Jess is a single mother of two younger daughters dwelling in northern California together with their opinionated four-year-old Siamese cat. Jess works for herself as a contract author/public relations guide, which is a job she loves. After getting divorced in 2020, Jess went on to purchase her own residence and chart her new life as a single dad or mum. Though Jess has executed an incredible job setting herself up with a satisfying profession in a spot she loves dwelling, she’s involved about her long-term monetary future. She’s requested for our assist in analyzing whether or not she ought to take a higher-paying job or if there are different methods she will be able to stretch her revenue.

What’s a Reader Case Examine?

Case Research handle monetary and life dilemmas that readers of Frugalwoods ship in requesting recommendation. Then, we (that’d be me and YOU, expensive reader) learn by their state of affairs and supply recommendation, encouragement, perception and suggestions within the feedback part.

For an instance, take a look at the last case study. Case Research are up to date by members (on the finish of the publish) a number of months after the Case is featured. Go to this page for hyperlinks to all up to date Case Research.

Can I Be A Reader Case Examine?

There are 4 choices for folk thinking about receiving a holistic Frugalwoods monetary session:

- Apply to be an on-the-blog Case Study subject here.

- Rent me for a private financial consultation here.

- Schedule an hourlong call with me here.

- Schedule a 30 minute call with me here.

→Undecided which option is best for you? Schedule a free 15-minute chat with me to study extra. Refer a good friend to me here.

Please be aware that area is proscribed for all the above and most particularly for on-the-blog Case Research. I do my finest to accommodate everybody who applies, however there are a restricted variety of slots accessible every month.

The Purpose Of Reader Case Research

Reader Case Research spotlight a various vary of monetary conditions, ages, ethnicities, areas, targets, careers, incomes, household compositions and extra!

The Case Examine collection started in 2016 and, so far, there’ve been 94 Case Studies. I’ve featured people with annual incomes starting from $17k to $200k+ and internet worths starting from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured homosexual, straight, queer, bisexual and polyamorous individuals. I’ve featured ladies, non-binary people and males. I’ve featured transgender and cisgender individuals. I’ve had cat individuals and canine individuals. I’ve featured people from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured individuals with PhDs and folks with highschool diplomas. I’ve featured individuals of their early 20’s and folks of their late 60’s. I’ve featured people who dwell on farms and people who dwell in New York Metropolis.

Reader Case Examine Tips

I most likely don’t must say the next since you all are the kindest, most well mannered commenters on the web, however please be aware that Frugalwoods is a judgement-free zone the place we endeavor to assist each other, not condemn.

There’s no room for rudeness right here. The purpose is to create a supportive setting the place all of us acknowledge we’re human, we’re flawed, however we select to be right here collectively, workshopping our cash and our lives with constructive, proactive solutions and concepts.

And a disclaimer that I’m not a skilled monetary skilled and I encourage individuals to not make critical monetary selections primarily based solely on what one individual on the web advises.

I encourage everybody to do their very own analysis to find out the perfect plan of action for his or her funds. I’m not a monetary advisor and I’m not your monetary advisor.

With that I’ll let Jess, right this moment’s Case Examine topic, take it from right here!

Jess’s Story

Howdy Liz and Frugalwoods readers! My identify is Jess and I’m a 37-year-old single mother of two daughters, ages 6 and 9, dwelling in lovely Northern California. I’ve lived on this area most of my life and we now have household close by. My daughters dwell with me slightly over half the time and we now have an opinionated four-year-old Siamese cat. I’ve been a contract author/public relations guide for about 6 years, and I completely love the work and the liberty that freelancing gives me. I’m additionally very concerned in my youngsters’ college and actions, due to the pliability of my work. Life with elementary-aged youngsters is filled with sports activities, birthday events, dance class and many enjoyable!

Jess’s Hobbies and Life-style

In terms of enjoyable and hobbies for myself, I like hitting the fitness center and yoga courses, snow snowboarding, taking part in tennis, cooking and having fun with the good meals and wine in my area. I additionally wish to hike and journey with my boyfriend and spend time with family and friends.

I bought divorced in the course of 2020, as a result of why not throw all the pieces into the air throughout a pandemic? In all seriousness, it has been a wholesome progress expertise – thankfully at this level we’re all dwelling comfortable, wholesome lives and the children’ dad and I are good co-parents. It’s not excellent, however we’re doing properly. Financially, we break up all the pieces down the center so it was a fairly clear break.

I’ve been in a critical relationship for awhile now, and in some unspecified time in the future we see a way forward for mixed households, which may change this entire image – however for now my family is simply me and my ladies.

What feels most urgent proper now? What brings you to submit a Case Examine?

I hit a wall lately with work and my revenue has dropped a bit. On the similar time, I purchased a home alone in April (I rented for nearly two years post-divorce) and with the market the best way it was, let’s simply say I paid prime greenback. Whereas I certified for the cost and technically can afford it, it’s tight every month, particularly with the slowing of my shopper work and revenue. I’m working to spice up my revenue and establish new shoppers/initiatives, and am additionally making an attempt to regulate my bills so there’s extra to work with. Whereas the home is the apparent monetary legal responsibility, it’s additionally not one I’m prepared to sacrifice. We love this house and I’m going to do no matter it takes to make it work.

With the massive mortgage plus child prices (actions! Sports activities! Discipline journeys! Fundraising!) and the price of dwelling in California, I really feel like I’m simply hemorrhaging cash generally with not so much left for enjoyable (can’t a lady get a pedicure!?). I do break up kid-related prices with my youngsters’ dad, which helps, however it may be tight.

The largest problem due to these components is that I really feel like I’m not saving sufficient, particularly for retirement, now that I’m alone. Once I bought divorced, we break up our retirement down the center and so now I really feel like I’m taking part in catch up. Final 12 months I used to be actually proud to avoid wasting slightly over 10% of my revenue – I do know that’s not fairly as excessive as some specialists advocate, however for a single mother, it felt good. I used to be additionally placing so much into my home fund on the similar time. This 12 months I haven’t saved practically that a lot. I additionally want I had extra to place away to spice up my emergency fund and put aside money for journey and mid-term bills so I don’t need to money move them.

What’s the perfect a part of your present way of life/routine?

I completely love the world the place we dwell. It’s a beautiful small city close to an even bigger suburb, and I wouldn’t change the placement for something. It’s a form and caring neighborhood, we now have an incredible college district, and all the pieces is very easy to get to – we by no means spend extreme quantities of time driving round to actions or errands, and so forth. We even have tons of entry to the outside – lakes, climbing and biking trails, and simply an hour or two from world-class snowboarding in Tahoe.

I’d additionally say the work schedule I’ve constructed for myself is right. I do work laborious and on an everyday schedule, however I hardly ever need to work greater than 30 hours per week. I’m capable of deal with private or family wants between calls or writing initiatives, for instance, and I don’t need to reply to anybody however myself. It additionally permits me to get in a noon exercise or run errands through the day so I’ve extra time later to spend with my ladies. The liberty/flexibility is unmatchable.

What’s the worst a part of your present way of life/routine?

My mortgage feels so costly! I knew what I used to be moving into after I purchased the home in April, however projection vs. actuality feels totally different, particularly as I famous with a dip in my revenue. And with an costly mortgage, all the pieces else begins feeling too excessive. (I did purchase this house with the intent to both keep right here ceaselessly if I’m single, or to show it right into a rental property if my marital standing adjustments sooner or later and we ultimately wish to transfer.)

The mortgage mixed with an absence of retirement and well being advantages additionally makes being my very own boss annoying. Generally I really feel like I ought to simply work full-time for a company for the steadiness and 401k match + medical health insurance – however then I understand it’s laborious to discover a wage to match what I’ve constructed for myself, particularly working the hours I do.

There’s yet another element I battle with, too, which is a bit much less tangible. Since turning into a sole revenue earner, I discover I’m very fearful financially of going broke, working out of cash, having monetary catastrophe strike, and so forth. It’s extra of a psychological subject than a monetary one. It’s pushed me at instances to not put cash into retirement as a result of I really feel like a money cushion offers me extra stability given our circumstances.

The place Jess Needs to be in Ten Years:

Funds:

Life-style:

- I envision being fortunately remarried, making ready to ship my ladies off to varsity, and looking out ahead to the following “empty nest” chapter with some monetary freedom on my facet.

- I anticipate I’ll nonetheless be having fun with most of the similar hobbies and actions!

Profession:

- I may see myself nonetheless working independently so long as I preserve hustling to remain the place I must preserve sustaining (and ideally rising) financially.

- Alternatively, I’m open to transferring right into a full-time, in-house position with a superb firm if I discover the suitable match.

Jess’s Funds

Revenue

| Merchandise | Variety of paychecks per 12 months | Gross Revenue Per Pay Interval (complete BEFORE all deductions) |

Deductions Per Pay Interval (with quantities) | Web Revenue Per Pay Interval (complete AFTER all deductions are taken out) |

| Jess’ revenue (self-employed) | 12 | $10,000 | Estimated taxes: $2,500 (be aware, I usually get again a big chunk in tax refund — anyplace from $5k to $9k, however my accountant prefers I pay loads upfront) | $7,500 |

| Annual gross complete: | $120,000.00 | Annual internet complete: | $90,000.00 |

Mortgage Particulars

| Merchandise | Excellent mortgage steadiness | Curiosity Price | Mortgage Interval and Phrases | Fairness | Buy value and 12 months |

| Mortgage on major residence | $533,000 | 4.30% | 30-year fixed-rate mortgage | $52,000 | $585k; bought in April 2022 |

Money owed: $0

Belongings

| Item | Quantity | Notes | Curiosity/kind of securities held/inventory ticker | Title of financial institution/brokerage | Expense Ratio | Account Kind |

| Roth IRA | $62,540 | My Roth IRA. I attempt to max this out yearly. No match. | ETFs and Mutual Funds | Schwab | Retirement | |

| Conventional IRA | $53,935 | Cash earned by earlier employer retirement plans and rolled over. | ETFs and Mutual Funds | Schwab | Retirement | |

| 529 School Fund: Child 1 (age 9) | $16,930 | We began these when the children had been infants. Now we have very beneficiant grandparents who’ve helped fund them! | ETFs and Mutual Funds | Merrill | School fund | |

| Financial savings account | $14,600 | That is my emergency fund. Barely decrease lately due to surprising medical payments and transferring prices. | Earns .02% curiosity | Financial institution of America | N/A | Money |

| 529 School Fund: Child 2 (age 6) | $11,935 | We began these when the children had been infants. Now we have very beneficiant grandparents who’ve helped fund them! | ETFs and Mutual Funds | Merrill | School fund | |

| SEP IRA | $1,511 | That is a further retirement account I opened for the years the place I’m capable of transcend the max in my Roth IRA. | ETFs and Mutual Funds | Schwab | Retirement | |

| Whole: | $161,451 |

Autos

| Automobile make, mannequin, 12 months | Valued at | Mileage | Paid off? |

| Toyota Highlander, 2015 | $24,000 | 100,000 | Sure |

Bills

| Merchandise | Quantity | Notes |

| Mortgage | $3,396 | This contains $89 in PMI, which I want to do away with earlier than later! |

| Groceries | $650 | Consists of family provides (corresponding to rest room paper) in addition to cat meals. |

| Medical insurance | $395 | I pay for insurance coverage out of pocket by Lined California |

| Retirement financial savings | $350 | Itemizing this as an expense as a result of it’s an merchandise I pay for out of pocket after I pay myself. My purpose is at all times 10% of my revenue, however this 12 months I haven’t been capable of swing it. In my tighter months I don’t save in any respect. |

| Utilities | $277 | Gasoline/Electrical: Avg. $165/month, Sewer: $400 a 12 months: Trash: $400 a 12 months, Water: $45/month |

| Gasoline | $275 | Fortuitously I don’t have excessive mileage so I can preserve fuel payments comparatively low |

| Youngsters actions | $275 | Consists of birthdays, sports activities, dance courses, college discipline journeys, after-school care, summer season camps, and so forth.

That is my half — their dad pays for the opposite half of all these bills. |

| HOA | $257 | Covers my gutter cleansing, roof substitute and entrance yard upkeep |

| Medical bills | $245 | This isn’t a typical line merchandise however I’m together with it anyway; I had a little bit of a well being subject this 12 months that value me practically $3k out of pocket |

| Eating places/espresso | $225 | Pizza nights with the children, occasional date night time, and so forth. |

| Trip/journey | $200 | I often save for journey in three-month stretches, however that is most likely the typical month-to-month breakdown |

| Emergency Fund financial savings | $200 | Attempting to spice up this fund again up because it’s not fairly sufficient for my consolation after shopping for my home. In my tighter months I don’t save in any respect. |

| Fitness center membership | $150 | It’s costly however I worth health and love this selection to get me out of my home since I’m ALWAYS right here |

| Charitable donations | $125 | Not one thing I wish to lower |

| Christmas | $125 | Averaged over the 12 months |

| Automobile insurance coverage | $104 | Triple A, bundled with my owners insurance coverage |

| Family provides | $100 | This contains necessities plus the occasional house décor splurge or issues like towels, sheets, and so forth. |

| Housekeeper | $90 | This could possibly be thought-about a “luxurious” nevertheless it’s a month-to-month sanity saver for a single working mother! |

| Automobile upkeep | $75 | Estimate of the typical breakdown together with common and main mileage upkeep, tires, and so forth. |

| Private care | $75 | Hair cuts, occasional pedicures, magnificence/hygiene merchandise |

| Web | $60 | |

| Subscriptions | $54 | Netflix, Disney+ bundle, Discovery+, Spotify, Audible |

| Presents | $50 | Consists of household/good friend birthdays, youngsters’ birthdays, and so forth. |

| Leisure | $50 | Averaged over the 12 months |

| School financial savings | $40 | I solely contribute slightly bit to the children’ funds for the time being. We’re lucky to have beneficiant grandparents who’re placing so much in for our children! When I’ve extra funds freed up and am assembly my retirement targets, I’d like to extend this. |

| Cell phone | $20 | Switched to Mint Mobile in October! |

| Dental insurance coverage | $16 | I pay for insurance coverage out of pocket by Lined California |

| Month-to-month subtotal: | $7,880 | |

| Annual complete: | $94,560 | NOTE: I understand this technically places me within the pink…yikes!! |

Credit score Card Technique

| Card Title | Rewards Kind? | Financial institution/card firm |

| Financial institution of America Rewards Card | Money again | Financial institution of America |

Social Safety

| Merchandise | Annual Quantity | 12 months and age you’ll start taking SS |

| Jess’ anticipated social safety | $47,388 | 2055, age 70 |

Jess’s Questions for You:

1) Is there a greater or extra artistic option to put aside cash for retirement that I’m simply not seeing?

2) Since I can’t change my mortgage, what different bills may I lower?

3) Ought to I be pursuing a full-time job with advantages as a substitute of making an attempt to make freelancing work in my state of affairs?

4) How can I launch my monetary fears and cease trying to greenback indicators for safety?

Liz Frugalwoods’ Suggestions

Jess has simply come by a number of very annoying, tumultuous life occasions–pandemic, divorce, transferring and shopping for a home–along with her funds intact! Jess, you must really feel tremendously happy with what you’ve been capable of accomplish in just a few brief years. I’m so impressed along with your willpower to offer a beautiful house on your ladies, maintain a job and work/life steadiness that fulfills you and proceed saving and investing for retirement. Many congrats on getting so far and I hope that right this moment we may help you see even additional down the monetary street. Let’s dive into Jess’s questions!

Jess’s Query #1: Is there a greater or extra artistic option to put aside cash for retirement that I’m simply not seeing?

Usually, there are 3 ways to avoid wasting/make investments more cash:

- Earn extra

- Spend much less

- Do a mix of each

Jess at the moment has $62,540 in a Roth IRA, $53,935 in a conventional IRA and $1,511 in a SEP IRA for a complete of $117,986. Let’s check out the place Jess stands in accordance with Constancy’s Retirement Rule of Thumb:

Purpose to avoid wasting no less than 1x your wage by 30, 3x by 40, 6x by 50, 8x by 60, and 10x by 67.

Since Jess is 37, let’s go along with 2x her wage, which might be $240,000 (2 x $120,000). What we’re taking a look at right here is how a lot Jess ought to have, at this level, if she intends to work till a conventional retirement age after which draw down a sustainable share of her retirement investments to dwell on annually.

In mild of that, Jess is appropriate in her evaluation that she ought to beef up her retirement financial savings. Let’s first take a second to speak in regards to the sorts of accounts she has accessible to contribute to and why it’s essential to speculate for retirement within the first place–and never simply save up a bunch of money.

Additionally, do not forget that this complete doesn’t embody her Social Safety, which is inflation-adjusted, and which she initiatives shall be $47,388 a 12 months beginning at age 70.

What you need to have the ability to do in retirement is draw down a sustainable share of your total funding portfolio to dwell on annually. You wish to have sufficient invested to help you do that throughout your retirement.

Many specialists take into account 4% to be a sustainable price of withdrawal. If, for instance, you realize you wish to spend an inflation-adjusted $50,000 per 12 months in your retirement (and never run out of cash earlier than you die), you’d must have $1.25M in retirement investments on the time of your retirement (as a result of 4% of $1.25M = $50,000 per 12 months).

The rationale to speculate for retirement—versus simply saving money for it—is threefold:

- There are tax benefits to using retirement accounts

- There are grave disadvantages to money (alternative value and it doesn’t sustain with inflation)

- There are benefits to investments (particularly, anticipated price of return)

Listed here are the Retirement Accounts Obtainable to Jess:

1) Roth IRA

Jess already has one in all these, which is fabulous. IRA stands for “Particular person Retirement Account” and there are two totally different major sorts of IRAs: Roth and Conventional. The distinction between the 2 is in how they’re taxed.

- A Roth IRA is a retirement account that’s post-tax:

- Meaning you pay taxes on the cash you place right into a Roth IRA, however you don’t pay taxes while you withdraw the cash in retirement.

- A Conventional IRA is a retirement account that’s pre-tax:

- Meaning you don’t pay taxes on cash you place into an IRA, however you do pay taxes while you withdraw the cash in retirement.

In 2023, the entire quantity an individual can put annually right into a traditional IRA and/or a Roth IRA can’t be greater than $6,500 (or $7,500 when you’re age 50 or older).

- An individual can have each a Roth and a conventional IRA, however their mixed annual contribution to each can’t exceed this $6,500 ($7,500 for ages 50+) restrict.

A Roth usually makes essentially the most sense in case your revenue is on the low finish as a result of in that case, your tax price is low and so it doesn’t matter that you just’re paying taxes in your contributions.

Primarily based on this chart from the IRS, Jess is certainly eligible to contribute to a Roth IRA as a result of her MAGI (modified adjusted gross revenue) is lower than $138k/12 months (assuming she accurately reported her revenue above).

2) Conventional IRA

Jess has one in all these too. Nevertheless, from a tax perspective it should possible take advantage of sense for her to pay attention her contributions to her Roth IRA. Once more, you may solely contribute $6,500 complete to each a Roth and a conventional IRA, which suggests she ought to deal with getting her Roth contribution as much as $6,500 per 12 months. She will be able to simply let her conventional IRA sit within the inventory market and develop.

3) SEP IRA

Jess has the triple crown of IRAs along with her SEP IRA, sometimes called an IRA for self-employed individuals as a result of they’re accessible to companies of any measurement (which incorporates enterprise of 1, like Jess’s). SEP contribution limits are a bit extra complicated, however the IRS helpfully explains as follows:

Contributions an employer could make to an worker’s SEP-IRA can’t exceed the lesser of:

- 25% of the worker’s compensation, or

- $66,000 for 2023

Since Jess’s gross annual revenue is $120k, she’s eligible to place $30k into her SEP IRA annually. Though this plan has the identify “IRA” in it, per our buddies on the IRS, you might be still allowed to contribute to it as well as the full $6,500 to your Roth IRA.

Grand complete, between her Roth and SEP IRAs, Jess may sock away $36,500 in 2023 ($30,000 into her SEP + $6,500 into her Roth), which breaks right down to $3,041.66 per thirty days.

Now that we’ve established what Jess is legally allowed to contribute to her two retirement accounts, we have to decide the place she’ll discover this cash. And so, let’s go to…

Jess’s Query #2: Since I can’t change my mortgage, what different bills may I lower?

Anytime somebody is thinking about saving more cash, I begin by categorizing all of their spending as Mounted, Reduceable or Discretionary. These three classes enable us to see the place reductions are potential:

- Mounted bills are stuff you can’t change. Examples: your mortgage and debt funds.

- Reduceable expenses are crucial for human survival, however you management how a lot you spend on them. Examples: groceries and fuel for the vehicles.

- Discretionary bills are issues that may be eradicated fully. Examples: journey, haircuts, consuming out.

Now that we all know which gadgets have leeway, I went by and assigned a “Proposed New Quantity” to every line merchandise. Solely Jess is aware of which gadgets are priorities and which gadgets she will be able to cut back, however the under spreadsheet will get this train began for her:

| Merchandise | Quantity | Notes | Class | Proposed New Quantity | Liz’s Notes |

| Mortgage | $3,396 | This contains $89 in PMI, which I want to do away with earlier than later! | Mounted | $3,396 | Jess is appropriate that that is actually excessive, however, she articulated that that is her highest precedence and she or he doesn’t wish to promote her home.

In mild of that, we’ll work to find out different areas the place reductions are potential. |

| Groceries | $650 | Consists of family provides (corresponding to rest room paper) in addition to cat meals. | Reduceable | $500 | That is already fairly low, however, it’s an space the place reductions could possibly be made. |

| Medical insurance | $395 | I pay for insurance coverage out of pocket by Lined California | Reduceable | $395 | Jess, have you ever appeared into subsidies by the state of CA? I assume you might have, however double checking simply in case. |

| Retirement financial savings | $350 | Itemizing this as an expense as a result of it’s an merchandise I pay for out of pocket after I pay myself. My purpose is at all times 10% of my revenue, however this 12 months I haven’t been capable of swing it. In my tighter months I don’t save in any respect. | Reduceable | $0 | So as to not confuse ourselves, I’m eradicating this retirement quantity in order that we’re solely taking a look at true bills on this sheet. |

| Utilities | $277 | Gasoline/Electrical: Avg. $165/month, Sewer: $400 a 12 months: Trash: $400 a 12 months, Water: $45/month | Reduceable | $277 | Any alternatives for reductions right here? Have you ever executed an power audit or used an power kilowatt monitor to find out areas the place you can in the reduction of on electrical energy utilization? |

| Gasoline | $275 | Fortuitously I don’t have excessive mileage so I can preserve fuel payments comparatively low | Reduceable | $175 | That is already fairly low, however, it’s an space the place reductions could possibly be made. |

| Youngsters actions | $275 | Consists of birthdays, sports activities, dance courses, college discipline journeys, after-school care, summer season camps, and so forth.

That is my half — their dad pays for the opposite half of all these bills. |

Reduceable | $175 | Any alternatives for reductions right here?

Would it not be potential to remove a few of the extra-curricular/discretionary actions? Would it not be potential to ask grandparents to reward issues like dance classes for birthdays or Christmas? |

| HOA | $257 | Covers my gutter cleansing, roof substitute and entrance yard upkeep | Mounted | $257 | Yikes! On prime of the mortgage, this brings Jess’s month-to-month carrying prices for the home to $3,653! |

| Medical bills | $245 | This isn’t a typical line merchandise however I’m together with it anyway; I had a little bit of a well being subject this 12 months that value me practically $3k out of pocket | Mounted | $245 | |

| Eating places/espresso | $225 | Pizza nights with the children, occasional date night time, and so forth. | Discretionary | $0 | A lot as I hate to remove this, it’s a discretionary line merchandise that could possibly be deleted. |

| Trip/journey | $200 | I often save for journey in three-month stretches, however that is most likely the typical month-to-month breakdown | Discretionary | $0 | A lot as I hate to remove this, it’s a discretionary line merchandise that could possibly be deleted. |

| Emergency Fund financial savings | $200 | Attempting to spice up this fund again up because it’s not fairly sufficient for my consolation after shopping for my home. In my tighter months I don’t save in any respect. | Reduceable | $0 | Just like the above retirement contribution, I’m going to remove this right here in order that we’re solely taking a look at true bills on this sheet. |

| Fitness center membership | $150 | It’s costly however I worth health and love this selection to get me out of my home since I’m ALWAYS right here | Discretionary | $0 | I hate to remove a precedence for Jess, however that is one thing that’s technically Discretionary. |

| Charitable donations | $125 | Not one thing I wish to lower | Discretionary | $0 | I hate to remove a precedence for Jess, however that is one thing that’s technically Discretionary. |

| Christmas | $125 | Averaged over the 12 months | Reduceable | $50 | Any alternatives for reductions right here? This totals $1,500 for Christmas.

Would it not be potential to buy second-hand items for the children? Do a Secret Santa with household to cut back the variety of items to present? Rethink your reward giving checklist? I’ll be aware that $50/month would nonetheless be a complete of $600 for Christmas. |

| Automobile insurance coverage | $104 | Triple A, bundled with my owners insurance coverage | Reduceable | $104 | Value purchasing this round when you haven’t executed so lately. |

| Family provides | $100 | This contains necessities plus the occasional house décor splurge or issues like towels, sheets and so forth. | Reduceable | $50 | |

| Housekeeper | $90 | This could possibly be thought-about a “luxurious” nevertheless it’s a month-to-month sanity saver for a single working mother! | Discretionary | $0 | Once more, I hate to remove it, however it’s one in all our few Discretionary line gadgets to work with. |

| Automobile upkeep | $75 | Estimate of the typical breakdown together with common and main mileage upkeep, tires, and so forth. | Mounted | $75 | |

| Private care | $75 | Hair cuts, occasional pedicures, magnificence/hygiene merchandise | Reduceable | $25 | |

| Web | $60 | Mounted | $60 | ||

| Subscriptions | $54 | Netflix, Disney+ bundle, Discovery+, Spotify, Audible | Discretionary | $0 | Might you choose only one or two of these subscriptions and remove the remaining? |

| Presents | $50 | Consists of household/good friend birthdays, youngsters’ birthdays and so forth. | Discretionary | $10 | |

| Leisure | $50 | Averaged over the 12 months | Discretionary | $0 | |

| School financial savings | $40 | I solely contribute slightly bit to the children’ funds for the time being. We’re lucky to have beneficiant grandparents who’re placing so much in for our children! When I’ve extra funds freed up and am assembly my retirement targets, I’d like to extend this. | Discretionary | $0 | My suggestion is to cease these contributions whereas getting your self on observe for retirement. See extra notes on this under. |

| Cell phone | $20 | Switched to Mint Mobile in October! | Mounted | $20 | Nicely executed on switching to an MVNO! |

| Dental insurance coverage | $16 | I pay for insurance coverage out of pocket by Lined California | Mounted | $16 | |

| Month-to-month subtotal: | $7,880 | Minus retirement & emergency fund financial savings = $7,330 | Proposed New Month-to-month subtotal: | $5,830 | |

| Annual complete: | $94,560 | Proposed New Annual complete: | $69,960 |

To be clear, I’m not an advocate for chopping each final expense. And, if Jess had been already on observe for retirement, I wouldn’t counsel so many eliminations. One of many challenges with Jess’s finances is that her house-related bills–mortgage + HOA charges–complete $3,653 a month. In mild of that, she is aware of she’ll be spending $43,836 per 12 months simply on housing. Whereas I perceive that that is her highest precedence, it does imply she might want to rethink a few of her different said priorities.

→If the home stays, lots of different Discretionary gadgets might want to go.

If Jess had been to implement the above proposed new finances, she’d be on observe to avoid wasting $20,040 a 12 months ($90,000 internet revenue – $69,960 bills).

A Notice On Saving For the Youngsters’ School

529s are tax-advantaged college savings accounts and Jess correctly opened one up for every of her youngsters. Nevertheless, whereas 529s are nice, you might want to make sure you’re not prioritizing contributions to a 529 forward of your personal retirement. That is why I counsel Jess cease contributing to her youngsters’ 529 accounts.

This can be a “put your personal oxygen masks on first” situation.

When you need to offer on your youngsters, you should present on your personal retirement. Youngsters can take out loans for varsity, you can’t take out loans for retirement. I at all times advise mother and father to first guarantee they’re on observe for their very own retirement, then contribute to a 529 account. The situation you wish to keep away from is that you just pay on your youngsters’ school after which have to maneuver in with them in your previous age since you didn’t save sufficient for retirement. I’m not saying that’s going to occur to Jess, however that’s my normal cautionary story round 529s (and different school financial savings accounts).

What To Do With This $20k Per 12 months?

If Jess is ready to save per the above pointers, there are two priorities clamoring for her cash:

- Her emergency fund

- Her retirement investments

Jess’s Emergency Fund: $14,600

Jess talked about that her emergency fund is just too small and I agree. Your money equals your emergency fund and your emergency fund is your buffer from debt. Ideally, you wish to goal an emergency fund of someplace between three to 6 months’ price of your spending. At Jess’s present price of spending $7,330 per thirty days, she ought to save up $21,990 (three months’ price) to $43,980 (six months’ price).

→Nevertheless, it’s additionally true that the much less you spend, the smaller your emergency fund must be.

If Jess had been to as a substitute begin spending on the proposed new quantity of $5,830 per thirty days, she’d wish to have an emergency fund of $17,490 (three months’ price) to $34,980 (six months’ price).

Why Have An Emergency Fund?

Your emergency fund is there for you if:

- You unexpectedly lose your job

- One thing horrible goes flawed with your home that must be mounted ASAP

- Your automotive breaks down and should be repaired

- You’re hit with an surprising medical invoice

- Your canine will get quilled by a porcupine and has to go to the emergency vet

As you may see, an emergency fund shouldn’t be for EXPECTED bills, corresponding to:

- Routine upkeep on a automotive, corresponding to oil adjustments and brake pads

- Anticipated house repairs, corresponding to boiler servicing/chimney sweeping

- Deliberate medical bills

An emergency fund’s purpose for existence is to forestall you from sliding into debt ought to the unexpected occur. It’s your personal private security internet.

That is additionally why it’s so vital to trace your spending each month. For those who don’t know what you spend, you gained’t understand how a lot you might want to save. I take advantage of and advocate the free expense tracking service from Empower, which was known as Private Capital (affiliate hyperlink).

Whereas everybody wants an emergency fund, some people have circumstances that make an emergency fund much more vital.

Listed here are just a few examples:

In all of those cases, you might have costly liabilities that might require cash to repair. Fortunate for Jess, she matches all of those classes, which is why I strongly encourage her to each cut back her spending and improve her emergency fund.

For people who hire and don’t have pets, youngsters or vehicles: your liabilities are usually much less. For those who don’t produce other individuals dependent upon our revenue and also you’re not liable for house or automotive repairs, you might have fewer potential emergencies to take care of. That’s to not say you shouldn’t have an emergency fund–you completely ought to!–however you may most likely calibrate to extra like a three-month fund. Realizing your danger degree and potential publicity is vital when figuring out how a lot you want in your emergency fund.

How To Allocate Between Retirement and Emergency Fund

Since Jess has competing targets right here–beefing up retirement and her emergency fund–I put collectively the under chart demonstrating how she would possibly allocate her financial savings yearly for the following 28 years:

| 12 months | Jess’s Age | Annual Web Revenue | Annual Bills | Distinction Between Revenue and Bills | Emergency Fund Whole | Whole $ to Put into Emergency Fund | Whole Obtainable $ to Put into Retirement | Annual Roth IRA Contribution | Annual SEP IRA Contribution |

| 2023 | 37 | $90,000 | $69,960 | $20,040 | $14,600 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2024 | 38 | $90,000 | $69,960 | $20,040 | $17,490 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2025 | 39 | $90,000 | $69,960 | $20,040 | $20,380 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2026 | 40 | $90,000 | $69,960 | $20,040 | $23,270 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2027 | 41 | $90,000 | $69,960 | $20,040 | $26,160 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2028 | 42 | $90,000 | $69,960 | $20,040 | $29,050 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2029 | 43 | $90,000 | $69,960 | $20,040 | $31,940 | $2,890 | $17,150 | $6,500 | $10,650 |

| 2030 | 44 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2031 | 45 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2032 | 46 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2033 | 47 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2034 | 48 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2035 | 49 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2036 | 50 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2037 | 51 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2038 | 52 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2039 | 53 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2040 | 54 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2041 | 55 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2042 | 56 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2043 | 57 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2044 | 58 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2045 | 59 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2046 | 60 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2047 | 61 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2048 | 62 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2049 | 63 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2050 | 64 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| 2051 | 65 | $90,000 | $69,960 | $20,040 | $34,830 | $0 | $20,040 | $6,500 | $13,540 |

| Whole contributions: | $188,500 | $372,430 |

As you may see, I saved her revenue and bills static for the sake of this mannequin. Clearly that’s most unlikely, however, the wonderful thing about this chart is that Jess can change these variables and examine the ensuing calculations. Identical deal for the Roth and SEP contributions–these are additionally most unlikely to stay static because the IRS adjustments them practically yearly. Once more, Jess can go in and regulate these quantities as wanted. I do have her maxing out her Roth, however not maxing out the SEP (at $30k/12 months) as a result of she doesn’t have sufficient room in her finances. Nevertheless, if she earns extra (or spends much less), she will be able to work on reaching that max if desired.

How A lot Would Jess Have At Age 65?

To reply that query, we now have to make use of a compounding curiosity calculator and account for her present retirement financial savings as properly:

| Roth IRA | SEP IRA | IRA | Whole in all Retirement Accounts at finish of 2051 | |

| Whole contributions made 2023-2035 | $188,500 | $372,430 | None as all cash ought to go into the opposite two accounts | |

| Current Account Balances (as of three/29/23) |

$62,540 | $1,511 | $53,935 | |

| TOTALS: | $251,040 | $373,941 | $53,935 | $624,981 |

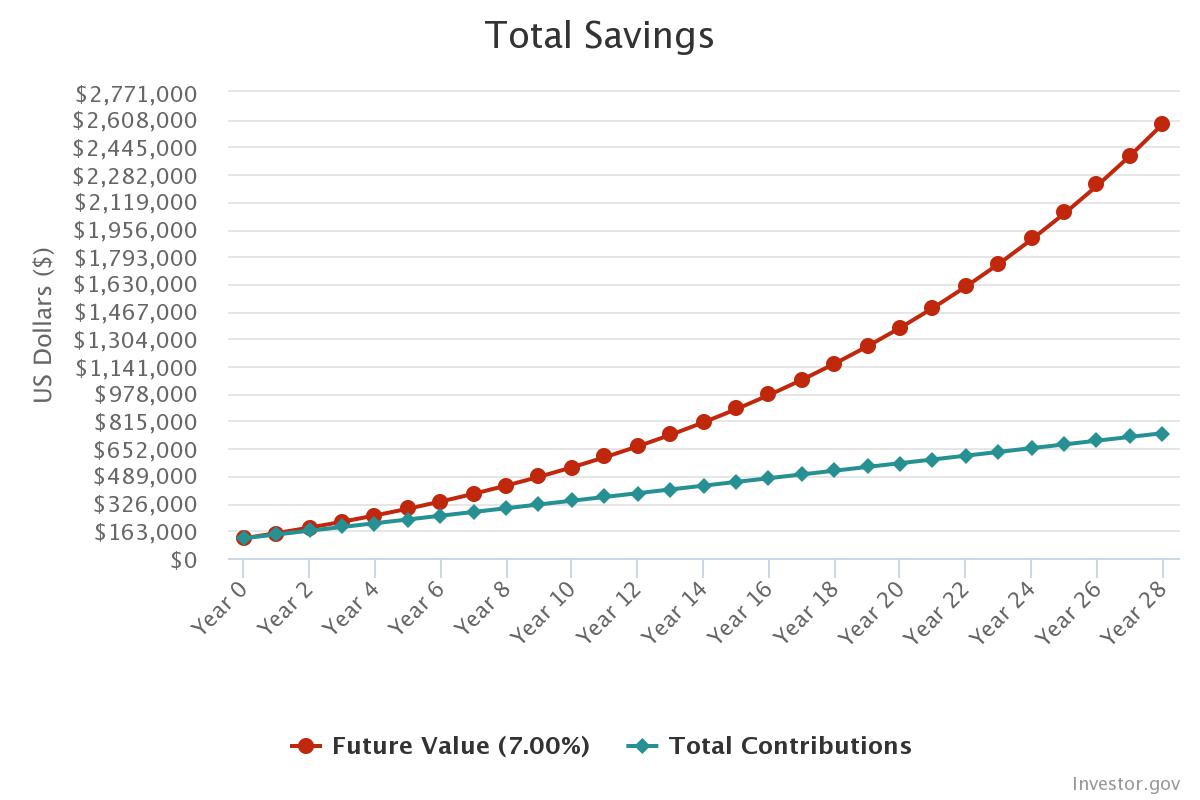

Whereas $624k sounds nice, it doesn’t account for inventory market returns! Let’s try this projection subsequent:

| Quantity Invested Per Month On Common (28 years = 336 months complete) | $1,860.06 |

| Projected Portfolio Whole in 2051: | $2,585,642.30* |

*assuming a 7% market return on 28 years of investing $1,850.06 per thirty days

If Jess had been to contribute $1,860.06 per thirty days to her retirement accounts for the following 28 years, she’d be on observe to retire at age 65 with $2,585,642.30 in her investments. This assumes a traditionally common 7% annual market return (which doesn’t imply 7% yearly, however relatively a mean of seven% yearly over the course of 28 years). With that quantity, if Jess had been to withdraw a sustainable 4% yearly beginning at age 65, she’d have $103,425.692 to dwell on yearly (plus Social Safety), which is fairly candy!

I did this calculation with this compounding interest calculator and right here’s a chart demonstrating the expansion she may see in her investments:

The caveats with this projection are, after all, that it’s a projection since we are able to’t know:

- What the inventory market will truly do.

- What the contribution limits shall be for Roth IRAs and SEP IRAs sooner or later.

- What Jess’s wage and bills shall be over time.

- What inflation will do.

The purpose of this train is to display the facility of compounding curiosity and the truth that Jess has time on her facet. She’s comparatively younger in her working life if she’s aiming for a conventional retirement age of ~65. In mild of that, she will be able to capitalize on a number of a long time price of potential funding returns. It’s a lot simpler to start out contributing early to retirement investments than it’s to play catch-up later. For those who begin late, you gained’t be capable to reap the rewards of funding returns and compounding curiosity.

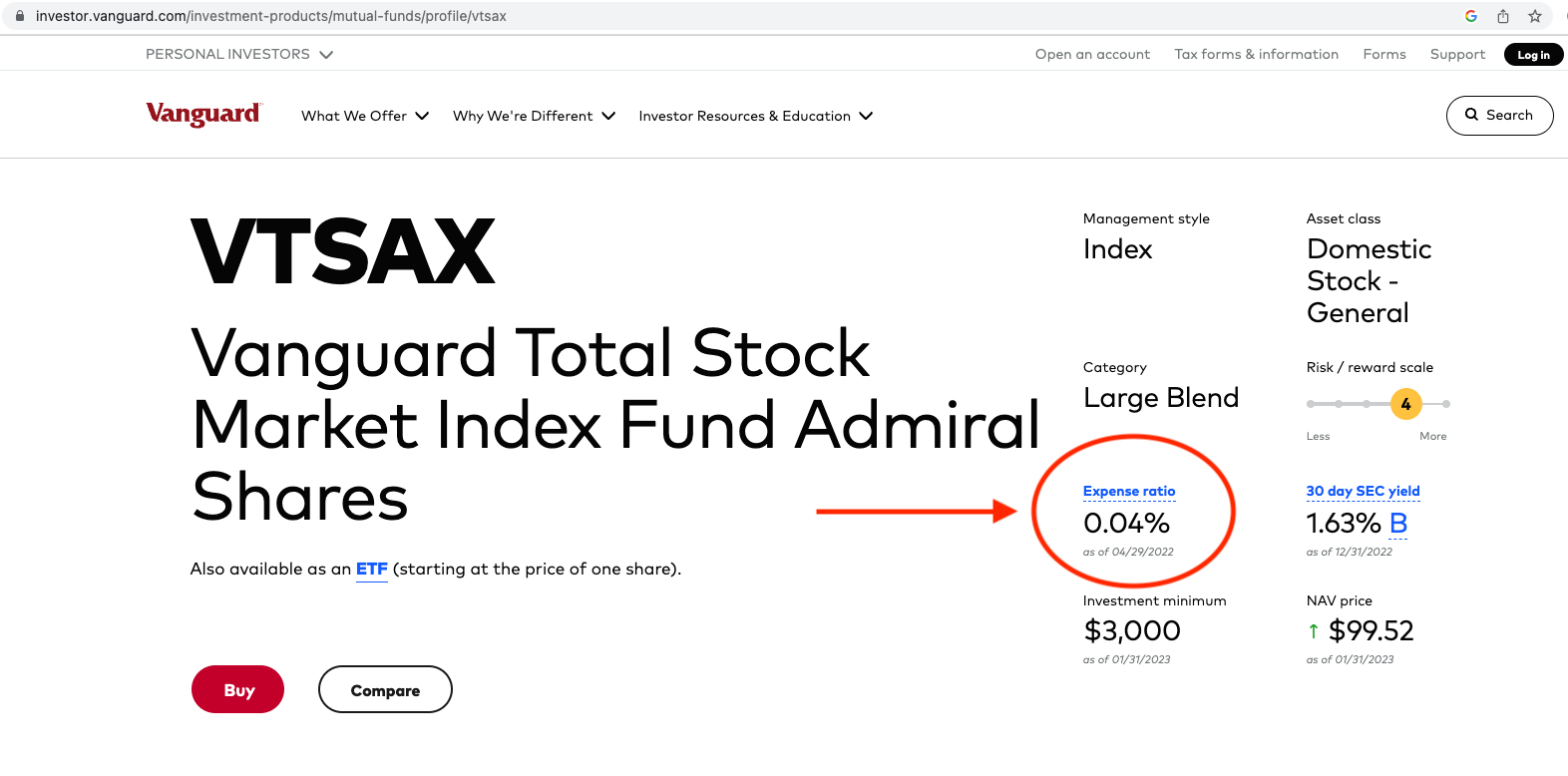

The Significance of Expense Ratios

One thing lacking from Jess’s checklist of retirement investments are their expense ratios. This isn’t a minor element you may ignore as a result of:

Expense ratios are the share you pay to a brokerage for investing your cash and, as they’re charges, you need them to be as little as potential.

As Forbes explains: “An expense ratio is an annual price charged to buyers who personal mutual funds and exchange-traded funds (ETFs). Excessive expense ratios can drastically cut back your potential returns over the long run, making it crucial for long-term buyers to pick out mutual funds and ETFs with affordable expense ratios.”

In mild of their significance to 1’s total long-term monetary well being, I encourage Jess to find the expense ratios for all of her retirement investments. I’m going to make use of VTSAX for instance of the right way to discover an expense ratio.

You’re going to love this as a result of it’s a three-step course of:

1. Google the inventory ticker (on this case I typed in “VTSAX”)

2. Go to the fund overview web page

3. Take a look at the expense ratio.

Screenshot under for reference:

And executed! Woohoo! To present you a way of whether or not or not your investments have affordable expense ratios, the next three funds are thought-about to have low expense ratios:

- Constancy’s Whole Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Whole Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Whole Market Index Fund (VTSAX) has an expense ratio of 0.04%

You can too use this calculator from Bank Rate to find out what you’ll pay in charges over the lifetime of your investments, primarily based on their expense ratios. For those who discover that your investments have excessive expense ratios, it’s properly price your time to research whether or not or not you may transfer them to lower-fee funds. This isn’t at all times potential with employer-sponsored plans (corresponding to 401ks) as you’re beholden to no matter funds your employer gives. However, it’s nonetheless price wanting by all accessible funds to pick out those with the bottom expense ratios.

The Significance of a Excessive-Yield Financial savings Account

The opposite factor that jumped out at me about Jess’s accounts is that her financial savings account isn’t incomes something in curiosity. Unacceptable ;)!

Jess must discover a high-yield financial savings account ASAP as a result of that is free cash! For instance, as of this writing, the American Express Personal Savings account earns a whopping 3.75% in curiosity (affiliate hyperlink). If Jess had been to place her emergency fund on this account, in a single 12 months her $14,600 would earn $548 in curiosity!!!

Jess’s Query #3: Ought to I be pursuing a full-time job with advantages as a substitute of making an attempt to make freelancing work in my state of affairs?

That is one thing solely Jess can reply. As I’ve simply modeled out, Jess earns sufficient and has the potential to avoid wasting sufficient to have each a completely funded emergency fund and a completely funded retirement. It’s now a query of what’s most essential to her.

- Does she wish to cut back her spending as outlined above?

- Or would she relatively improve her revenue?

If Jess needs to deal with revenue will increase, then she ought to go for it along with her freelance work and see what’s potential for her. If she’d relatively lose the pliability/hours of freelancing however achieve the steadiness of a paycheck from an employer, she will be able to go that route. The attractive factor right here is that Jess has choices. She will be able to management each variables–revenue and bills–and she or he’ll simply must determine which levers to push.

Jess’s Query #4: How can I launch my monetary fears and cease trying to greenback indicators for safety?

To a sure extent, you may’t. Cash does present safety. It’s a truth. I believe it’s naive to imagine in any other case. Alternatively, I additionally suppose it’s potential to place an excessive amount of emphasis on monetary stability. Monetary stability doesn’t essentially cut back anxiousness, make individuals happier or ship fulfilling existence. It’s all about your notion of cash and the emotional response it’s important to it.

There are many millionaires who really feel financially insecure and terrified. Conversely, there are many people with far much less who expertise far higher contentment and stability of their lives. There’s an excessive amount of privilege in having monetary safety and the boldness that your primary wants shall be met. And so the problem is to not lose sight of that whereas additionally permitting your self to really feel assured in regards to the monetary place you’re in.

Abstract:

- Transfer your money right into a high-yield financial savings account ASAP

- Overview the Proposed New Bills spreadsheet to find out which bills you’re prepared to cut back or remove

- Know that when you select to remain in the home, many different discretionary gadgets will must be eradicated

- Overview the expense ratios for your entire retirement investments and alter funds if wanted

- Cease contributing to the children’ 529s whilst you atone for retirement

- Implement the above plan for beefing up your emergency fund and retirement investments

- Decide when you’d relatively improve revenue or lower bills (or do each) as a way to do that

- Regulate the long-term retirement funding targets over the a long time

- Know that point is in your facet proper now by way of compounding curiosity and that it’s MUCH higher to start out investing for retirement sooner relatively than later

Okay Frugalwoods nation, what recommendation do you might have for Jess? We’ll each reply to feedback, so please be happy to ask questions!

Would you want your personal Case Examine to seem right here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Rent me for a private financial consultation here. Schedule an hourlong or 30-minute call with me here, refer a good friend to me here, or e mail me with questions (liz@frugalwoods.com).

Questioning about hiring me for a session? Grab 15 minutes on my calendar without spending a dime to debate!

By no means Miss A Story

Signal as much as get new Frugalwoods tales in your e mail inbox.