pet emergency fund. I contribute $50 each month. | N/A | N/A | N/A |

| TOTAL: | $233,481 |

Autos

| Automobile make, mannequin, 12 months | Valued at | Mileage | Paid off? |

| VW Jetta | $25,398 | 300 | No; the quantity I owe is listed underneath “Money owed” |

Bills

| Merchandise | Quantity | Notes |

| Mortgage, taxes and insurance coverage | $1,574.68 | Principal ($1,018.56), curiosity ($303.35) and escrow ($252.77) |

| Family | $411 | Contains all family provides, home decorations, bedding, small home equipment, cleansing merchandise, residence enchancment objects |

| Grocery | $322 | Contains all meals and drinks (together with alcohol) |

| Automotive cost | $246 | Particulars underneath “Money owed” part |

| Furnishings cost | $230 | Particulars underneath “Money owed” part |

| Utilities | $182 | Contains electrical energy and water |

| Charity | $129 | Contains recurring donations and approximate one-off donations from people asking for assist |

| Pets | $112 | Contains annual vet appointments, meals, flea remedy, toys, treats (this can be a shared expense with my boyfriend) |

| Medical | $97 | Contains co-pays, contacts, prescriptions, allergy pictures |

| Restaurant | $92 | Contains take out from date evening (1 date each 1-2 weeks) |

| Hobbies | $85 | Contains gardening and stitching provides |

| Presents | $62 | Contains birthdays, Christmas for household and associates |

| Fuel | $62 | |

| Affirm mattress cost | $60 | Particulars underneath “Money owed” part |

| Automotive Insurance coverage | $59 | |

| Web | $53 | Contains web solely |

| Firewood | $38 | Contains 2 cords of wooden used for heating over the winter |

| Clothes | $18 | Contains garments and footwear (I purchase nearly every little thing off eBay) |

| Rubbish | $18 | Contains rubbish service |

| Bar Charges | $15 | Contains state bar charges for New York and California |

| Subscriptions | $14 | Contains native newspaper ($8) and Paramount+($6; the place I get Star Trek and is extraordinarily beneficial to me) |

| Leisure | $10 | Contains online game, motion pictures, and so forth. |

| Month-to-month Subtotal: | $3,890 | |

| Annual Whole: | $46,680 |

Credit score Card Technique

| Card Title | Rewards Sort? | Financial institution/card firm |

| Alaska Visa | Journey | Financial institution of America |

Vanessa’s Questions for You

1) Brief time period: how can I reconfigure my finances to be extra balanced?

- In doing the evaluation for the Case Examine, I noticed how a lot of my finances goes to family items (usually which means fees from Goal; Mattress, Bathtub, & Past; the native ironmongery shop and objects like Christmas decorations, mini-chainsaws, chimney cleanings), particularly if I desire a bigger discretionary finances for issues like hobbies and touring?

- The place ought to I readjust my finances if my boyfriend and I do breakup?

- My revenue from my aspect hustle and plasma donations are inconsistent. My aspect hustle is consulting for a start-up and so they don’t essentially pay frequently (which I’m happy with as a result of they do finally at all times pay) and the plasma donations are set by the corporate and may change each month. It’s nice to have the additional cash, however it isn’t one thing I completely depend on.

2) Medium time period: What ought to I do about my new automobile/furnishings cost?

3) What are the most effective saving strategies for medium (a couple of thousand {dollars}) and huge (tens of 1000’s of {dollars}) purchases?

- Proper now I’ve a few funding accounts, however each of these (one shares and one ETFs) are down proper now. Is there a greater technique or in-between technique between financial institution accounts that earn no curiosity and the temperamental inventory market?

4) Long run: Ought to I transform or promote my home?

- Both approach, I feel I must save for this as a result of I wish to pay money (or as a lot money as attainable) for both. A few of my money reserves went in direction of my automobile’s down cost (about $6K in order that my funds could be underneath $250/month).

- My coronary heart says to maintain the home and put money into its care and maintenance, however my head says it’s most likely not the most effective monetary selection. Additionally, in say 5-10 years what may the circumstances or conditions be that would change my determination?

Liz Frugalwoods’ Suggestions

Vanessa’s in nice form and I feel a number of what we’ll be immediately are longer-term plans, that are enjoyable to map out! I commend Vanessa for considering via her long run monetary plans and am excited to suppose via these things along with her!

Vanessa’s Query #1: Brief time period: how can I reconfigure my finances to be extra balanced?

First space: house-related prices

I truly suppose Vanessa’s finances is already fairly balanced. I feel the disconnect right here is that Vanessa could also be evaluating her post-home possession finances to her pre-home possession finances and people two won’t ever be in alignment. Dwelling possession is great, it’s enjoyable, it may be an awesome funding, it’s a safe place to your cash, however it ain’t low cost. Having now owned two properties myself, I can let you know that one thing is ALWAYS breaking, one thing ALWAYS must be mounted or changed and…. the bills by no means finish. This isn’t to scare Vanessa (or anybody else considering residence possession), it’s merely smart to imagine it’ll be an ongoing, fixed, perpetually month-to-month expense. It’s not a foul factor to spend cash on wanted repairs to a house, it’s only a truth of not being a renter.

I counsel Vanessa do the ol’ expense deep dive on all these Mattress, Bathtub & Past, Goal, ironmongery shop, and so forth purchases and divide them up in keeping with the beneath rubric:

1) Emergency, required:

2) One-time, together with giant home equipment:

- For instance: the mini chainsaw. Positive, you’ll have to switch it sometime, however not yearly.

3) Ornamental:

- For instance: throw pillows, Christmas decorations, and so forth. Most of those are additionally doubtless one-time.

4) Annual upkeep:

- For instance: chimney sweeping.

I feel re-assessing her finances in keeping with these distinct classes may assist Vanessa higher metabolize the true prices of residence possession. This may also spotlight areas that may be diminished/eradicated if desired (corresponding to “ornamental”) and issues that must be budgeted for frequently (corresponding to “annual upkeep”). If she’s not already utilizing an expense monitoring service, corresponding to the free one from Personal Capital, doing so may assist on this course of (affiliate hyperlink).

Second space: The place ought to I readjust my finances if my boyfriend and I do breakup?

I feel Vanessa must wait and see on this entrance. As it’s, she’s shouldering the majority of their family bills, so I’m unsure the lack of his $500 contribution per thirty days will probably be all that seismic since I assume issues like family provides (bathroom paper, toothpaste, and so forth) and groceries will doubtless lower.

In the event that they do break up, I additionally encourage Vanessa to present herself some grace and time earlier than being too frightened about her new finances. A break-up (even when mutual and desired) remains to be a seismic change and Vanessa ought to guarantee she takes time for self-care and relaxation afterwards. As soon as she’s a couple of months out from the breakup, she will do an evaluation of her post-breakup bills and the way she may need/have to recalibrate.

Basically, Vanessa is tremendous frugal and her bills are actually low! With out her boyfriend’s lease cost and each of her aspect hustles, she’s nonetheless making greater than she spends each month:

$4,428 (wage) – $3,890 (bills) = $538

Provided that, there’s no hair-on-fire scenario for Vanessa to instantly remedy in the event that they do break-up. She will take her time to type via issues and decide how/if she desires to regulate her spending going ahead.

Vanessa’s Query #2: Medium time period: What ought to I do about my new automobile/furnishings cost?

Precisely what you’re doing! Notably with the 0% curiosity on the furnishings, there are zero mathematical causes to pay them off early. The factor that’s unhealthy about debt are excessive rates of interest. Debt with no rate of interest isn’t unhealthy, it’s a reallocation of assets. The caveat is that if both furnishings mortgage incurs an rate of interest sooner or later, then you definately may wish to pay them off.

When it comes to the automobile, I fully agree with Vanessa’s analysis and determination to purchase a brand new automobile. It is not sensible to purchase a used automobile for almost as a lot (or as a lot!) as a brand new automobile. Within the present ridiculous bananas automobile market, you may as effectively purchase new. No purpose to pay extra for used! The one purpose it USED to make sense to purchase USED is as a result of used vehicles was once a TON cheaper than new vehicles. Now that they’re not, the whole automobile calculus is modified. So Vanessa, relaxation assured you made an awesome determination on this entrance: you selected a cheap, protected, new, dependable automobile. Be ok with the analysis you probably did and the choice you made!

The automobile’s rate of interest can also be extremely low at 0.90%. Though the rate of interest isn’t zero, I nonetheless agree with Vanessa’s evaluation that it makes probably the most mathematical sense to deploy her assets into belongings that can earn her greater than a 0.9% return.

With debt-payoff on low or zero curiosity money owed, it’s at all times a query of:

What’s the chance price of paying off this debt?

In different phrases, if I don’t dump my cash into this debt, what else can my cash do for me? Trace: the reply is NOT “tackle extra debt to purchase a ship!,” it’s extra like “put money into my retirement, financial savings or brokerage accounts!”

However that is all a query of non-public choice. Positive, it’s mathematically finest to not repay low-interest debt, however some individuals accomplish that as a result of they worth the peace of thoughts of no debt OVER the potential monetary returns of investing their cash. Simply be clear with your self about whether or not you’re making a “peace of thoughts” or a “financially/mathematically finest” determination.

Vanessa’s Query #3: What are the most effective saving strategies for medium (a couple of thousand {dollars}) and huge (tens of 1000’s of {dollars}) purchases?

This query is definitely higher requested when it comes to time horizon, not greenback quantities. Right here’s why:

This query is definitely higher requested when it comes to time horizon, not greenback quantities. Right here’s why:

1) If I wish to purchase a home someday within the subsequent, oh, two years or so, I’ll wish to maintain that cash liquid (in a checking/financial savings account) in order that I don’t lose any of it within the at all times unpredictable inventory market.

2) If I wish to purchase a retirement rental within the subsequent, oh, forty years or so, I’ll wish to make investments that cash within the inventory market (in a taxable brokerage account) in order that it will probably develop over time.

Q: Why do I do that?

A: Market volatility.

If I have been to take a position all the cash I intend to make use of for my down cost on a home within the subsequent few years, there’s a really actual probability I’d lose some (or most) of that cash.

- To be clear, I wouldn’t truly “lose” the cash, it could simply be fluctuating with the market.

- I might truly lose the cash if I bought my shares throughout a downturn and locked in that loss.

The inventory market goes up and down. That’s actually what it’s designed to do. You can’t panic when it goes down–that’s like panicking when a canine wags it’s tail as a result of that’s actually what a canine does. I’ll let you know after I’d truly lose my cash: if I panicked and bought every little thing throughout a market downturn. Then, I’ve locked in a loss and sure, that’s unhealthy and sure, individuals do this as a result of it’s human nature to panic whenever you see your hard-earned $$$$ winnowed down throughout a downturn.

The inventory market goes up and down. That’s actually what it’s designed to do. You can’t panic when it goes down–that’s like panicking when a canine wags it’s tail as a result of that’s actually what a canine does. I’ll let you know after I’d truly lose my cash: if I panicked and bought every little thing throughout a market downturn. Then, I’ve locked in a loss and sure, that’s unhealthy and sure, individuals do this as a result of it’s human nature to panic whenever you see your hard-earned $$$$ winnowed down throughout a downturn.

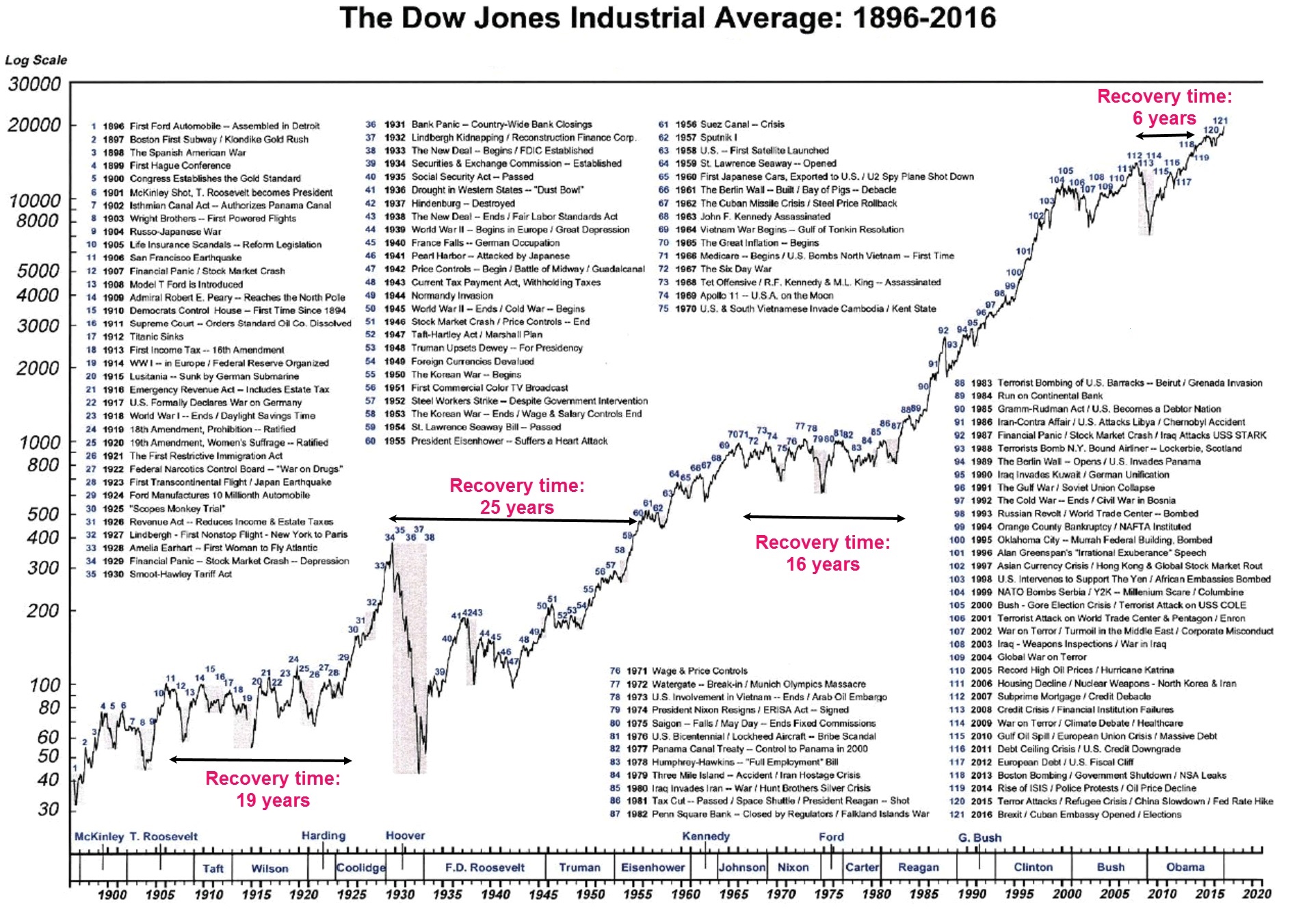

But when I don’t panic and don’t promote, I DON’T lock within the loss. As a substitute, I journey the market. I maintain my cash invested for many years as a result of, historical past demonstrates that over time, the market goes up. Over time, historical past has proven a 7% common annual return. So long as I don’t panic and promote in a downturn. Now may historical past not repeat itself and the market fall off a cliff? Completely! Additionally, may we be hit by an asteroid? Completely! Investing is dangerous; dwelling on Earth can also be dangerous. Solely YOU know your private danger tolerance and solely YOU could make the funding selections that align together with your objectives and your danger tolerance.

Right here’s a graph of the Dow Jones Industrial Common’s habits over a 120-year interval (1896-2016):

This long-winded, cartoon-riddled reply is as an instance for Vanessa (and everybody else) that investing is a query of your time horizon, extra so than your greenback quantity, in addition to your danger tolerance.

Brief Time period Financial savings

Now that we’ve established the inventory market is the place for our LOOOOONNNNNGGG time period cash, what can we do with our brief time period cash? A number of choices:

- Checking account

- Excessive-yield financial savings account

The inventory market isn’t a financial savings account. It’s a long-term funding account. You solely put in cash you do not want anytime quickly.

Issues which might be NOT financial savings accounts:

- ETFs

- Particular person shares

- 401ks

- Pensions

- Whole market index funds

- Canine wagging their tails

Issues that ARE financial savings accounts:

- Financial savings accounts

Asset Allocation and Investing Technique

Let’s do a rundown of the place Vanessa has her cash:

1) Money:

Vanessa has three completely different liquid (AKA checking/financial savings) accounts totaling: $24,313

What’s money for? Everybody say it with me:

- Emergency fund (this needs to be three to 6 month value of your dwelling bills).

- Dwelling bills.

- Saving for near-term bigger purchases (holidays, new vehicles, a costume to your sister’s marriage ceremony, a brand new cat rental, and so forth)

Vanessa spends $3,890 a month, which suggests she ought to have an emergency fund of $11,670 (three months value) to $23,340 (six months value). Therefore, her money financial savings are spot on!

Advised tweaks:

- Maybe mix these three accounts into one? It is a private choice and I prefer to have every little thing as consolidated as attainable, however I do know some people favor a number of ear-marked accounts. If there’s no urgent purpose to have three completely different accounts, I’d mix for simplicity

- Transfer every little thing to a high-yield financial savings account(s). Rates of interest are rising proper now and one the one areas the place that is advantageous are high-yield financial savings accounts. Be sure to’re incomes one thing in your financial savings account–by no means accept 0%. Even a small share makes a distinction over time.

- For instance, the American Express Personal Savings account presently earns 0.60% in curiosity. This isn’t a ton, however in a 12 months, Vanessa’s $24,313 may have elevated to $24,459 (affiliate hyperlink). Meaning she’d earn $146 simply by having her cash in a high-interest account!

2) Retirement:

Vanessa’s three retirement accounts whole $176,440. Let’s reference our favourite retirement rule of thumb:

Purpose to avoid wasting at the least 1x your wage by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67 (supply: Fidelity).

Since Vanessa’s 37, let’s go along with age 40. This implies she ought to have:

[$4,428 x 12 =] $53,136 x 3 = $159,408

Vanessa is 100% spot on on this class as effectively! Woohoo, Vanessa is rocking it!

3) Taxable investments:

The foundations round taxable investments are:

- Be sure to perceive the fundamentals of investing. I extremely advocate the e book The Simple Path to Wealth: Your Road Map to Financial Independence And a Rich, Free Life, by: JL Collins (affiliate hyperlink). It’s a incredible primer on investing.

-

Solely make investments cash you don’t want within the close to time period.

- Keep in mind that investing is for the long run.

- Don’t panic and promote when the market goes down.

- In the event you do that, it defeats the whole objective of investing. You’d doubtless be higher off not investing in any respect.

- Be sure to perceive the charges/expense ratios of your investments. I did a deep dive on expense ratios in this post. All funding accounts have charges related to them. In the event that they don’t have a price, they’re not an funding account. It’s essential to have low charges as a result of you possibly can lose a TON of cash to excessive charges over the many years of your investing profession. Three brokerages recognized for his or her low-fee whole market index fund choices are:

- Constancy

- Vanguard

- Charles Schwab

- I select to put money into whole market, low-fee index funds. Learn The Simple Path to Wealth to know why that is the selection I (and the overwhelming majority of different FIRE people) make.

I additionally wish to spotlight for Vanessa that investing in particular person shares is a passion, not an funding technique. Inventory choosing is one thing lots of people get pleasure from doing for enjoyable, however it’s not a smart monetary transfer. Solely do that if in case you have cash to burn and actually get pleasure from choosing shares. In any other case, historic market information signifies you’re higher off in a complete market low-fee index fund.

Vanessa’s Query #4: Long run: Ought to I transform or promote my home?

Vanessa hit the nail on the pinnacle when she mentioned that both approach, she’l doubtless have to attend. Yep, yep, yep. If something is extra sizzling cocoa bananas than the automobile market proper now, it’s the housing market. Now isn’t the time to purchase a house except you completely need to. Ditto for renovations you’ll be hiring another person to carry out. Contractors are totally booked and supplies are both unavailable or costly. Or extra doubtless, each.

I feel Vanessa is sensible to consider this potential future determination and to begin properties on the market in her space. By no means hurts to go to a couple open homes to get a way of what’s available on the market. If nothing else, it may present some renovation concepts and ideas on the way to take care of her uncommon upstairs room.

Vanessa has a fully incredible rate of interest (1.99%!!!!!!!) on her mortgage, so she is sitting fairly proper now. Don’t do something to jeopardize this enviable scenario!

Abstract:

For probably the most half, Vanessa ought to simply maintain doing what she’s already doing! She’s made glorious monetary choices over time. The few tweaks I counsel:

-

Do a deep dive into house-related bills and create sub-categories for:

- Emergency, required

- One-time, together with giant home equipment

- Ornamental

- Annual upkeep

- Really feel assured about not paying off the automobile, home and furnishings at an accelerated tempo as a result of the rates of interest are fabulously low.

- Learn The Simple Path to Wealth: Your Road Map to Financial Independence And a Rich, Free Life, by: JL Collins, to broaden her data and understanding of investing (affiliate hyperlink).

- Determine the time horizons for her bigger purchases and decide if investing or money will probably be wisest.

- Do an evaluation of all accounts and take into account:

- Consolidating money accounts into one. Guarantee this account is high-yield and incomes curiosity.

- Take into account eliminating the person shares account and as an alternative specializing in low-fee, whole market index funds.

- Wait on making the renovate or transfer determination. Spend this time gathering information: interview contractors, go to open homes, get renovation concepts, and save up!

- Know that you’re doing an awesome job!!

Okay Frugalwoods nation, what recommendation do you’ve got for Vanessa? We’ll each reply to feedback, so please be happy to ask questions!

Would you want your individual case research to seem right here on Frugalwoods? E mail me (mrs@frugalwoods.com) your transient story and we’ll discuss.

By no means Miss A Story

Signal as much as get new Frugalwoods tales in your e mail inbox.