As we speak, we’re sharing the very best (and worst) cash recommendation we’ve ever obtained. We’ll be sharing our guide report for I Will Teach You to Be Rich by Ramit Sethi, and Ramit will be part of us for an interview as nicely.

We’re additionally answering a number of listener questions.

A giant thanks to our sponsors! Take a look at the affords from LMNT, Shopify, MilkBar, and Ritual. And, if you happen to’re searching for a particular code you heard on the podcast, you’ll be able to see a full listing on this page!

Elsie’s finest cash recommendation: Change your mindset and get excited in regards to the stuff you can do with cash.

Emma’s finest cash recommendation: Be curious and ask questions.

Elsie’s worse cash recommendation: To keep away from bank cards.

Emma’s worse cash recommendation: Purchase it since you deserve it.

Elsie’s wealthy life: Her home and adorning for holidays.

Emma’s wealthy life: Her home, a walkable neighborhood, and touring.

Elsie’s recommendation: Outline the naked minimal that it’s a must to do.

Emma’s recommendation: Make a aim to say at the least one encouraging factor to somebody.

Elsie’s self-care technique: Speak to folks you’re keen on, really feel your emotions, and assist the place you’ll be able to.

Emma’s self-care technique: Limiting time on her telephone and setting a timer to really feel your emotions.

Execs: They’re cute and look good, they cowl your eyebrows, and no Botox is required in your brow.

Cons: Holding them trimmed and getting greasy bangs from skincare gadgets.

Elsie: You’re listening to the A Lovely Mess Podcast. As we speak we’re right here to share a few of the finest and worst cash recommendation we’ve ever obtained. We’ll even be sharing our guide report for I Will Train You To Be Wealthy by Ramit Sethi and Ramit may even be part of us for an interview on this episode. We’re additionally answering a number of listener questions as nicely.

Emma: Superior.

Elsie: So earlier than we started, we bought to see one another final weekend. It was so enjoyable. So I put a query field up and I stated, we might do some AMA after which we forgot to do it so we added a few of these inquiries to the tip of this episode. So it’ll be on the very finish after the interview. However yeah, we had a lot enjoyable that we just about simply forgot that Instagram existed, which I feel is an effective factor.

Emma: Sure, I truthfully don’t even have very many like, I’ve like two pictures from the journey as a result of I simply didn’t get my telephone out the entire time, principally.

Elsie: It was enjoyable. It was identical to household cocooning. We have been simply staying in an Airbnb, strolling to eating places that have been like two blocks away. It was great. We had numerous cousin time.

Emma: Sure. We went to a bookstore. We went to an artwork store. Yeah, it was simply actually enjoyable. Actually enjoyable to spend that point with our mother and actually enjoyable to spend it with one another and our brother’s spouse, Ruby, simply celebrating mothers.

Elsie: St. Louis is so cute.

Emma: Yeah, it truly is.

Elsie: Yeah, I’m excited. So this week, we’re going to speak about our greatest and worst cash recommendation. We’re going to do a guide report for I Will Train You To Be Wealthy, which really, have written it down, all the opposite instances we’ve talked about Ramit’s guide and the instances he’s been on the podcast. It’s type of like a reoccurring topic we’ve finished a whole lot of instances. So we’ve Episode 35, which I keep in mind that’s the primary time I met him and did the primary interview. That was the early quarantine days. Which is so way back. Episode 35 is named Wealthy Life Chat with Ramit Sethi after which in episode 74, Emma does an interview with him. It’s like a bonus episode, chat with Ramit. Then in episode quantity 115, we talked about cash dials and he wasn’t part of it or something.

Emma: However he was part of it. It’s his idea.

Elsie: Yeah, cash dials is likely one of the issues that he teaches about in his guide and he talks about on Instagram on a regular basis. So in that episode, we talked about what our cash dials are. On this episode, we’re gonna discuss finest and worse cash recommendation. I really like speaking about cash. I do know that it’s a cold and hot topic. A few of our listeners have tell us it’s their favourite topic and a few of our listeners have tell us that they’d moderately we didn’t talk about it ever. I feel I’m on the crew, I adore it. What about you?

Emma: Yeah, I’m in all probability on crew, I adore it. I suppose possibly a part of the factor is, it’s bizarre to speak about your private cash. I might by no means meet somebody for the primary time at a celebration and be like, so how a lot cash do you make? Clearly, that isn’t one thing I might select to do. I feel most individuals would fill related.

Elsie: That’s what my six-year-old would say. What number of {dollars} do you will have?

Emma: Precisely. What number of {dollars} do you will have? Nicely, I’ve this many cash after which she wins. Yeah, in that sense, I perceive cash may be very awkward topic and actually, there’s so many feelings wrapped up with it. However I’m with you. I like to speak about cash. I like to remain interested by it. I need to be taught extra. It’s not one thing that I used to be born realizing about, like most issues. So I simply need to be taught and I prefer to be taught from folks with very totally different life than me, very totally different earnings ranges, and really totally different views. Even when I don’t agree, I feel it’s very attention-grabbing to listen to. I like listening to a standpoint that’s totally different from my very own as a result of worst case is simply attention-grabbing and finest case I discovered one thing.

Elsie: Yeah, me too. I just like the thought experiment of listening to one thing controversial even if you happen to write up not agreeing with it. It’s nonetheless attention-grabbing. The opposite factor I might add to that’s, I feel there’s a whole lot of unhealthy cash recommendation that goes round. There’s a whole lot of issues which can be simply typically repeated that we form of simply settle for, however they’re actually really a few of them are outdated cliches, a few of them are identical to unhealthy mindsets, in my view. So I feel that it’s enjoyable to consider, like what’s significant to you, what you need to do along with your cash, and what attitudes that you simply need to have since you don’t should have the identical attitudes as everybody else, which I feel is fairly cool.

Emma: Yeah, you are able to do it your method. Okay, so what’s the very best cash recommendation you’ve ever been given?

Elsie: I feel that the very best cash recommendation that I’ve ever obtained is after I discovered to deal with the massive wins, as a substitute of inflexible guidelines. I feel that for thus lengthy most of my life till I used to be in my mid-30s, I used to be pondering of cash as strictly as budgeting. Then I might simply really feel responsible, as a result of anytime, like after I was youthful, I might make a price range of how a lot you need to spend each month, after which it’s type of a whole lot of work to keep up, to see if you happen to’re on observe or not. I’m probably not a spreadsheet particular person, I may by no means sustain with it. So I all the time simply felt responsible that like, I’m simply not an individual who likes to be on a line-by-line price range. However after I discovered this fully totally different angle of specializing in the massive wins as a substitute, then I discovered it’s completely okay to not have a price range, so long as I’ve objectives that I’m assembly. So now I solely fear about if I’m assembly my financial savings objectives, and I by no means, ever fear about how a lot I spend on one thing small like Uber Eats and even groceries. In our price range, it’s not important sufficient to ever grow to be an enormous win. So yeah, it was like my path to freedom. It was fully a thoughts shift, mindset shift that I feel I’m perpetually modified. I’ve achieved a lot extra with our private finance since I made that shift. I feel earlier than I used to be type of caught in a rut simply feeling unhealthy in regards to the type of boring issues that I wasn’t doing. However I wasn’t capable of simply get excited in regards to the cool issues we might be doing with our cash. So now I’m largely simply excited. What’s yours?

Emma: I feel one factor that you simply’re type of mentioning there that basically struck a chord with me is I do really feel like for me, and I feel possibly lots of people, however I’ll simply converse for myself, there was type of a whole lot of guilt wrapped up with cash early on. You do type of be taught some inflexible guidelines. So for me, if there’s an space of my life the place I really feel a whole lot of guilt prefer it’s only a fixed, I’m feeling a whole lot of guilt on this space. I simply began avoiding it. I feel that’s in all probability the primary factor that will get me off the bus on that type of mindset in the direction of cash. The most effective recommendation that I’ve ever been given about cash is to be curious and ask questions. So I feel like guilt, if that’s holding you again from asking questions round cash since you really feel like I’m doing it fallacious and I’m unhealthy, or I’m grasping, or I’m overspending, no matter this drawback. For me, I’ve additionally had numerous moments in my life the place I simply didn’t perceive the phrases that individuals have been throwing at me. The primary time I purchased a home, I felt there have been so many phrases that I used to be like, I didn’t be taught this in highschool or school. I don’t know what this implies. I’m googling and I nonetheless don’t actually perceive. I suppose I’m simply going to should ask and kinda really feel like an fool however right here we go. Fortunately, for no matter purpose, I used to be given the recommendation, many instances in my life, each about private finance and in addition about proudly owning a small enterprise, to only ask questions and be curious. Don’t fear about wanting silly, that doesn’t matter. It doesn’t matter. Simply ask. I feel that’s actually useful as a result of no one is aware of every thing about getting a mortgage or your credit score rating or something. You simply should ask questions so that you shouldn’t be scared to

Elsie: I really like this recommendation. Emma and I all the time say it’s like one of many issues that we really feel is a energy or a superpower that we’ve is that we’re not afraid to be in an enormous assembly and ask a extremely silly query. I feel that for anybody who, like keep in mind that the subsequent time that you simply’re in that state of affairs to only ask it as a result of I feel that it’s a lot extra highly effective to confess if you don’t know issues and be taught then to only undergo your life, attempting to faux such as you already know every thing. How many individuals have mortgages and investments that they don’t perceive? You don’t should be that method, although. I really like that being curious. Okay, ought to we do worst?

Emma: Sure. So what was the worst cash recommendation you got?

Elsie: Okay, mine is, it’s really type of embarrassing. I don’t suppose I’ve instructed this on the podcast earlier than. However I didn’t have a bank card. I had one after I was like college-age after which I didn’t have one till I used to be over 35. It’s as a result of I used to be taught that having a bank card is harmful and a lure and scary. A part of my guilt mentality was I had fairly small objectives and I had a whole lot of issues I used to be staying away from akin to having a bank card that I didn’t actually know why. Once I first learn, I Will Train You To Be Wealthy and it was like, what sort of bank card oh, possibly you desire a bunch of bank cards. It was explaining all of it. I used to be like, oh my gosh, I suppose I ought to simply get it.

Emma: I didn’t know you didn’t have a bank card.

Elsie: Yeah, I didn’t get it till, I bear in mind it was like someday proper earlier than we went to China to undertake Marigold as a result of after we went with Nova, we didn’t have one. It was like type of a problem. They have been like, why don’t you will have a bank card, then we have been like, we simply don’t. However anyway, now I’ve had one for 3 years or no matter and I’ve by no means had a late fee or missed a fee. I do know now that I can belief myself and that I’m sensible sufficient to do it. I feel the most important factor is I had like no confidence in myself. I used to be simply afraid all the time that relating to cash, I used to be afraid of failing. Clearly, it’s a must to be taught another person’s plan and do this for some time to achieve the arrogance you want. As soon as I simply tried it, it wasn’t laborious. I feel that the rewards got here fairly rapidly as a result of I simply found that I may do issues that I had by no means even tried earlier than.

Emma: Actually folks do battle with bank card debt. I’ve had some shut associates battle with that earlier than. I feel the concept you simply instantly determined you couldn’t belief your self. That’s type of unusual. Ramit’s guide, which we’ll discuss somewhat extra, however he type of talks about utilizing bank card corporations like gaming the system somewhat bit use it to your profit as a result of there’s all totally different varieties. They provide totally different sorts of rewards. Yep, precisely. So you may get factors for journey, you may get factors for money again, there’s all kinds of various choices on the market. You need to use it to your profit. Hopefully, you’re spending cash that you’d be spending anyway with a debit card or with money or no matter you usually do along with your funds. So then you may doubtlessly get one thing out of it, which is type of I feel, a fairly sensible concept and an attention-grabbing method to have a look at it. Okay, for me, worst cash recommendation is type of the I don’t know tips on how to precisely the way it’s been phrased to me earlier than, however type of the concept of, I need to hear what you consider this occasion. Even if you happen to can’t afford one thing or even when it’s not in your price range for that point, like possibly you’re attempting to achieve another objectives, go forward and purchase it since you deserve it. You deserve it. That type of factor. I do suppose clearly, you must deal with your self typically, clearly. It’s not like I feel by no means do something enjoyable along with your cash, like, no, that’s the very reverse of residing your wealthy life, which is what Ramit tries to show. However I additionally simply don’t like the concept telling somebody who is perhaps overspending that you simply deserve it, like tying it to your price. I feel I actually bristle at the concept you’re tying your self-worth to the issues that you simply buy. That you simply both deserve them otherwise you don’t deserve them primarily based in your price as an individual or one thing. That to me is a really, I don’t like that in any respect. In my life, for instance, I’ve had numerous totally different budgets through the years. I’ve had very totally different disposable earnings ranges all through my life to this point. At no level was I price roughly as an individual so it’s simply not like, I don’t know, I simply don’t like that mindset. I don’t like the place that leads. I feel it could lead on somebody to overspend and really feel very justified. I additionally suppose although it could lead on somebody to type of suppose, oh, I can’t purchase myself that factor so I’m not price it. I actually don’t like that concept, both. All of it. I simply don’t actually like the way in which that wording is. It’s a factor I’ve heard earlier than and I simply type of bristle at it. I seen a whole lot of instances folks imply nicely, so it’s not prefer it makes me offended after I hear it. I simply actually don’t favor that in any respect.

Elsie: No, that makes excellent sense. The concept that you deserve one thing. It doesn’t actually make sense as a result of if you’re poor, you continue to deserve every thing and when what superrich, you don’t deserve extra, that is smart. I feel that you’ve level. I do suppose that that’s one of many many concepts floating round that individuals simply haven’t thought by.

Emma: Yeah, I feel it’s meant to be encouraging however I simply don’t suppose it really is. I feel it’s just a bit bit empty. So anyway, that’s not the very best recommendation so I’m placing it on the worst listing. I’m certain I’ve heard different random issues through the years although too. Individuals are like, I don’t know, anytime you hear somebody give recommendation that’s like, that is true for everybody. Nobody should purchase a home, everybody should purchase a home, no matter. I all the time really feel like okay, let’s look into that somewhat bit extra as a result of normally, issues aren’t for everybody or nobody. These are fairly excessive. There’s simply so many various eventualities that after I hear recommendation like that, I’m like, I don’t suppose you’ve thought that by for everybody.

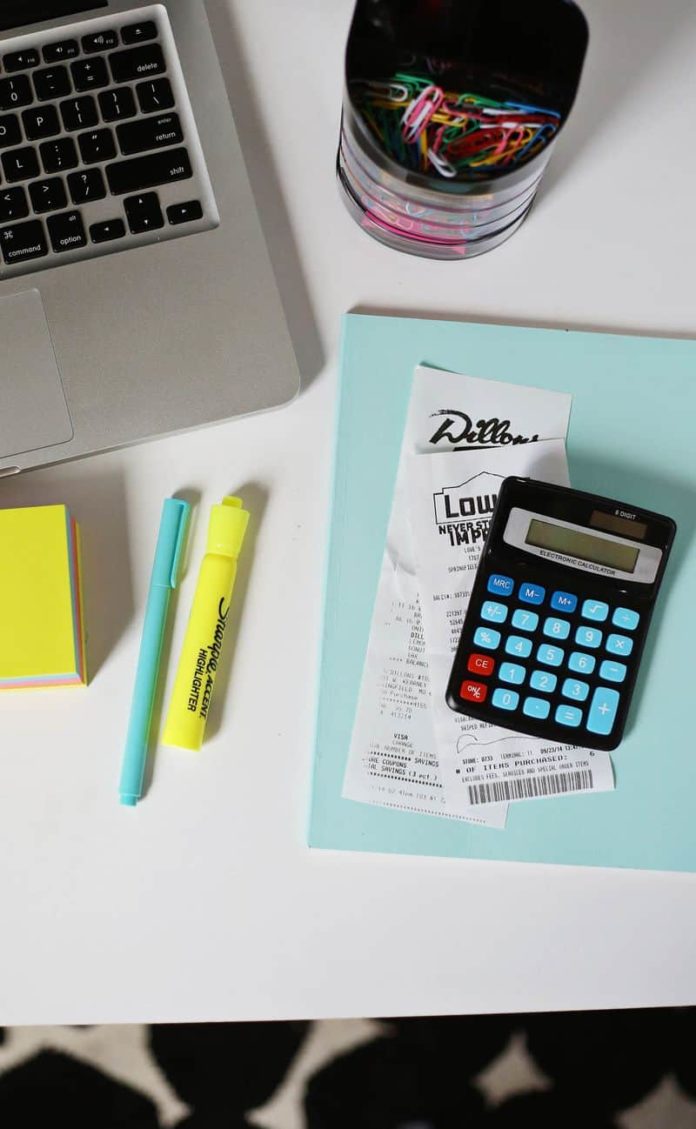

Elsie: Agree. Agree. Agree. Okay, so for the guide, I Will Train You To Be Wealthy, let’s merge into our guide report half. So we stated earlier than, this guide shouldn’t be for rich folks, it’s about having a rich mindset. Huge majority of the guide is about working by yourself mindset in your personal wealthy life. There are additionally elements of it which can be about establishing investments and issues like that, which can be sensible, too. However I feel that it’s all issues that you may do in a wide selection of various conditions. Okay, we’ve mentioned this guide earlier than on our podcast, however I simply needed to incorporate it in our guide membership, as a result of I do know some folks have had it on their listing of which means to learn it. In case you learn it, we might love to listen to your feedback. Ship us a message, go away us touch upon the weblog at the moment is the very best place the place we are able to chat backwards and forwards. I need to hear what it meant to you. However we’re going to share a few of our private favourite takeaways from the guide. For me, it was positively life-changing. I really feel like I’ve finished quantity of gushing over it by the previous couple years.

Emma: Yeah, we’re positively fangirls. I hope that’s clear. Like Elsie was saying, I feel certainly one of my favourite issues in regards to the guide total if I used to be simply going to advocate it to somebody they usually’re like, why this one. Of all the non-public finance books I’ve learn, which has been fairly a number of through the years, I feel this one is the right combine, at the least to me, of issues about mindset. Then additionally sensible issues like what sort of bank card you would possibly need to arrange, what sort of checking account, investments, and sensible recommendation alongside mindset stuff. I really feel like a whole lot of books, it’s both one or the opposite and I really like that this guide, actually, I feel has an ideal mixture of each since you really actually do want each. It’s worthwhile to have that wholesome mindset in the direction of cash however then if you happen to don’t have sensible ideas, chances are you’ll not know what to do with this now wholesome mindset. Then if you happen to solely have the sensible ideas you would possibly miss out in your wealthy life. Let’s share a few our takeaways from the guide, issues we discovered and applied, after which possibly let’s share somewhat bit about what our wealthy life is, and what it means to us.

Elsie: Alright, so my massive takeaway is, I learn this guide about three years in the past for the primary time after which I learn it once more final yr, and it’s type of like a pump-up factor for me. It makes me really feel very amped. So I spend a whole lot of time on making plan after which I spend very, little or no time micromanaging our price range now. So the factor that I really like about it, I really feel like I’ve a really free life. I like my charts that I coloration in. So I’ve my coloration and charts for financial savings and we’re engaged on retirement proper now. I’m coloring in little containers every time we hit a brand new marker. That may be very encouraging for me. It’s one thing that identical to works for me, that may be a motivator. I’ve heard lots really, that is on Ramit’s podcast fairly a bit, a whole lot of {couples} struggle about small purchases. You’re spending an excessive amount of on this, what did you purchase at this retailer sort of issues. My husband I, we principally don’t have these fights or conversations even virtually in any respect. We discuss massive issues that we’re spending cash on however just like the little issues type of it feels prefer it’s not a stress level anymore in our relationship, which it was a few years in the past as a result of I used to all the time be like, we should always spend much less on this, we should always spend much less on this. It was type of senseless it didn’t have like an enormous goal. It was identical to what I believed we quote-unquote, ought to do. So I feel that’s the most important change to my life is now I’ve virtually no guilt spending cash as a result of I do know that we live in line with our values that we arrange collectively, we created collectively. So we type of don’t should be unhappy or burdened or fear or evaluate ourselves to different folks. We simply get to dwell our wealthy life.

Emma: Yeah, and I feel for me, in an identical method, it type of freed me as much as spend extra on little issues that make me glad. I spent a whole lot of time earlier in my life having a fairly inflexible price range, not as a lot out of guilt. I simply wanted to as a result of I didn’t have a whole lot of earnings. I had some massive objectives. I talked about this in different episodes, however I saved up like $10,000 by the point I graduated school in order that I may transfer to LA and I had type of a cushion in order I began my life there. So like that. Once I moved again to Missouri, I had a aim that after a yr I needed to purchase my first dwelling,. I used to be 25 on the time and single. I used to be in a position to try this and once more, I needed to be fairly inflexible in my price range with the intention to make these objectives occur. That’s what I needed on the time, these objectives so it was completely price it to me. However I feel I simply bought into type of a behavior of that after that time the place I by no means actually loosened these reins for no actual purpose. I simply was like, oh yeah, I simply don’t purchase good garments. I simply don’t purchase skincare simply because I really feel like. I simply would by no means purchase issues principally that have been type of simply enjoyable stuff. I imply, you do want garments. I simply form of realized through the years like every so often, not like day-after-day or something, however identical to every so often, I ought to identical to purchase issues as a result of it makes me type of glad to have a brand new jumpsuit as a result of I’m a jumpsuit fanatic or a brand new pair of glasses as a result of I’m attempting to put on my glasses extra and I didn’t love the one pair that I had. Elsie trolled me as a result of I didn’t purchase prescription sun shades for years as a result of I used to be like I don’t want these. I simply want the prescription glasses. Then I used to be like, why are you doing that although, Emma? You possibly can afford to purchase prescription sun shades, simply purchase them. Now I’ve a pair and I wore them on a stroll final evening with Oscar and it was nice as a result of I didn’t should get a hat as a result of I had glasses, blah, blah. So anyway, I feel pondering extra about wealthy life and simply a few of the ideas. The mindset stuff from his guide type of made me understand I had simply type of gotten right into a behavior of being low-cost for no purpose. It served me for a time and that was great, simply type of realizing like, oh, this behavior you’re in is now not serving you and it’s okay to vary it. That’s okay.

Elsie: I really like that concept that your mindset about cash and your guidelines for your self can and will change all through your life. For me, a whole lot of it was like these judgment attitudes, the place you’re pondering like, oh, you shouldn’t spend cash on that, or oh, that’s too costly. What’s quote-unquote, too costly, is a relative factor. I don’t suppose I knew that after I was youthful. I feel I believed it was an absolute truth.

Emma: That is too costly for anybody so if anybody has it, they’re overspending.

Elsie: I feel that yeah, how I used to be raised, not essentially by my mother and father, if my mother and father are listening, however simply by my cultural, bubble. I feel I used to be raised to suppose that no matter if you happen to earn extra if you end up afterward in life, that you must spend absolutely the minimal. Now I do suppose that that’s type of a self-defeating mentality. So yeah, I feel like the entire theme of evolution, protecting an open thoughts, being prepared to vary your concepts, that can be wholesome. That’s what I need our listeners to get out of this guide as nicely.

Emma: For certain, possibly we should always inform somewhat bit what our wealthy life appears like.

Elsie: So the wealthy life idea, it’s just about such as you’re selecting the issues that imply lots to you. So I’m going to spend extra on the issues that imply lots to me after which the issues that don’t imply as a lot to me, I’m not going to spend as a lot on them. So one thing that’s an instance for me of significant is clearly my home. My husband and I each make money working from home and I adore it. I simply love home adorning, feeling cozy, having friends, any and all of it, holidays, it’s my particular factor. So for me, having an enormous closet of Halloween decorations is definitely part of my wealthy life. An instance of one thing that isn’t necessary for me personally, is having a flowery automobile. So lots of people in our Q&A, all the time ask us what sort of automobile we’ve and I feel it’s as a result of they need to understand how a lot cash we’ve. However I’ve a daily model, I’ll simply say what it’s, I’ve a Ford SUV. It’s a daily automobile. It’s household automobile. It’s not a Lexus, there’s even method nicer automobiles than that. I imply, a few of my associates are into that and I really like that for them. I don’t suppose it’s useless or wasteful in any respect for them. However for me it might be can be as a result of it’s simply not one thing that brings me pleasure or that I’m keen about. What are yours?

Emma: Actually mine are so related. I’m very keen about my home, my dwelling. For me, it additionally has to do with location, I actually love having the ability to go on walks and take my son on walks. Proper now he’s in a stroller sometime, I shall be scurrying behind him as he learns to trip a motorbike, no matter, like totally different seasons. However a walkable neighborhood is de facto necessary to me. I simply additionally love a house that feels good and has every thing that you simply want. You are feeling excited to have folks over however I don’t really feel like I want a essentially large home or essentially small home. I feel the most important factor is de facto the walkable neighborhood. We’ve got a canine and we’ve a son and I make money working from home so there’s all these concerns and issues too. The opposite factor that I’ve a sense it’s type of in your listing too, is journey. I like to journey and I don’t really feel like I have to do it the entire time. I’m now in a season of my life the place I might miss my son if I did it on a regular basis however I do like to journey. That’s one thing that I need to spend cash on. I’ve a dream, sometime, I’m going to go to Antarctica. I don’t know when. It’s gonna price some huge cash and it makes me somewhat anxious to consider however I actually need to go. It’s simply on my bucket listing for lifetime of like, I need to go to Antarctica. I simply suppose it appears stunning, attention-grabbing and simply one of many farthest locations you’ll be able to go on our planet, which I feel is type of fascinating. That to me is price spending cash over regardless that it’s type of a big-ticket merchandise. Much like you, Elsie I don’t give a sh*t about automobiles. I simply don’t care. I couldn’t care much less. I’ve a 2014 Subaru and I adore it. I’m gonna drive it until it’s lifeless as a result of I don’t care. It doesn’t matter to me, it really works nice. It’s nice. Don’t care.

Elsie: That’s the entire level of it. We may share each single factor that’s on our listing and each single factor that’s not but it surely’s type of not the purpose. The purpose is it’s a must to make your individual listing and choose the issues that deliver you pleasure and make your life, make you’re feeling such as you’re f*cking residing like that’s what it’s alleged to be. It doesn’t matter what anybody else does with their cash. I really like the concept of simply reserving judgment as a result of I feel so many individuals don’t do this. Okay, so if it’s okay with you, let’s go forward and soar into my interview together with her Ramit. Then we are going to come again and do a number of Q&A on the finish. Nicely, I’m so excited to do that interview.

Ramit: Thanks me too.

Elsie: Yeah, thanks for being part of our guide membership. So I simply regarded this up and do you know that you simply first got here on our podcast on episode 35 and now it’s episode 148?

Ramit: Oh, my gosh. Nicely, I’m flattered to be again. Meaning lots.

Elsie: I feel you simply bought the award for essentially the most frequent podcast good friend.

Ramit: I’ll take it.

Elsie: Okay, so this episode is named Finest and Worst Cash Recommendation so wealthy life one on one. So we defined the idea form of earlier after we have been speaking about our wealthy lives. We have been giving examples of what we outlined for ourselves and what helped us. However I hoped that for our listeners, that you may discuss the advantages of personalizing your individual cash values. I feel lots of people don’t perceive how huge the variations are. It may be such a wide selection of several types of issues for various folks.

Ramit: So I really like this idea of making your individual cash guidelines. I’ve 10 of my cash guidelines and I feel everyone ought to have 10 of your individual cash guidelines. Once you first hear the phrase guidelines, lots of people suppose that it’s restrictive, unfavourable, it’s the issues you’ll be able to’t do. However I really like cash guidelines which can be expansive, that say sure. So I’ll provide you with an instance of a few of my cash guidelines after which I’ll let you know why I selected them. Considered one of mine isn’t query spending cash on books, appetizers, well being, or donating to a good friend’s charity fundraiser. Now, let me let you know why I selected that. Initially, I by no means query it as a result of I’ve an opinion that if you happen to see a guide that’s attention-grabbing to you, you must simply purchase it. It’s referred to as Ramit’s guide shopping for rule, simply purchase it, 10 bucks and also you get years’ price of an creator’s experience, the very best worth you’ll be able to spend. Appetizers, after I was a child, we didn’t actually purchase appetizers. We couldn’t actually afford them and so now to have the ability to go to a restaurant and see two or three appetizers and say I’ll simply take all of them, that feels very wealthy to me, regardless that it’s 20 bucks or so. So you’ll be able to see that it’s private to me. You might not care about appetizers, so don’t have a cash rule about it however I do. I care about well being, I need to spend cash on it. Right here’s one other instance, enterprise class on flights over 4 hours, okay, somewhat bit extra extravagant. Once more, lots of people listening go, that should be good, should be good. It’s good. That’s why I selected it. The rule for me is I need to simplify making choices. So I don’t have to sit down there and select which flight and debate with myself, I simply have a single rule. If anybody’s reserving my flight for me, they learn about that rule. Now, you may not care. I don’t care about spending cash on enterprise class, or chances are you’ll not be capable of afford it. That’s why it’s my rule, not yours. However I embrace this rule as a result of I need to present you that guidelines might be enjoyable. In fact, I’ve some primary ones, like all the time have one yr of emergency fund money, save 10%, make investments 20%, minimal of gross annual earnings. These are sustainable issues which can be good for my monetary administration however then there’s these things like enterprise class. So I problem everybody right here to create your individual cash guidelines and the extra you create them, the extra private they’re, and the extra incomprehensible they are going to be to different folks. You hearken to my guidelines, you go this man’s a psycho. Why is he speaking about enterprise class and appetizers and quantity 10 marry the proper particular person. Why? Nicely, as a result of that issues to me, and my cash. For you, what issues to you? I ought to be capable of have a look at your cash guidelines and inform that it’s particularly handmade for you. That’s when you already know you will have 10 nice cash guidelines.

Elsie: I really like that. I used to be really listening to your podcast final week and I began engaged on my 10 cash guidelines, and I discovered it type of laborious to get to 10. So I’m nonetheless engaged on it.

Ramit: So I’ll let you know what most individuals do once they give you their cash guidelines for the primary time. Their cash guidelines all sound like this, don’t waste cash on natural clean. Don’t waste cash on this. By no means purchase that. It’s all restrictive. I am going, hey, have a look at your guidelines, do you really really feel good these guidelines, after which they type of sheepishly go no. They’ll say stuff like by no means eat out after I can cook dinner at dwelling and I am going, when was the final time you ate out? They go Tuesday. I suppose why are you placing a rule like that? They really feel that they should create guidelines that they should dwell as much as, in a unfavourable method.

Elsie: Yeah, I feel that’s what we have been speaking about earlier on this episode is that a whole lot of the unhealthy cash recommendation is rather like, actually restrictive guilt-based recommendation, that we spent a whole lot of years like, I by no means actually adopted it. I simply felt unhealthy on a regular basis. Emma adopted it and adopted it and form of drove herself insane. Eager about an ample life, I prefer to make the imaginative and prescient boards just like the collages with all of the cool issues on them. I feel it’s type of like that, however along with your cash.

Ramit: I really like that. Yeah, completely. What you stated is so true. We spend our lives feeling responsible about this restrictive cash recommendation and we don’t even observe it. So what’s the purpose, it doesn’t work. So we would as nicely choose issues which can be ample, which can be significant to me, and look, if you happen to can’t afford a enterprise class flights, and truthfully, you don’t care about it. It is perhaps choose my daughter up from faculty each afternoon. That may be a wealthy life, prices you nothing however you can begin to see the way you create your individual guidelines that make you’re feeling good, not unhealthy.

Elsie: I really like that. Okay, so I need to share with you my distinctive instance. That’s fairly bizarre and loopy and I hope you adore it. However I hoped earlier than that you may simply share a few of the examples you’ve heard by the years of identical to folks’s wealthy lives that’s like this wouldn’t apply to 90% of individuals, but it surely makes this particular person so glad.

Ramit: Nicely, my favourite instance ever was a younger mom, who wrote me and he or she stated, Ramit, I heard you discuss a wealthy life for years, however I by no means actually bought it. It didn’t join with me till I went with my daughter to Disneyland. She stated that her daughter is disabled, and her daughter has particular wants. She stated I thought of what I needed to do to make that day particular for my daughter. I made a decision that I used to be going to get a behind-the-scenes Disney VIP move and he or she stated that it was magical for her daughter. They bought to go to the entrance of the traces, which was useful for her daughter. They bought these stunning pictures, they met their favourite characters and he or she stated that was the second the place I noticed I can use cash to create my wealthy life.

Elsie: That’s completely unbelievable.

Ramit: I really like that. This concept that we are able to earn cash, and we work so laborious. We reserve it and we make investments it after which we flip round and prohibit ourselves from really utilizing it. It simply drives me insane. So after I hear folks spending cash on the issues they love, after all, they need to be capable of afford it. In fact, they need to take into consideration what’s significant. Sure, however okay, you probably did that. Now spend it and spend it guilt-free. This younger mom did it and I used to be so glad she shared her story with me.

Elsie: I adore it. I feel that that’s one of many issues I really like that you simply train. So I hope that our listeners will get into that and I hope lots of people have had an opportunity to learn the guide as a result of it was actually actually life altering for us. I really like that your recommendation about making a living extremely private. I used to evaluate myself a lot and in addition decide others like unhealthy behavior from center class that I needed to do away with in my life, doing a whole lot of evaluating and stuff. So I used to be curious what your recommendation is for our listeners who need to have extra confidence with their cash?

Ramit: Yeah, I exploit a precept I name D to C, the D to C precept. It stands for from disparagement to curiosity. Once I used to go on airplanes, after I was youthful, I might all the time sit within the again the most cost effective seats. I bear in mind strolling previous first-class and enterprise class and I might go, these folks have been so silly, why would they pay 4 instances the identical value? We’re all attending to the identical place and it was disparagement. What I want I had finished is to get extra curious and say, hey, these individuals are clearly sensible sufficient to have the ability to afford one thing up right here. Why? Why would they spend 4 instances the quantity after we’re all attending to the identical place? If I had requested that query, I may need began to know sure issues like, possibly they make a lot cash, {that a} first-class seat is simply the identical as an economic system seat is to me. That might have allowed me to say, what sort of job have they got? How did they begin making a lot? What can I do to make extra? I may need discovered that some folks have a well being problem, they usually want more room to stretch out their legs. However I by no means bought to any of that, as a result of I used to be judgmental. I struggle that tendency day-after-day nonetheless, it’s born and it’s taught from a younger age. We be taught sure issues about judgment, like from films, wealthy individuals are evil. However I additionally suppose that if you happen to develop up believing that making extra money makes you a nasty particular person, you then’re not going to make more cash. The truth is, you’re not even going to benefit from the cash you will have.

Elsie: That’s so true. Okay, so I need to discuss in regards to the podcast, I’m so excited. I all the time, all the time, all the time was annoying messaging you when are you going to start out a podcast, I can’t wait in your podcast. You’re like, there’s no podcast, Elsie. There’s not a podcast and someday, it magically appeared on my telephone and I’m so glad. So I needed to say a few my favourite episodes that I feel our listeners would additionally actually like. Okay, so principally, it has the vibe that you simply’re listening to both a non-public marriage dialog or possibly even one thing they’d be speaking to a therapist with which I do know you’re like, clearly say I’m not a therapist, but it surely has that vibe like folks actually are tremendous, tremendous trustworthy. I’m so amazed, just like the issues that individuals are saying on there. They’re like so trustworthy. Okay, I actually preferred episode 22, which is named I’m quitting my job however I’m Frightened My Husband Doesn’t Assist Me. So this episode, they couldn’t resolve whether or not or not the spouse may spend $200 a month shopping for dietary supplements. It type of like went on for nearly the complete episode and I believed that was actually relatable as a result of all of us have these monetary hang-ups. The place it’s like you’ll be able to spend no matter on so many price range gadgets. All of us have this one price range merchandise that we discover greater than the opposite ones and a whole lot of instances like in a partnership, it may be the factor that the opposite particular person spending cash on. So yeah, I actually preferred that episode. Then the opposite one which I cherished was okay, simply hearken to this one, episode 41, My Spouse received’t Admit That Her Enterprise is Failing. My husband and I are each serial entrepreneurs so we’ve began heaps and many companies by our relationship. We’ve been collectively 15 years, and a few of them failed. So if you happen to begin a whole lot of companies, you normally don’t have like an ideal observe file, and figuring out whether or not or not it’s successful, or a fail is so troublesome, particularly if you’re undecided if it’s untimely or if you happen to’ve had sufficient time resolve. So I cherished that one. I believed it was fascinating. It gave me a whole lot of recollections as nicely. So yeah, have you ever had a favourite?

Ramit: Sure. However it’s like kids, you’ll be able to’t actually say. There are some that basically, actually stand out to me. Episode one, the place there was a husband who didn’t belief his spouse on operating their enterprise. I really misplaced my mood on that episode and I really actually regretted it. We have been within the edits they usually needed to chop it out. This was the primary episode and I stated, no, we’re going to place it in. That is going to be actual. The podcast is about actual conversations with actual folks and actual numbers from behind closed doorways. So I’m not all the time excellent on this stuff. We’re going to place that in and we put it in and you’ll hear me lose my mood, and I apologized. However I keep in mind that one. I additionally bear in mind an episode the place the husband wrote me a letter in all caps and he stated, please assist me. My spouse of 21 years is about to divorce me as a result of she says I’m low-cost and he had a internet price of $13 million. He would solely fly economic system. His spouse spent two weeks discovering the proper mattresses for his or her youngsters after which he stated, no, that’s too costly. Simply this lack of belief. However it was fairly superb listening to why. Why can somebody make hundreds of thousands of {dollars} and nonetheless really feel scared about cash? I really suppose that shakes lots of people as a result of lots of people consider deep down as soon as I’ve X {dollars}, I’ll cease feeling unhealthy about cash, and you’ll by no means cease feeling unhealthy. It’s not a quantity. It’s a sense. It’s your cash psychology. I’ve one other man who made $8 million, and he would evaluate the value of strawberries. Why? Why? As a result of as you earn more money, it doesn’t magically change your emotions about it. Nicely, I admire you listening to it. Are you aware why I began the podcast?

Elsie: I need to know.

Ramit: You have been telling me for a very long time, do a podcast. I used to be like I need to however I’ve no concepts. I don’t need to simply sit round interviewing. I’m not that good at it. I don’t actually take pleasure in it. So I believed again to when my spouse and I began speaking about cash after we have been engaged. We actually began having these conversations. The truth is, we have been speaking about signing a prenup and it was actually troublesome. I went on-line, and I’m like tips on how to discuss a prenup. All the recommendation on the market was so generic, it was like have the dialog. I’m like, what dialog? Actually, what am I alleged to say? I want that I may pay attention in to different {couples}, however you’ll be able to’t. There’s no place to hearken to them. So lastly, out of the blue, someone reached out on Instagram, they’re like, hey, my spouse and I’ve $700,000 of debt, roughly. We don’t know tips on how to take care of it. So I stated, hop on Instagram Reside, let’s simply discuss it. We did and it was mind-blowing. That’s after I realized, I need to discuss to {couples} however the catch is I need them to share their actual numbers. You and I’ve by no means heard conversations like this.

Elsie: I’ve by no means heard something prefer it.

Ramit: Yeah, as a result of folks don’t discuss these things publicly. However each couple has arguments about cash. Each single couple. Each single couple has disagreements. One particular person’s overspend, one is affordable. One particular person doesn’t need to do that and the others a hardcore investor. I needed to deliver these to the floor so that they’re not hidden anymore within the darkness. That’s what I hope to do with this podcast.

Elsie: Yeah, it actually comes by. It’s not like any podcast I’ve ever listened to, which is, I imply, the best factor about it. I feel I had an concept of what sort of podcast you’d make and it’s fully totally different.

Ramit: So what did you suppose I used to be gonna do?

Elsie: I feel I believed it could be like, like, the Good Passive Earnings or one thing like, I don’t know, like, only a common cash podcast. I really like that podcast. I didn’t suppose it could be just like the one-on-one conversations and I don’t understand how a lot time it takes so that you can get folks to be so trustworthy however no matter it’s, it’s price it.

Ramit: Thanks.

Elsie: Alright, so how can we observe you?

Ramit: Okay, you’ll be able to observe me on social. I’m @ramit on Instagram, @ramit on Twitter. You possibly can observe me on my publication, the place I discuss a whole lot of these things in additional element, particularly, cash psychology, you’ll be able to go to iwt.com/beautifulmess, iwt.com/beautifulmess to enroll.

Elsie: Superior. Okay, thanks a lot Ramit.

Emma: Let’s do a number of listener questions earlier than we go. So these are issues that we bought requested and we forgot to reply on our St. Louis journey. So we’re doing it now. First one was, do you take care of social anxiousness after which observe up is do you will have recommendation for dealing socially?

Elsie: So I do have like fairly unhealthy social anxiousness and it does have an effect on my life. It’s one of many issues I work on in remedy and it’s fairly annoying. So for me, the factor that I discover useful is to principally outline for myself upfront if it is a factor that I can skip on the final minute, or if it is a factor that I completely can’t skip. I feel having these parameters helps me as a result of I type of need to skip every thing. If it’s going to a spot that’s crowded, particularly if I’ve to go with out like my consolation zone, which might be having Emma or Jeremy with me. If I’ve to go on my own to a crowded place like a celebration, it’s very troublesome for me. Yeah, deciding is that this one thing that I can skip or is it one thing the place I can go there and be for 20 minutes or half-hour, and I don’t have to remain all evening, issues like that. I feel it’s, for me, at the least a everlasting battle. However I feel that simply realizing how a lot I’ve to do, like what’s the naked minimal is useful for me. Generally you arrive someplace and also you’re having a lot enjoyable and also you meet somebody who you click on with, and you then need to be there and it adjustments immediately after which typically it doesn’t and I go away early. I imply, I hope that that’s regular. I don’t know.

Emma: No, I feel it’s very regular. I don’t know if I get social anxiousness however I positively get anxious to be round new folks typically, or I’ll really feel like, nicely, I suppose for me, I begin enjoying the function in my head of all of the bizarre issues folks have stated about us through the years on the web. And I feel, oh, what if this new particular person I’m assembly is pondering these things, proper now. They’re pondering that I’m, no matter, XYZ all of the imply issues folks say. Generally I actually gotta quiet that and shut that down and simply type of be like, primary, impossible that’s occurring. Quantity two, whether it is it’s not my drawback. It’s their drawback. I feel that’s a tough stance to take however you already know, there it’s. This can be a little dorky however it’s what I do. So if I’m going someplace, and I’m going to be round those that possibly I don’t know that nicely and that’s normally extra what’s going to spike my nervousness. I’m like, I don’t know what I’m going to speak about. What in the event that they requested me a query, and I don’t actually know, like when individuals are like, what do you do for a residing? I’m all the time like, oh boy, as a result of it’s identical to, lots to clarify. I’m like, are you even ? I don’t know if I can clarify this in an attention-grabbing method. So what I’ll do is, earlier than I head out, I’ll type of in my head, attempt to remind myself, look, there’s in all probability lots of people who’re going to be there, or this different couple you’re assembly with or no matter they may really feel as nervous as you might be. So how about you simply make it your aim to say one actually encouraging factor to somebody tonight. That’s simply it, after which I deal with that. Then if I do this, then I take into account the evening of success. So if the rest goes bizarre, or there’s like a second the place I’m standing on my own, and it’s awkward, I’m like, you already know what, I stated that one encouraging factor to that particular person and I actually meant it. I believed by what they have been saying to me, I requested them some questions. I actually tried to say one thing useful. That’s success. That’s it. That’s all I bought. I transfer on with my life as a result of it’s like, nicely, there you go.

Elsie: Yep. That positively will get my stamp of approval.

Emma: Okay, subsequent query was, will there be a Halloween particular this yr?

Elsie: So final yr, we did a Christmas particular and we promised everybody we might do Halloween particular.

Emma: Did we? No, we did.

Elsie: I feel we made an enormous deal about it. So I’m proud to say we’ve already booked our week of taking pictures in August, and we’re going to shoot Halloween and Christmas however we’re going to do it in a different way. We’re gonna do a unique format this yr. We’re attempting to only enhance on our experiences and learnings from final yr. So we’ll have to attend and see the way it all rolls out. However we’re making a ton of actually cute movies for the Halloween and vacation season. It’s gonna be enjoyable is our favourite time of yr by lots.

Emma: Okay. Third query is how do you handle all of the laborious information and do you will have a self care technique?

Elsie: I feel that that is simply an ongoing factor that we’re all the time going to be studying our entire lives. So far as managing the laborious information, truthfully, I simply talked to my husband, Jeremy and I talked to Emma, and I let myself really feel unhappy. If there are issues we are able to do to assist, and typically there are and typically there aren’t like issues you’ll be able to donate to, then I feel that’s nice, too. If there’s one thing we are able to do in our personal neighborhood, that’s all the time the very best however there’s not all the time.

Emma: Yeah, there’s not all the time typically it’s like a much bigger factor that you simply’re like, nicely, how do I even assist with that? One factor I’ll do is, and we talked about this in a earlier episode, however limiting my time on my telephone. It’s not me saying be uninformed, completely tune out. By no means have a look at the information. No, that’s probably not my level. My level is extra to say, for every of us, we’ve a sure capability, and we’ve numerous issues in our lives, we’ve to handle ourselves, handle our households, do our jobs, and no matter is in your life and we solely have a lot capability. So if you happen to understand you’re reaching yours, and I typically understand I attain mine, particularly emotionally. For me, that’s a time to do away with the telephone as a result of I’m going to see one thing that’s in all probability going to make me go over my emotional capability, and I simply can’t actually do this I have to handle myself. The opposite factor I used to be gonna say is I type of like set a timer for my emotions. I don’t actually set a timer however what I imply is I’ll type of have a look at the clock and be like, okay, you’ll be able to have, you already know, 5 minutes or 10 minutes to only really feel offended or scared or no matter it’s that I’m feeling. Generally I’ll do that on a stroll too. I do know that like, oh, I’m gonna stroll down this block after which backup this block or no matter. So I’ll be like, alright, this entire block, go forward and rage as a lot as you need, really feel as unhappy as you’re feeling. There are occasions I’m on a stroll and I’m crying. It’s like rolling down my face, tears, as a result of I simply give myself the house to be like, I’ve some emotions about this. Often it’s a whole lot of like concern and unhappiness however typically I’m feeling somewhat rage. It’s not like, you already know, timer goes off and also you’re not allowed to really feel anymore. It’s not a lot that. It’s only for me, I can type of spiral and spiral after which I’ll get to the tip of my day and really feel like I didn’t get as a lot finished as I needed at work or I wasn’t as current with Oscar, or I didn’t spend at the least a part of my stroll occupied with what I’m grateful for in my life proper now, which exist concurrently feeling unhappy or offended about one thing. These issues can coexist and it doesn’t imply that you simply’re being faux so I feel that for me is part of it’s type of quote-unquote setting a timer on my emotions to each give them house and in addition not allow them to take over.

Elsie: Generally somewhat little bit of crying is simply pretty much as good as a whole lot of crying.

Emma: Yeah, does the identical physique factor that it’s gonna do and it’s one will prevent a whole lot of time although. Okay after which the fourth and closing query is professionals and cons of getting bangs. They’re occupied with it. I don’t have bangs so that is all Elsie. So what are all of them, Elsie, a professionals and cons.

Elsie: All proper, so Emma has had bangs earlier than.

Emma: I hate them con con con for me.

Elsie: I do know so many individuals who suppose that they’re only a burden in your life however I’ve largely all the time had them. So professionals and cons. Nicely, the professional, I might say that they, for some folks, they’re cute they usually look good.

Emma: Yeah, positively.

Elsie: Like I’m a type of folks. Each time I lower my bangs, folks rapidly are giving me extra compliments and simply usually appear extra like into how I look. In order that they work for some faces and I feel for some folks, it additionally like, I really feel like the entire eyebrow pattern of the 2020s. You understand how it’s been like, folks put a whole lot of work into their eyebrows. I really feel like I don’t should put that a lot work into my eyebrows as a result of I’ve bangs which I really like. I additionally don’t get Botox on my brow as a result of I don’t care. I virtually did as soon as and the woman was like, why do you care as a result of you will have bangs. I used to be like, you already know what, you’re proper, I don’t care. Yeah, I might say these are the principle professionals. And the con. For me the most important con is I needed to be taught to chop them myself. For me, I’m a kind seven and a artistic particular person. They’re simply not constant. I can’t get them precisely the identical each time. My hair grows actually quick so I do have to chop them greater than as soon as a month. So I couldn’t go to an expert each time I do this. It’s simply not life like for my schedule. So yeah, the cons are studying to chop them after which the opposite con clearly is like getting greasy bangs. So I’m a type of folks with the jelly donut face after I fall asleep. I put all of the skincare merchandise on, zillion step rountine and I adore it, it brings me pleasure. That may clearly make your freshly washed bangs not final as lengthy. So yeah, total, I feel it’s a small dedication. I feel everybody ought to have bangs as soon as of their life simply to see in the event that they prefer it or not, particularly if it’s one thing that you simply suppose is cute. Lots of people additionally suppose they’re not cute, which I can’t show you how to with that.

Emma: I feel they’re cute.

Elsie: I perceive that there are extra upkeep than not having them. However for me, it’s simply how my face was born so I can’t change it. I’ll in all probability all the time have them.

Emma: I felt that it simply didn’t look good on me. Then additionally I positively have greasy pores and skin after which additionally jelly donut skincare. So it simply was an excessive amount of for me so I didn’t like them. I don’t know, I’m only a lazy particular person. So actually, my aesthetic is like what works for being fairly lazy. Right here we’re.

Elsie: Nicely don’t get them if you happen to don’t actually need them. Okay, so we shall be again subsequent week with our closing episode of spring. We’ll be sharing our summer time studying listing in addition to our summer time bucket listing so it’s gonna be a enjoyable episode. Be completely for certain that you’re subscribed to the podcast earlier than our break as a result of we’re going to have two months off for our summer time break and we don’t need you to overlook it after we come again simply since you fall out of the routine. So yeah, we’re very grateful in your help, ensure you’re subscribed, and we shall be again subsequent week.