Whereas many nonetheless refuse to consider it, monetary consultants and insiders have lengthy warned {that a} collapse of the U.S. forex is a mathematical inevitability.1,2 Probably the most shocking factor, actually, is that it has lasted this lengthy. The identical may be stated for the monetary system of the world as an entire.

Collapse Predictions Go Again Extra Than a Decade

In 2011, Enterprise Insider warned “the greenback collapse would be the single largest occasion in human historical past,” touching “each single dwelling individual on the earth.”3 Additionally they warned that “The collapse of currencies will result in the collapse of ALL paper property,” and that “The repercussions to it will have unbelievable outcomes worldwide.”

That very same yr, liberal billionaire George Soros echoed the identical warning, saying “We’re on the verge of an financial collapse.”4 The primary distinction was that Soros predicted the collapse of the Euro. Soros additionally famous that:5

“It’s a form of monetary disaster that’s actually growing. It’s foreseen. Most individuals understand it. It’s nonetheless growing. The authorities are literally engaged in shopping for time.”

To date, authorities have efficiently “purchased time,” holding the system along with proverbial duct tape and paperclips. However finally, time will run out and the system will fail. To cite Ayn Rand, “You may ignore actuality, however you’ll be able to’t ignore the implications of ignoring actuality.”

In 2013, funding adviser and monetary strategist Michael Pento warned:6 “Our addictions to debt and low-cost cash have lastly brought about our main worldwide collectors to name for an finish to greenback hegemony and to push for a ‘de-Americanized’ world.”

That very same yr, Canadian billionaire investor Ned Goodman additionally predicted7 that “the greenback is about to change into dethroned because the world’s defacto forex,” that we have been “headed to a interval of stagflation, perhaps severe inflation,” and that “america will probably be shedding the privilege of having the ability to print at its will the worldwide reserve forex.”

Extra just lately, in June 2020, economist and former Morgan Stanley Asia chairman, Stephen Roach, advised CNBC:8

“The U.S. economic system has been troubled with some important macro imbalances for a very long time, specifically a really low home financial savings price and a continual present account deficit. The greenback goes to fall very, very sharply9 … These issues are going from bad to worse as we blow out the fiscal deficit within the years forward.”

Don’t Anticipate a ‘Comfortable Touchdown’

All of final yr, whilst inflation began rising earlier than our eyes, authorities denied that issues have been as bad as they appeared. Inflation is transitory, they stated. It wasn’t till Might 2022 that Federal Reserve chair Jerome Powell lastly admitted that executing a gentle touchdown could also be past the Federal Reserve’s management (see video above).

Powell’s definition of a “gentle touchdown” was 2% inflation with a powerful labor market. Clearly, we’re effectively previous that time already. The chart beneath, from U.S. Inflation Calculator, is illustrative.10

U.S. inflation is at the moment at 8.3%, however in some markets, it’s within the double digits. Used automobile gross sales, for instance, have seen an inflation price of twenty-two.7% prior to now 12 months.11 Globally, meals costs elevated by 29.8% between April 2021 and April 2022.12

Might 31, 2022, Treasury secretary Janet Yellen lastly additionally admitted13 she was unsuitable when, in 2021, she stated inflation can be a “small danger” that may be “manageable” and “not an issue.” In an interview with CNN host Wolf Blitzer, Yellen claimed:

“There have been unanticipated and huge shocks to the economic system which have boosted vitality and meals costs, and provide bottlenecks that affected our economic system badly that I did not, on the time, absolutely perceive.”

How the treasury secretary may very well be so blind to fiscal realities is tough to fathom. However she’s not the one one attempting accountable our monetary scenario on “unanticipated” occasions. Individuals on the World Financial Discussion board’s Davos assembly blame inflation on company greed, which solely proves they’re unqualified to handle something, not to mention a world economic system. As famous by Kentucky Sen. Rand Paul:14

“If you happen to have been in a third-grade class, I’d provide you with a failing grade when you advised me inflation was attributable to greed. That’s the dumbest rationalization, essentially the most implausible, missing all information, that somebody may put ahead.

Inflation is attributable to a rise within the cash provide … The Federal Reserve prints it as much as borrow it; it floods the economic system and drives costs up. If you happen to don’t perceive that, it’ll by no means get any higher.”

Once more, recall that Soros in 2011 acknowledged that financial collapse is “foreseen” and that authorities have been merely shopping for time earlier than the inevitable collapse.15 Now that we’re within the economic system’s ultimate demise throes, those that have been conscious of the trajectory for effectively over a decade, if not longer, can’t admit it, as a result of then they’d have to clarify why they didn’t act to cease it.

Such an admission would additionally expose the central financial institution system because the fraud that it’s. So, they now blame something they’ll consider, even when it makes no rational sense.

Huge Image Overview

In a June 5, 2022, Twitter thread, Kim Dotcom offered the next overview of the scenario and the way we obtained right here:16

“The fact is that the U.S. has been bankrupt for a while and what’s coming is a nightmare: Mass poverty and a brand new system of management … Complete U.S. debt is at $90 trillion. U.S. unfunded liabilities are at $169 trillion. Mixed that’s $778,000 per U.S. citizen or $2,067,000 per U.S. tax payer.

Keep in mind, the one means the US Authorities can function now could be by printing more cash. Which implies hyperinflation is inevitable. The entire worth of ALL firms listed on the U.S. inventory market is $53 trillion.

The true worth is far decrease as a result of the US has been printing trillions to offer curiosity free loans to funding banks to pump up the inventory market. It’s a rip-off. A lot of the $53 trillion is air.

The worth of all U.S. property mixed, each piece of land, actual property, all financial savings, all firms, every part that every one residents, companies, entities and the state personal is value $193 trillion. That quantity can also be stuffed with air similar to the U.S. inventory market.

Let’s do the mathematics: U.S. whole debt $90 trillion; U.S. unfunded liabilities $169 trillion. Complete $259 trillion. Minus all U.S. property, $193 trillion. Stability, -$66 trillion. That’s $66 trillion of debt and liabilities after each asset within the U.S. has been bought off … So even when the U.S. may promote all property on the present worth, which is unimaginable, it could nonetheless be broke. The U.S. is past bankrupt …”

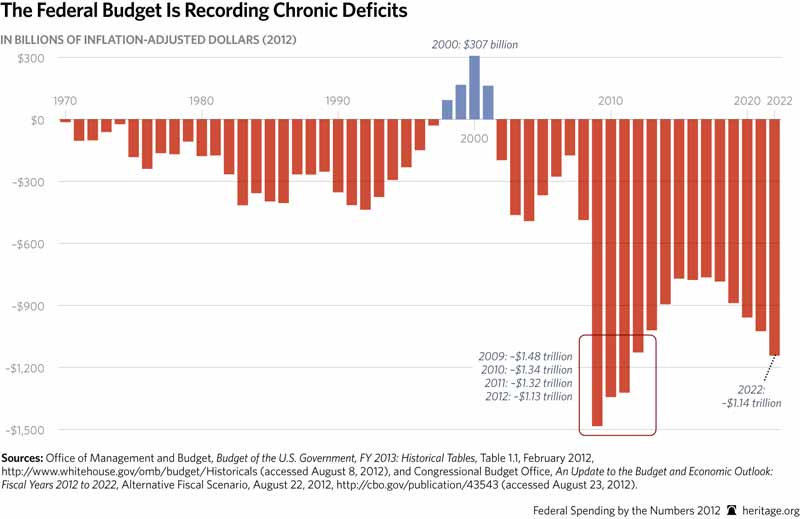

On the root of this collapse is cash printing. As famous by this Twitter person, the U.S. has been working a deficit since 2001. Within the final 50 years, the U.S. has had solely 4 years throughout which it made a revenue, and that revenue wouldn’t even cowl six months-worth of the present annual deficit.

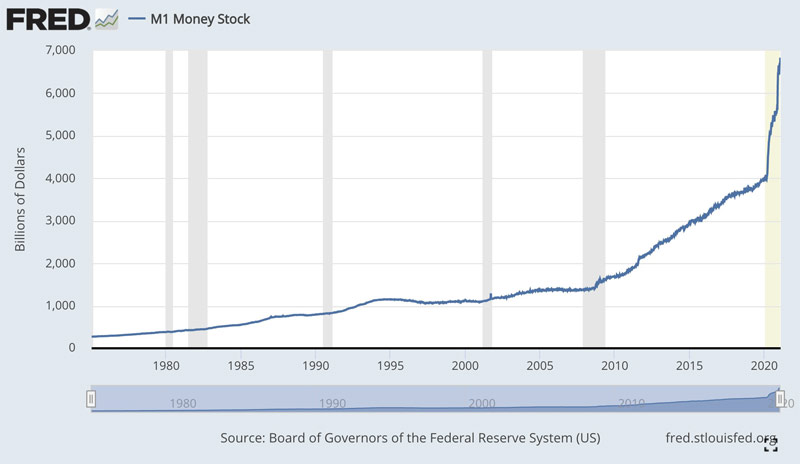

With debt and spending spiraling uncontrolled for thus lengthy, the U.S. authorities has had no alternative however to print more cash, which solely makes the issue worse. Cash printing is what causes inflation. It’s incorrect to view inflation as a value enhance, per se.

It’s actually a decline within the worth, or buying energy, of the forex. The worth of your cash declines because the pool of whole {dollars} obtainable will increase. Right here’s a chart exhibiting how the printing of cash has skyrocketed over time.

How Has the Greenback Survived This Lengthy?

The rationale the greenback has survived this lengthy is as a result of it’s the world’s reserve forex. Nations all over the world should maintain U.S. {dollars} because it’s the forex used for world commerce. Many have lived below the phantasm that this is able to by no means change. Alas, nothing on this world is everlasting.

Because the U.S. has continued to print {dollars}, it has brought about inflation all over the world, so the supremacy of the greenback is now not uncontested. And, when the greenback does lastly collapse, international markets will go down with it — until international locations ditch the greenback because the reserve forex first, which might be an absolute catastrophe for People, as it could set off hyperinflation virtually instantly.

Mainly, a technique of taking a look at cash printing and the ensuing inflation is as a type of theft. Worth is stolen. Buying energy is stolen. And the inflation of the greenback is, as Kim Dotcom notes,17 “The largest theft in historical past,” because it impacts the entire world.

What’s extra, there’s no approach to repair this downside. There’s no means out. As in a private chapter, at a sure level, there’s no means so that you can ever pay again the curiosity you owe on the cash you borrowed. At that time, your solely possibility is to file for chapter and begin over.

In 2020, the World Financial Discussion board formally introduced {that a} Nice Reset is within the works, and this “reset” is principally how the globalist cabal intends to “repair” this case. It’s not a gorgeous answer for the common individual, nevertheless, as a result of The Nice Reset solves the issue by transferring all of the world’s wealth and energy into the fingers of the few and erasing democracy worldwide in a single fell swoop.

Mainly, they’re now attempting to regulate the demolition of the world’s monetary system in such a means that individuals will voluntarily conform to their new system. What many nonetheless fail to grasp is that the brand new system will probably be far worse than the outdated one. Not less than below the fiat forex central financial institution system, there was the phantasm that the common individual may construct wealth.

Underneath The Nice Reset’s new centralized monetary system, all wealth and all of the world’s assets will probably be below the management of unelected technocrats who will rule and micromanage your private life by means of technological surveillance and algorithms — all below the guise of “saving the planet.”

Who Owns and Controls the World

Already, 90% of all S&P 500 corporations are owned by a mere three funding corporations: BlackRock, Vanguard and State Avenue. This contains drug firms and the centralized legacy media, which I reviewed in “The Same Shady People Own Big Pharma and the Media.”

Time Warner, Comcast, Disney and Information Corp — 4 of the six media firms that management greater than 90% of the U.S. media panorama18,19 — are owned by BlackRock and Vanguard. For sure, if in case you have management of this many information retailers, you’ll be able to management whole nations by the use of rigorously orchestrated and arranged centralized propaganda disguised as journalism.

The property of BlackRock alone are valued at $10 trillion.20 Making this circle of energy even smaller, Vanguard is the most important shareholder of BlackRock.21,22 And who owns Vanguard? As a result of its authorized construction, possession is tough to discern. It’s owned by its varied funds, which in flip are owned by the shareholders. Apart from these shareholders, it has no exterior buyers and isn’t publicly traded.23

That stated, most of the oldest, richest households on the earth may be linked to Vanguard funds, together with the Rothschilds,24,25 the Orsini household, the Bush household, the British Royal household, the du Pont household, and the Morgans, Vanderbilts and Rockefellers.

Contemplating BlackRock in 2018 introduced that it has “social expectations” from the businesses it invests in,26 its potential position as a central hub in The Nice Reset and the “construct again higher” plan can’t be ignored.

Add to this data exhibiting it “undermines competitors by means of proudly owning shares in competing firms” and “blurs boundaries between non-public capital and authorities affairs by working carefully with regulators,”27,28 and one can be hard-pressed to not see how BlackRock/Vanguard and their globalist house owners would possibly be capable to facilitate The Nice Reset and the so-called “inexperienced” revolution, each of that are a part of the identical wealth-theft scheme.

The Managed Demolition of Meals and Finance

At this level, it’s essential to grasp that The Nice Reset includes not solely the managed demolition of finance but in addition the managed demolition of our food system. In any case, he who controls the meals actually controls the world. As defined by Package Knightly in Off-Guardian:29

“We’re within the early levels of a meals disaster. The press has been predicting this for years, however up till now it at all times seemed to be nothing greater than fearmongering, designed to fret or distract folks, however the indicators are there that this time, to cite Joe Biden, it ‘goes to be actual.’

No one is aware of how bad it may get, besides the people who find themselves creating it. As a result of the proof is fairly clear, it’s being intentionally and cold-bloodedly created … We’ve got Russia’s ‘particular operation’ in Ukraine driving up the value of staple meals, wheat and sunflower oil, in addition to fertilizer.

We’ve got the sudden ‘fowl flu outbreak’ driving up the value of poultry and eggs. The hovering value of oil is driving up the price of meals distribution. The inflation attributable to enormous influxes of fiat forex means households are spending more cash on much less meals. And as all that is occurring, the U.S. and UK (and perhaps others, we don’t know) are actually paying farmers to not farm …

Simply because the COVID ‘pandemic’ was stated to spotlight ‘weaknesses within the multilateral system,’ so this meals disaster will present that our ‘unstable meals techniques are in want of reform’ and we have to guarantee our ‘meals safety’ … or a thousand variations on that theme …

In an interview from July final yr, Ruth Richardson the Govt Director of the NGO International Alliance for the Way forward for Meals actually stated: ‘Our dominant meals system must be dismantled and rebuilt’ …

Writing within the Guardian two weeks in the past, George Monbiot, weathervane for each deep state agenda, states along with his trademark lack of subtlety: ‘The banks collapsed in 2008 — and our meals system is about to do the identical … The system has to vary.’”

So, simply what sort of meals system is the globalist cabal dreaming of implementing? Nicely, the World Financial Discussion board has been speaking about this for years, so it’s not laborious to determine what they need to transition us into.

One key change will probably be to transition us away from actual meat and into patentable lab-grown meats. They’ve additionally been pushing the concept of consuming bugs, weeds and gene-edited meals.

“Supranational firms, with income bigger than the price range of some nations, are growing carbon footprint tracker apps30 which reward folks for making the ‘proper choices. That might simply be utilized to meals,’” Knightly provides.31

“The play is evident: Proper now they’re on the point of tear all our outdated meals techniques down, with the acknowledged goal of constructing them again higher. However higher for them, not us.”

The Time to Put together Is Now

Even when you don’t consider the worst-case eventualities are potential, I urge you to organize for a minimum of some measure of ache. Maybe meals shortages received’t flip into whole famine circumstances, however they could. At naked minimal, think about storing just a few months of additional meals for your loved ones, as costs within the close to future are solely going to go up, and/or begin rising a few of your individual meals.

Likewise, whether or not the financial crash finally ends up being laborious or gentle, put together your self for potential monetary hardship. Shopping for bodily treasured metals may very well be one defensive technique, as it could possibly assist defend towards forex devaluation. Investing in actual property, comparable to land may very well be one other.

It’s laborious to make definitive suggestions, as your technique will rely in your private scenario, so take a while to suppose issues by means of. If you happen to do nothing to hedge your bets, you might at some point end up left with nothing — which is exactly what the World Financial Discussion board has declared will probably be our lot. Different key areas of primary preparation have been listed in yesterday’s article, “Are You Prepared for the Coming Food Catastrophe?”