Elizabeth and Nick Woodruff of Binghamton, New York, had been sued for almost $10,000 by the hospital the place Nick’s contaminated leg was amputated.

Heather Ainsworth for KHN and NPR

conceal caption

toggle caption

Heather Ainsworth for KHN and NPR

Elizabeth and Nick Woodruff of Binghamton, New York, had been sued for almost $10,000 by the hospital the place Nick’s contaminated leg was amputated.

Heather Ainsworth for KHN and NPR

Elizabeth Woodruff drained her retirement account and took on three jobs after she and her husband had been sued for almost $10,000 by the New York hospital the place his contaminated leg was amputated.

Ariane Buck, a younger father in Arizona who sells medical insurance, could not make an appointment together with his physician for a harmful intestinal an infection as a result of the workplace mentioned he had excellent payments.

Allyson Ward and her husband loaded up bank cards, borrowed from relations, and delayed repaying scholar loans after the untimely beginning of their twins left them with $80,000 in debt. Ward, a nurse practitioner, took on further nursing shifts, working days and nights.

“I needed to be a mother,” she mentioned. “However we needed to have the cash.”

The three are amongst greater than 100 million individuals in America ― together with 41% of adults ― beset by a well being care system that’s systematically pushing sufferers into debt on a mass scale, an investigation by KHN and NPR exhibits.

The investigation reveals an issue that, regardless of new consideration from the White Home and Congress, is way extra pervasive than beforehand reported. That’s as a result of a lot of the debt that sufferers accrue is hidden as bank card balances, loans from household, or cost plans to hospitals and different medical suppliers.

To calculate the true extent and burden of this debt, the KHN-NPR investigation attracts on a nationwide poll carried out by KFF (Kaiser Household Basis) for this venture. The ballot was designed to seize not simply payments sufferers could not afford, however different borrowing used to pay for well being care as properly. New analyses of credit score bureau, hospital billing, and bank card knowledge by the City Institute and different analysis companions additionally inform the venture. And KHN and NPR reporters carried out tons of of interviews with sufferers, physicians, well being trade leaders, shopper advocates, and researchers.

The image is bleak.

Prior to now 5 years, greater than half of U.S. adults report they’ve gone into debt due to medical or dental payments, the KFF poll discovered.

1 / 4 of adults with well being care debt owe greater than $5,000. And about 1 in 5 with any quantity of debt mentioned they do not anticipate to ever pay it off.

“Debt is now not only a bug in our system. It is without doubt one of the foremost merchandise,” mentioned Dr. Rishi Manchanda, who has labored with low-income sufferers in California for greater than a decade and served on the board of the nonprofit RIP Medical Debt. “Now we have a well being care system nearly completely designed to create debt.”

The burden is forcing households to chop spending on meals and different necessities. Hundreds of thousands are being pushed from their properties or into chapter 11, the ballot discovered.

Share your story

Are you coping with medical debt of your personal? NPR and KHN want to hear from you as we report this particular sequence on medical debt. Share your story here.

Medical debt is piling extra hardships on individuals with most cancers and different power sicknesses. Debt ranges in U.S. counties with the best charges of illness may be three or 4 occasions what they’re within the healthiest counties, in keeping with an Urban Institute analysis.

The debt can also be deepening racial disparities.

And it’s stopping People from saving for retirement, investing of their youngsters’s educations, or laying the normal constructing blocks for a safe future, reminiscent of borrowing for faculty or shopping for a house. Debt from well being care is almost twice as frequent for adults underneath 30 as for these 65 and older, the KFF ballot discovered.

Allyson and Marcus Ward of Chicago moved throughout the nation to be nearer to household after the untimely beginning of their twins, Milo and Theo, left them with about $80,000 in medical debt.

Taylor Glascock for KHN and NPR

conceal caption

toggle caption

Taylor Glascock for KHN and NPR

Allyson and Marcus Ward of Chicago moved throughout the nation to be nearer to household after the untimely beginning of their twins, Milo and Theo, left them with about $80,000 in medical debt.

Taylor Glascock for KHN and NPR

Maybe most perversely, medical debt is obstructing sufferers from care.

About 1 in 7 individuals with debt mentioned they have been denied entry to a hospital, physician, or different supplier due to unpaid payments, in keeping with the ballot. A good better share ― about two-thirds ― have delay care they or a member of the family want due to price.

“It is barbaric,” mentioned Dr. Miriam Atkins, a Georgia oncologist who, like many physicians, mentioned she’s had sufferers surrender remedy for worry of debt.

Affected person debt is piling up regardless of the landmark 2010 Inexpensive Care Act.

The legislation expanded insurance coverage protection to tens of hundreds of thousands of People. But it additionally ushered in years of strong earnings for the medical trade, which has steadily raised costs over the previous decade.

Hospitals recorded their most worthwhile 12 months on document in 2019, notching an combination revenue margin of seven.6%, in keeping with the federal Medicare Payment Advisory Committee. Many hospitals thrived even by way of the pandemic.

However for a lot of People, the legislation didn’t stay as much as its promise of extra reasonably priced care. As an alternative, they’ve confronted 1000’s of {dollars} in payments as well being insurers shifted prices onto sufferers by way of increased deductibles.

Now, a extremely profitable trade is capitalizing on sufferers’ incapacity to pay. Hospitals and different medical suppliers are pushing hundreds of thousands into bank cards and different loans. These stick sufferers with excessive rates of interest whereas producing earnings for the lenders that high 29%, in keeping with research firm IBISWorld.

Affected person debt can also be sustaining a shadowy collections enterprise fed by hospitals ― together with public college techniques and nonprofits granted tax breaks to serve their communities ― that promote debt in non-public offers to collections firms that, in flip, pursue sufferers.

“Individuals are getting harassed in any respect hours of the day. Many come to us with no thought the place the debt got here from,” mentioned Eric Zell, a supervising lawyer on the Authorized Help Society of Cleveland. “It appears to be an epidemic.”

In debt to hospitals, bank cards, and relations

America’s debt disaster is pushed by a easy actuality: Half of U.S. adults haven’t got the money to cowl an sudden $500 well being care invoice, in keeping with the KFF ballot.

In consequence, many merely do not pay. The flood of unpaid payments has made medical debt the most typical type of debt on shopper credit score data.

As of final 12 months, 58% of money owed recorded in collections had been for a medical invoice, according to the Consumer Financial Protection Bureau. That is almost 4 occasions as many money owed attributable to telecom payments, the following commonest type of debt on credit score data.

However the medical debt on credit score reviews represents solely a fraction of the cash that People owe for well being care, the KHN-NPR investigation exhibits.

- About 50 million adults ― roughly 1 in 5 ― are paying off payments for their very own care or a member of the family’s by way of an installment plan with a hospital or different supplier, the KFF ballot discovered. Such debt preparations do not seem on credit score reviews except a affected person stops paying.

- One in 10 owe cash to a good friend or member of the family who lined their medical or dental payments, one other type of borrowing not usually measured.

- Nonetheless extra debt finally ends up on bank cards, as sufferers cost their payments and run up balances, piling excessive rates of interest on high of what they owe for care. About 1 in 6 adults are paying off a medical or dental invoice they placed on a card.

How a lot medical debt People have in complete is difficult to know as a result of a lot is not recorded. However an earlier KFF analysis of federal data estimated that collective medical debt totaled at the very least $195 billion in 2019, bigger than the financial system of Greece.

The bank card balances, which additionally aren’t recorded as medical debt, may be substantial, in keeping with an analysis of credit card records by the JPMorgan Chase Institute. The monetary analysis group discovered that the standard cardholder’s month-to-month steadiness jumped 34% after a serious medical expense.

Month-to-month balances then declined as individuals paid down their payments. However for a 12 months, they remained about 10% above the place they’d been earlier than the medical expense. Balances for a comparable group of cardholders with no main medical expense stayed comparatively flat.

It is unclear how a lot of the upper balances ended up as debt, because the institute’s knowledge does not distinguish between cardholders who repay their steadiness each month from those that do not. However about half of cardholders nationwide carry a steadiness on their playing cards, which often provides curiosity and charges.

Bearing the burden of money owed massive and small

For a lot of People, debt from medical or dental care could also be comparatively low. A few third owe lower than $1,000, the KFF ballot discovered.

Even small money owed can take a toll.

Edy Adams, a 31-year-old medical scholar in Texas, was pursued by debt collectors for years for a medical examination she obtained after she was sexually assaulted.

Adams had just lately graduated from faculty and was residing in Chicago.

Police by no means discovered the perpetrator. However two years after the assault, Adams began getting calls from collectors saying she owed $130.58.

Edy Adams of Austin, Texas, was pursued for years by debt collectors over a $130.68 invoice for a medical examination she obtained after being sexually assaulted in Chicago.

Julia Robinson for KHN and NPR

conceal caption

toggle caption

Julia Robinson for KHN and NPR

Edy Adams of Austin, Texas, was pursued for years by debt collectors over a $130.68 invoice for a medical examination she obtained after being sexually assaulted in Chicago.

Julia Robinson for KHN and NPR

Illinois legislation prohibits billing victims for such exams. However irrespective of what number of occasions Adams defined the error, the calls stored coming, every forcing her, she mentioned, to relive the worst day of her life.

Typically when the collectors known as, Adams would break down in tears on the cellphone. “I used to be frantic,” she recalled. “I used to be being haunted by this zombie invoice. I could not make it cease.”

Well being care debt will also be catastrophic.

Sherrie Foy, 63, and her husband, Michael, noticed their fastidiously deliberate retirement upended when Foy’s colon needed to be eliminated.

After Michael retired from Consolidated Edison in New York, the couple moved to rural southwestern Virginia. Sherrie had the house to take care of rescued horses.

The couple had diligently saved. They usually had retiree medical insurance by way of Con Edison. However Sherrie’s surgical procedure led to quite a few problems, months within the hospital, and medical payments that handed the $1 million cap on the couple’s well being plan.

When Foy could not pay greater than $775,000 she owed the College of Virginia Well being System, the medical heart sued, a once common practice that the college mentioned it has reined in. The couple declared chapter.

Sherrie Foy of Moneta, Virginia, had her retirement plans upended when surgical procedure to take away her colon left her with almost $800,000 in payments and compelled her and her husband, Michael, into chapter 11.

Carlos Bernate For KHN and NPR

conceal caption

toggle caption

Carlos Bernate For KHN and NPR

Sherrie Foy of Moneta, Virginia, had her retirement plans upended when surgical procedure to take away her colon left her with almost $800,000 in payments and compelled her and her husband, Michael, into chapter 11.

Carlos Bernate For KHN and NPR

The Foys cashed in a life insurance coverage coverage to pay a chapter lawyer and liquidated financial savings accounts the couple had arrange for his or her grandchildren.

“They took every thing we had,” Foy mentioned. “Now now we have nothing.”

About 1 in 8 medically indebted People owe $10,000 or extra, in keeping with the KFF ballot.

Though most anticipate to repay their debt, 23% mentioned it is going to take at the very least three years; 18% mentioned they do not anticipate to ever pay it off.

Medical debt’s large attain

Debt has lengthy lurked within the shadows of American well being care.

Within the nineteenth century, male sufferers at New York’s Bellevue Hospital needed to ferry passengers on the East River and new moms needed to scrub flooring to pay their money owed, in keeping with a history of American hospitals by Charles Rosenberg.

The preparations had been largely casual, nonetheless. Extra typically, physicians merely wrote off payments sufferers could not afford, historian Jonathan Engel mentioned. “There was no notion of being in medical arrears.”

Right now debt from medical and dental payments touches almost each nook of American society, burdening even these with insurance coverage protection by way of work or authorities packages reminiscent of Medicare.

Almost half of People in households making greater than $90,000 a 12 months have incurred well being care debt prior to now 5 years, the KFF ballot discovered.

Ladies are extra seemingly than males to be in debt. And oldsters extra generally have well being care debt than individuals with out youngsters.

However the disaster has landed hardest on the poorest and uninsured.

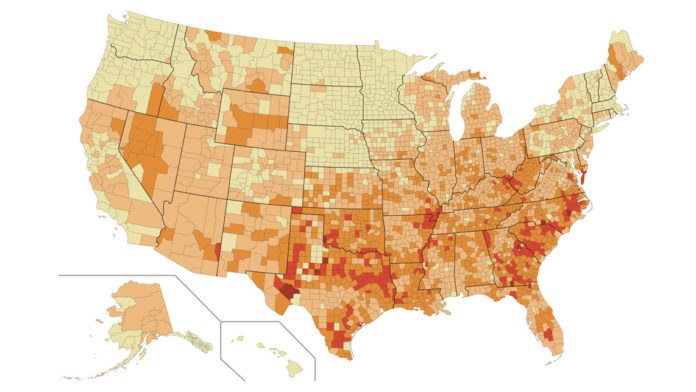

Debt is most widespread within the South, an evaluation of credit score data by the City Institute exhibits. Insurance coverage protections there are weaker, lots of the states have not expanded Medicaid, and power sickness is extra widespread.

Nationwide, in keeping with the ballot, Black adults are 50% extra seemingly and Hispanic adults 35% extra seemingly than whites to owe cash for care. (Hispanics may be of any race or mixture of races.)

In some locations, such because the nation’s capital, disparities are even bigger, City Institute knowledge exhibits: Medical debt in Washington, D.C.’s predominantly minority neighborhoods is almost 4 occasions as frequent as in white neighborhoods.

In minority communities already fighting fewer instructional and financial alternatives, the debt may be crippling, mentioned Joseph Leitmann-Santa Cruz, chief govt of Capital Space Asset Builders, a nonprofit that gives monetary counseling to low-income Washington residents. “It is like having one other arm tied behind their backs,” he mentioned.

Medical debt can even maintain younger individuals from constructing financial savings, ending their training, or getting a job. One evaluation of credit score knowledge discovered that debt from well being care peaks for typical People of their late 20s and early 30s, then declines as they become old.

Cheyenne Dantona’s medical debt derailed her profession earlier than it started.

Dantona, 31, was recognized with blood most cancers whereas in faculty. The most cancers went into remission, however when Dantona modified well being plans, she was hit with 1000’s of {dollars} of medical payments as a result of one in every of her main suppliers was out of community.

She enrolled in a medical bank card, solely to get caught paying much more in curiosity. Different payments went to collections, dragging down her credit score rating. Dantona nonetheless goals of working with injured and orphaned wild animals, however she’s been pressured to maneuver again in together with her mom exterior Minneapolis.

“She’s been trapped,” mentioned Dantona’s sister, Desiree. “Her life is on pause.”

The strongest predictor of medical debt

Desiree Dantona mentioned the debt has additionally made her sister hesitant to hunt care to make sure her most cancers stays in remission.

Medical suppliers say this is without doubt one of the most pernicious results of America’s debt disaster, preserving the sick away from care and piling poisonous stress on sufferers when they’re most weak.

The monetary pressure can sluggish sufferers’ restoration and even improve their probabilities of loss of life, most cancers researchers have discovered.

But the hyperlink between illness and debt is a defining characteristic of American well being care, in keeping with the City Institute, which analyzed credit score data and different demographic knowledge on poverty, race, and well being standing.

U.S. counties with the best share of residents with a number of power situations, reminiscent of diabetes and coronary heart illness, additionally are likely to have essentially the most medical debt. That makes sickness a stronger predictor of medical debt than both poverty or insurance coverage.

Within the 100 U.S. counties with the best ranges of power illness, almost 1 / 4 of adults have medical debt on their credit score data, in contrast with fewer than 1 in 10 within the healthiest counties.

The issue is so pervasive that even many physicians and enterprise leaders concede debt has turn out to be a black mark on American well being care.

“There isn’t a motive on this nation that individuals ought to have medical debt that destroys them,” mentioned George Halvorson, former chief govt of Kaiser Permanente, the nation’s largest built-in medical system and well being plan. KP has a comparatively beneficiant monetary help coverage however does typically sue sufferers. (The well being system shouldn’t be affiliated with KHN.)

Halvorson cited the expansion of high-deductible medical insurance as a key driver of the debt disaster. “Individuals are getting bankrupted after they get care,” he mentioned, “even when they’ve insurance coverage.”

What the federal authorities can do

The Inexpensive Care Act bolstered monetary protections for hundreds of thousands of People, not solely rising well being protection but in addition setting insurance coverage requirements that had been speculated to restrict how a lot sufferers should pay out of their very own pockets.

By some measures, the legislation labored, research shows. In California, there was an 11% decline within the month-to-month use of payday loans after the state expanded protection by way of the legislation.

However the legislation’s caps on out-of-pocket prices have confirmed too excessive for many People. Federal laws enable out-of-pocket maximums on particular person plans as much as $8,700.

Moreover, the legislation didn’t cease the expansion of high-deductible plans, which have turn out to be commonplace over the previous decade. That has pressured rising numbers of People to pay 1000’s of {dollars} out of their very own pockets earlier than their protection kicks in.

Final 12 months the common annual deductible for a single employee with job-based protection topped $1,400, nearly 4 occasions what it was in 2006, in keeping with an annual employer survey by KFF. Household deductibles can high $10,000.

Whereas well being plans are requiring sufferers to pay extra, hospitals, drugmakers, and different medical suppliers are elevating costs.

From 2012 to 2016, costs for medical care surged 16%, nearly 4 occasions the speed of general inflation, a report by the nonprofit Well being Care Price Institute discovered.

For a lot of People, the mixture of excessive costs and excessive out-of-pocket prices nearly inevitably means debt. The KFF ballot discovered that 6 in 10 working-age adults with protection have gone into debt getting care prior to now 5 years, a price solely barely decrease than the uninsured.

Even Medicare protection can depart sufferers on the hook for 1000’s of {dollars} in expenses for medication and remedy, studies show.

Samantha and Ariane Buck of Peoria, Arizona, say they had been turned away from a doctor’s workplace due to cash they owed, forcing them to hunt emergency care. They estimate they now have about $50,000 in medical debt.

Ash Ponders for KHN and NPR

conceal caption

toggle caption

Ash Ponders for KHN and NPR

Samantha and Ariane Buck of Peoria, Arizona, say they had been turned away from a doctor’s workplace due to cash they owed, forcing them to hunt emergency care. They estimate they now have about $50,000 in medical debt.

Ash Ponders for KHN and NPR

A few third of seniors have owed cash for care, the ballot discovered. And 37% of those mentioned they or somebody of their family have been pressured to chop spending on meals, clothes, or different necessities due to what they owe; 12% mentioned they’ve taken on further work.

The rising toll of the debt has sparked new curiosity from elected officers, regulators, and trade leaders.

In March, following warnings from the Shopper Monetary Safety Bureau, the most important credit reporting companies said they’d take away medical money owed underneath $500 and those who had been repaid from shopper credit score reviews.

In April, the Biden administration announced a brand new CFPB crackdown on debt collectors and an initiative by the Division of Well being and Human Providers to assemble extra info on how hospitals present monetary assist.

The actions had been applauded by affected person advocates. Nonetheless, the adjustments seemingly will not deal with the foundation causes of this nationwide disaster.

“The No. 1 motive, and the No. 2, 3, and 4 causes, that individuals go into medical debt is they do not have the cash,” mentioned Alan Cohen, a co-founder of insurer Centivo who has labored in well being advantages for greater than 30 years. “It is not difficult.”

Buck, the daddy in Arizona who was denied care, has seen this firsthand whereas promoting Medicare plans to seniors. “I’ve had previous individuals crying on the cellphone with me,” he mentioned. “It is horrifying.”

Now 30, Buck faces his personal struggles. He recovered from the intestinal an infection, however after being pressured to go to a hospital emergency room, he was hit with 1000’s of {dollars} in medical payments.

Extra piled on when Buck’s spouse landed in an emergency room for ovarian cysts.

Right now the Bucks, who’ve three youngsters, estimate they owe greater than $50,000, together with medical payments they placed on bank cards that they cannot repay.

“We have all needed to reduce on every thing,” Buck mentioned. The youngsters put on hand-me-downs. They scrimp on college provides and depend on household for Christmas items. A dinner out for chili is an extravagance.

“It pains me when my children ask to go someplace, and I am unable to,” Buck mentioned. “I really feel as if I’ve failed as a mother or father.”

The couple is making ready to file for chapter.

About This Undertaking

Prognosis: Debt is a reporting partnership between KHN and NPR exploring the dimensions, influence, and causes of medical debt in America.

The sequence attracts on the “KFF Well being Care Debt Survey,” a ballot designed and analyzed by public opinion researchers at KFF in collaboration with KHN journalists and editors. The survey was carried out Feb. 25 by way of March 20, 2022, on-line and through phone, in English and Spanish, amongst a nationally consultant pattern of two,375 U.S. adults, together with 1,292 adults with present well being care debt and 382 adults who had well being care debt prior to now 5 years. The margin of sampling error is plus or minus 3 proportion factors for the complete pattern and three proportion factors for these with present debt. For outcomes primarily based on subgroups, the margin of sampling error could also be increased.

Further analysis was conducted by the Urban Institute, which analyzed credit score bureau and different demographic knowledge on poverty, race, and well being standing to discover the place medical debt is concentrated within the U.S. and what components are related to excessive debt ranges.

The JPMorgan Chase Institute analyzed records from a sampling of Chase bank card holders to have a look at how clients’ balances could also be affected by main medical bills.

Reporters from KHN and NPR additionally carried out tons of of interviews with sufferers throughout the nation; spoke with physicians, well being trade leaders, shopper advocates, debt legal professionals, and researchers; and reviewed scores of research and surveys about medical debt.

KHN (Kaiser Well being Information) is a nationwide newsroom that produces in-depth journalism about well being points. Along with Coverage Evaluation and Polling, KHN is without doubt one of the three main working packages at KFF (Kaiser Household Basis). KFF is an endowed nonprofit group offering info on well being points to the nation.