Aurelia is a highschool instructor at a public faculty in Boston who just lately purchased her first apartment and is thrilled to be a house owner on the age of 27! Tempering that enthusiasm, nevertheless, are her new competing monetary calls for of home upkeep prices, retirement, saving for Invisalign braces and paying off her scholar loans. Aurelia has a zest for all times and a love for her college students, however her wage doesn’t fairly match that enthusiasm. She’d like our assist figuring out tips on how to prioritize her monetary objectives whereas nonetheless residing a strong life stuffed with pals, journey and hobbies. Let’s head to Boston to dive into Aurelia’s questions!

What’s a Reader Case Research?

Case Research deal with monetary and life dilemmas that readers of Frugalwoods ship in requesting recommendation. Then, we (that’d be me and YOU, pricey reader) learn by their scenario and supply recommendation, encouragement, perception and suggestions within the feedback part.

For an instance, try the last case study. Case Research are up to date by members (on the finish of the submit) a number of months after the Case is featured. Go to this page for hyperlinks to all up to date Case Research.

Can I Be A Reader Case Research?

There are 4 choices for people concerned with receiving a holistic Frugalwoods monetary session:

- Apply to be an on-the-blog Case Study subject here.

- Rent me for a private financial consultation here.

- Schedule an hourlong call with me here.

- Schedule a 30 minute call with me here.

→Undecided which option is best for you? Schedule a free 15-minute chat with me to study extra. Refer a good friend to me here.

Please be aware that area is restricted for all the above and most particularly for on-the-blog Case Research. I do my finest to accommodate everybody who applies, however there are a restricted variety of slots obtainable every month.

The Objective Of Reader Case Research

Reader Case Research spotlight a various vary of monetary conditions, ages, ethnicities, areas, objectives, careers, incomes, household compositions and extra!

The Case Research sequence started in 2016 and, so far, there’ve been 95 Case Studies. I’ve featured of us with annual incomes starting from $17k to $200k+ and web worths starting from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured homosexual, straight, queer, bisexual and polyamorous individuals. I’ve featured ladies, non-binary of us and males. I’ve featured transgender and cisgender individuals. I’ve had cat individuals and canine individuals. I’ve featured of us from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured individuals with PhDs and folks with highschool diplomas. I’ve featured individuals of their early 20’s and folks of their late 60’s. I’ve featured of us who dwell on farms and people who dwell in New York Metropolis.

Reader Case Research Tips

I most likely don’t have to say the next since you all are the kindest, most well mannered commenters on the web, however please be aware that Frugalwoods is a judgement-free zone the place we endeavor to assist each other, not condemn.

There’s no room for rudeness right here. The objective is to create a supportive atmosphere the place all of us acknowledge we’re human, we’re flawed, however we select to be right here collectively, workshopping our cash and our lives with constructive, proactive ideas and concepts.

And a disclaimer that I’m not a educated monetary skilled and I encourage individuals to not make severe monetary selections based mostly solely on what one particular person on the web advises.

I encourage everybody to do their very own analysis to find out the very best plan of action for his or her funds. I’m not a monetary advisor and I’m not your monetary advisor.

With that I’ll let Aurelia, at present’s Case Research topic, take it from right here!

Aurelia’s Story

Hello Frugalwoods! I’m Aurelia and I’m 27 (the place does the time go?), born and now residing (endlessly!) in Boston, MA. My mother and father dragged me to suburbia once I was younger however I’m a metropolis woman at coronary heart and have been again within the metropolis since school. I’m fortunately single and have an exquisite job instructing historical past to newcomer immigrants in an city highschool whereas co-running an outdoor membership for the youngsters. After I’m not at work I’m normally on the ballet, studying, taking part in video video games, mountaineering and tenting, bouncing, or going out (particularly consuming out) with pals. My mother and father dwell lower than half-hour away and I spend as a lot time with them as I can, since my sibling lives in Florida. I simply turned a house (apartment) proprietor this previous June – one thing I believed would by no means occur, particularly at a younger age – and I’m completely loving it!

What feels most urgent proper now? What brings you to submit a Case Research?

I used to be NOT imagining I might turn into a house owner and positively not at 27! To make an extended story as temporary as potential: I used to be idly perusing actual property listings in my neighborhood (don’t all millennials do that?) and an income-restricted unit in a big constructing I’ve all the time preferred got here up. After studying over the necessities, I noticed this is able to be the one time I might be eligible to purchase on this earnings bracket AND in my neighborhood, which I might have been priced out of in any other case, because the lease is simply too rattling excessive. After speaking it over with my mother and father to test if I used to be loopy to even contemplate it, I pulled the set off and ended up being the one provide. And right here I stand earlier than you, a house owner… who now should work out her subsequent steps (once more)! I’m now forward of all of my pals and really feel like I’ve skipped a number of steps in how I understood life’s development to be.

Even earlier than shopping for my apartment, I had a number of totally different objectives I used to be juggling – retirement, journey, saving for a 2nd masters to extend my earnings (which I’ve since shelved, as I feel there are higher choices), paying off my scholar loans, and saving for Invisalign – and never notably properly. Now enter a home and…you’ll be able to see how I’m a bit confused making an attempt to determine what to do first and what wants to attend! I’ve landed on eliminating my scholar mortgage debt as shortly as potential, however there are some questions I would like enter on on the subject of work and retirement.

What’s the very best a part of your present way of life/routine?

Regardless that I spent plenty of my childhood in rural/suburban areas, it’s truthful to say that I’m a metropolis woman at coronary heart. The benefit of with the ability to go anyplace and do something, strive totally different cuisines, and luxuriate in enjoyable and attention-grabbing locations (inside and outdoors) makes me very joyful. I even have an intense should be outdoors, and Boston/New England is ideal for that! I’ve a pleasant palette of hobbies and actions to select from and pals who dwell close by that I can do them with (or on my own, if I would like). Professionally, work could be “messy” generally (if you already know, you already know) however I’m on the level in my instructing profession the place I’m solely working 40 hours per week and may fortunately depart work at work. I gained’t deny that instructing, particularly this particular inhabitants, could be emotionally draining generally, so I’m joyful that I dwell alone now and have some mellower hobbies I can recharge with. I additionally love the neighborhood spirit of my constructing and my neighborhood.

What’s the worst a part of your present way of life/routine?

Work could be draining generally and the pandemic years have been tough in my faculty, not simply due to the pandemic. Because of this, I don’t get as a lot face time with my 9-5 pals throughout the faculty yr as I would like (being this drained may additionally simply be…getting older?). Instructing can also be not terribly profitable, and whereas we gained a large wage enhance in our contract, issues are tight financially.

I’ve all the time tried to dwell as frugally as potential whereas having a full and joyful life, however including the bills of homeownership is making issues even tighter.

On the identical time, there aren’t plenty of alternatives to earn more cash at work and the few obtainable are: a) an excessive amount of time/accountability relative to the compensation provided; or b) threaten my work-life stability or work happiness.

I discover that the extra individuals I have to work with, the unhappier I’m. I’m so not concerned with work politics. I additionally need to watch out managing my well being and vitality ranges as a result of I’ve some power diseases that may spiral into severe illness if I overextend myself. Nonetheless, my place exists in only a few locations and the staff I work with is great.

The place Aurelia Desires to be in 10 Years:

Funds:

- Free (or near free) of non-mortgage debt

- Paid for Invisalign

- Paid for one in every of my huge “initiatives” (ending the loft in my apartment or occurring a big journey)

- Extra money saved for emergencies and retirement

Life-style:

-

Extra of what I’m doing now, though with extra touring (presently nothing, beforehand 1-2 lengthy weekend-style home journeys).

- I might actually love to go to Central and South America the place all my college students are from.

- I’m presently single however I think about within the subsequent 10 years I could meet a associate and incur bills associated to that.

- Attributable to well being points, I might have a tough time having organic youngsters. I’ve not dominated out adopting or fostering, however my apartment just isn’t sufficiently big and I might not do it on my own. I can see myself because the aunt who spoils her nieces/nephews rotten with enjoyable journeys/occasions within the metropolis with good meals afterwards…

Profession:

- Nonetheless instructing as a result of the work is intellectually stimulating and the youngsters are nice, however seeking to maximize earnings with out compromising my values.

- I don’t need to be an administrator having seen how a lot mine works (plus I would want to return to highschool for that).

- Subsequent yr I’ll apply to be a brand new instructor mentor for a wage bump (I utilized for a trip place and didn’t get it, which was discouraging).

- I considered a second MA, which I discovered on-line for an inexpensive value, however I can’t justify that upfront expense proper now and truthfully… I don’t need to return to being a scholar, as a lot as I liked it.

- Facet be aware: I have already got my Grasp of Arts in Instructing English as a Second Language and a BA in Historical past with a minor in dance!

- I don’t assume there’s a lot else on the market that fits my skillset and my way of life objectives/desires on the identical wage level.

- The pandemic taught me the exhausting approach that distant work just isn’t satisfying for me (hybrid, possibly).

Aurelia’s Funds

Earnings

| Item | Gross Earnings | Deductions & Quantity | Internet Earnings |

| Earnings, paid in 24 checks September – June (so it’s biweekly, however sort of not) | $5,872 | medicare: $85, PPO: $326, 457: $100, imaginative and prescient: $6, dental: $43, pension: $646, state taxes: $296, federal taxes: $508.05, union dues: $87 | $3,805 |

| be aware: December is a bit of bit larger as a result of we’ve got a premium vacation, and I get roughly $100/month from my membership (however I strive to not depend it because it’s unpredictable!) | |||

| Month-to-month subtotal: | $3,805 + $100-$150 membership | ||

| Annual whole: | $45,660 (simply wage) |

Mortgage Particulars

| Merchandise | Excellent mortgage stability | Curiosity Fee | Mortgage Interval and Phrases | Fairness | Buy value and yr |

| Main mortgage on my apartment | $317,000 | 2.75% | 30-year fixed-rate mortgage | ~$20k (not together with secondary mortgage) | $362k, bought June 2022 |

| Secondary mortgage on my apartment | $23,500 | 0.00% | 30 years…form of | n/a | $0, this was the downpayment help from my metropolis once I purchased my apartment. The secondary mortgage is paid off in full, interest-free, upon refinance or totally paying off the mortgage. I might be a idiot to refinance 2.75%, so… |

| Complete: | $339,500 |

Money owed

| Item | Excellent mortgage stability | Curiosity Fee | Mortgage Interval/Payoff Phrases/Your month-to-month required cost |

| Federal scholar loans | $73,000 | 5.20% | I’m on an income-based compensation plan for Public Service Loan Forgiveness (PSLF). I’m virtually midway by my 10-year requirement and can see forgiveness (with no tax bomb) in late 2028. I’m eligible for $10k in mortgage forgiveness if it passes, however it could not change my month-to-month funds proper now. |

| Non-public scholar loans | $45,000 | 4.98% | Paid biweekly to sneak further funds in. Payoff is 2041, however I need to be free ASAP! |

| Complete: | $118,000 |

Belongings

| Merchandise | Quantity | Notes | Curiosity/sort of securities held/Inventory ticker | Identify of financial institution/brokerage | Expense Ratio |

| Pension | $25,100 (what I’ve put in) | That is the full of what I’ve put in up to now to my MTRS contributions.

How do I issue pension worth into retirement? If I max out my pension (at 58, eligible to retire at 60) I get 80% of my previous couple of years’ earnings in retirement. |

Obligatory 11% contribution from each paycheck | MTRS (the MA state lecturers’ retirement system) | n/a |

| Roth IRA | $15,700 | I began this once I was 19! | Goal 2060 retirement fund (though I’ll realistically retire in 2055) | Vanguard | 0.08% |

| Checking Account | $7,500 | Checking account | Charles Schwab | n/a | |

| Financial savings Account | $3,000 | 4.25% | LendingClub | n/a | |

| 457 (employer plan) | $1,400 | That is my non-pension employer plan. I didn’t enroll in it till I earned PTS (tenure) out of a foolish concern that I’d be fired.

For now I put $50/month in since my tax bracket is on the bubble re: if Roth or non-Roth contributions make sense. I don’t have sense of what my taxes will seem like now that I’m a house owner (!!) It’s additionally actually annoying to request adjustments in contributions so I need to be certain that I’ve more cash available. I may contribute to this post-tax. |

Goal 2060 retirement fund | Empower | 0.07% |

| Complete: | $52,700 |

Autos: none!

Bills

| Merchandise | Quantity | Notes |

| Mortgage | $1,346 | Principal, curiosity, taxes. My property taxes are $30/month. Thanks metropolis proprietor occupancy deduction! |

| Non-public Scholar Mortgage | $413 | Usually 2 biweekly funds of 155, generally 3 if it’s a 3 paycheck month. I’m sending an additional $50/cost to get out of debt quicker! |

| Financial savings: No August Wage | $400 | I get 3 paychecks in late June that should cowl July, August, and early September…clearly not sufficient cash. I’ve determined to remove uncertainty by saving cash prematurely only for wage substitute. |

| Groceries | $250 | This contains family/cleansing provides and alcohol (I dwell subsequent to a sure high quality craft cider taproom/brewery). I completely store at Market Basket (hardly ever sneaking into Dealer Joe’s for snacks), however generally I exploit Amazon Recent as I dwell in a meals desert. |

| HOA Price | $167 | Sizzling water, widespread areas, landscaping, typical HOA issues |

| Financial savings: House owner Fund | $150 | In my Homebuyer 101 class we have been informed to save lots of 1% of our residence’s worth every year to go in the direction of enchancment and upkeep prices. Cash may be very irregular for me in the summertime so I don’t know the way a lot a month this seems to be like this yr, however by this 1% calculation it needs to be $300/month. I’m a bit of forward so it’s about 200/month. I’ve an unfinished loft that I need to construct sooner fairly than later and my home equipment are great however older, so I need to be prepared when these instances come.

objective is 3600 every year, present stability 2k |

| Boston Ballet | $100 | Paid in Could, averaged month-to-month. 2 orchestra seats to each present + $20 volunteer dues (I give excursions, amongst different issues!). I principally dwell on the Opera Home when the ballet is in season and see most exhibits 4-5 instances (and get to hang around with the dancers!). I additionally obtain perks like extra free tickets, attending firm class and particular performances at no cost. I get to deal with quite a lot of particular individuals in my life (they pay for meals in return). I’ve been a subscriber for 8 years now and I’ve acquired a number of seat upgrades – if I pause my subscription I might lose my seats. |

| Good friend Dates | $100 | Averaged to account for the educational calendar (extra free time throughout breaks), however a slush fund for issues I do with my pals. I depend meals out with pals towards this quantity. This summer season I used library passes to go along with pals to many museums at no cost, however some have been solely discounted. |

| LinkPass | $90 | Limitless bus, practice and ferry. No employer transit advantages however could be deducted from taxes. 🙁 |

| Financial savings: Invisalign | $87 | I want to begin saving for this as my enamel are crowded and getting worse. I’ve shopped round and the bottom quote (dental faculty) have quoted the work at $5.5k over a yr (month-to-month funds). All consults agree that the work must be finished inside the subsequent 5 years (by 2026). Dental insurance coverage covers 0%. Sadly no low cost for paying every little thing up entrance, however I want to save at the very least 1/2 of the quantity earlier than starting the remedy.

Objective is $2,250 by Could 2024 |

| Trampoline / Dance Lessons | $85 | Limitless bounce + cheer courses that greater than pays for itself. Essential to my bodily and psychological well being and may’t do it at residence! Plus I get passes to carry pals so we will do one thing enjoyable at a low price. |

| House owner Insurance coverage | $70 | |

| Electrical | $50 | Regardless of the brutal warmth wave this previous summer season, my electrical prices are fairly constant. |

| Physician Visits | $50 | copays and pressing care averaged – larger than typical attributable to a current MRI |

| Household Trip | $50 | My mother and father anticipate me to pay 1/3 of the household trip. |

| Christmas | $50 | Averaged over the previous 2 years. Features a tree, presents for pals/household, vacation bills (baking for coworkers), any journey and donations to neighborhood orgs who assist of us in want of a meal. I’m going frugal for individuals’s birthdays so Christmas is my annually factor. |

| Financial savings: Laptop computer Fund | $50 | Saving for a brand new laptop computer. 100/600 |

| Web | $40 | |

| Medication | $35 | generally larger relying on the sickness of the month |

| Fuel | $30 | Averaged. Nonetheless haven’t turned my warmth on as a result of huge home windows = huge solar! |

| Contact Lenses | $30 | Curse astigmatism! |

| Eating Out | $30 | After I eat out on my own, both full meals or getting treats at a espresso store. Pre-pandemic this was larger however I attempt to prepare dinner extra. Normally dip into this once I’m too sick to prepare dinner and need a meal. That is a straightforward place to chop down (generally you simply want Dunks) |

| Furnishings / House Items | $20 | That is exhausting to quantify since I made some huge ticket purchases that I can’t be making once more (as YNAB jogs my memory, my common is excessive!): this features a sofa I acquired for FREE minus the price of shifting it, a TV, a washer machine, and a brand new drying rack (sadly not free). I feel I’m finished for now… |

| Outdoorsy Issues | $20 | Averaged; if I hike with pals, covers gasoline bills or any meals/snacks we have to get. This could possibly be larger if I get new gear, however I’m all set for now. |

| Haircut | $20 | 2x/yr for a curly reduce, can’t go any longer between |

| HBO MAX | $16 | Don’t inform anyone that my mother has my HBO password…! |

| Ultimate Fantasy XIV Subscription | $13 | I play repeatedly with my pals. |

| NYT Tutorial Subscription | $12 | |

| Amazon Prime | $12 | I’d fairly not, however I a) dwell in a meals and retailer desert and b) maintain my mom proud of Prime Video. I order sufficient issues that the month-to-month price is decrease than what I might pay in delivery. |

| YNAB | $6 | Sharing a household plan with a good friend! |

| Donations | $5 | Averaged, annual donation to work scholarship. |

| Clothes | $5 | The final time I purchased garments was final February? I purchased myself a really good ski bib… |

| Federal Scholar Mortgage | $0 | At the moment paused. When funds resume I have to request a recalculated month-to-month cost, however solely after I file my taxes to see if this can be a profit or a burden.

(shall be round $250/month beginning in June 2023) |

| Financial savings: Journey Fund | $0 | Saving to see an expensive good friend graduate in VA this spring, utilizing a mixture of factors and money. After this, saving for a visit to Canada to see one other good friend.

(fund will get topped up as spent, @ 350) |

| Financial savings: Video Sport Fund | $0 | This has been a lot larger than typical since 2022 was an awesome yr for recreation, and I had gone years with out shopping for any. I both await deep gross sales, go to the library first, or I purchase used at a neighborhood retro retailer (and get a ten% instructor low cost)! 2023 seems to be quieter so I’ll most likely purchase 1-2 video games and be finished for a bit.

(fund is 65, replenished when spent, had been spending 40/mo final yr) |

| Cell Cellphone | $0 | My mother complains in regards to the cellphone invoice however refuses to take my cash? (Don’t fear, I’ve already prompt an MVNO.) |

| Gardening | $0 | On maintain proper now as I cross my fingers and await a neighborhood plot. Usually $5-10/month averaged in any other case for soil and native seedlings. |

| Month-to-month subtotal: | $3,802 | contains invisalign and house owner financial savings, however not upcoming scholar mortgage restart in june 2023 |

| Annual whole: | 45,624 | $3 below! |

Credit score Card Technique

| Card Identify | Rewards Sort? | Financial institution/card firm |

| Chase Freedom Limitless | Journey/Money Again | Chase Financial institution |

| CapitalOne QuickSilver | Money Again | CapitalOne |

| Residents Financial institution MasterCard | nothing (I acquired it as an AU at 16 to construct credit score and study good habits) | Residents Financial institution |

Aurelia’s Questions For You:

-

Pre-tax or Roth contributions?

- For reducing my taxable earnings (PSLF), it most likely is sensible to go heavy on pre-tax retirement contributions, however I solely have 5 extra years of PSLF (Public Service Loan Forgiveness).

- Decreasing taxable earnings is useful normally, however at my earnings I virtually undoubtedly can’t get into the 12% bracket (nor will I see a better one, at the very least not for some time).

- What’s a gal to do?

- How ought to I take into consideration my pension within the context of planning my different saving for retirement?

- I’m in MTRS (the Massachusetts state lecturers’ retirement system)

- If I max out my pension (at age 58, eligible to retire at 60) I get 80% of my previous couple of years’ earnings in retirement.

- Since I’m on this pension system, I gained’t obtain any Social Safety

- How do I prioritize a myriad of financial savings/debt-purging objectives? To recap, my objectives are:

- Paying off scholar loans

- Saving for retirement

- Paying for Invisalign braces out-of-pocket

- Saving for house owner initiatives/repairs

- Journey, a lot later

- Am I lacking one thing I haven’t considered? I’m additionally apprehensive about my mother and father:

- My mother and father have little retirement financial savings and can most likely need to work till the day they die. They’re of their late 50s and each have a number of power well being situations that impair their high quality of life.

- They’ve a mortgage on a single household residence in metro Boston that they might simply promote for 3-4x the value they paid and, after paying off the mortgage, have some cash to dwell on along with Social Safety. They may transfer someplace with a decrease price of residing and be high quality, however I’d like for my mother and father to be shut.

- Is it price pushing aside retirement contributions altogether to get out of debt quicker?

- I’ve taken sufficient private finance courses to know that the reply might be a staunch NO (time worth of cash, child!), however the problems of getting a pension and the curiosity in opening up money movement make me hesitate for a microsecond…

Thanks a lot for any perception you’ll be able to provide, Liz and the Frugalwoods Group!

Liz Frugalwoods’ Suggestions

I like Aurelia’s love of life! She has so many pursuits, hobbies and passions and her enthusiasm exudes from her writing. I had a smile on my face the entire time I examine every little thing she’s curated in her life. Her Case Research additionally raises the unhappy specter that we don’t pay our lecturers sufficient on this nation. Nowhere close to sufficient. If I have been Queen of the World, I might pay all lecturers an funding banker wage as a result of they deserve it! Sadly, nobody will elect me Queen of the World (a lot as I’ve tried… ). Given my incapacity to extend Aurelia’s wage, let’s do what’s inside our management and dig into her questions!

Aurelia’s Questions #1 and #2: How ought to I take into consideration my pension within the context of planning my different saving for retirement? And, ought to I make pre-tax or Roth contributions?

The reply right here is dependent upon whether or not or not Aurelia thinks she’s going to stay working in MA public faculties till she retires. If she does, she’s acquired an awesome deal right here. 80% of her wage yearly in perpetuity is incredible! As her present wage, she couldn’t afford to dwell on 80% of it, however her wage will enhance through the years and her bills will lower as she pays off her scholar loans and ultimately her mortgage.

→The most important caveat is the well being of her pension system.

Whereas I really feel extra assured in regards to the viability of a state pension system, reminiscent of Aurelia’s, there stays an inherent threat of default in any pension system. Because the MA Teacher’s Retirement System Independent Auditor’s Report on Pension Plan Schedules is publicly obtainable as a PDF, I learn it (properly, a few of it). I truthfully don’t assume you guys notice how thrilling my job is…

In an audit, an out of doors auditor seems to be on the books of a corporation or entity (on this case, Aurelia’s pension system) and offers their opinion on how that group/entity is doing financially. The auditor on this case was charged with making assessments reminiscent of: Is that this pension system prone to default? How doubtless? How wholesome is that this pension in mild of the variety of residing pensioners? And extra! Let’s see what they discovered!

The MA Teacher’s Retirement System Independent Auditor’s Report on Pension Plan Schedules For Fiscal Year 2021: a enjoyable read-along with Liz!

We start by taking a look at web page 7 in an effort to higher perceive the parameters of this pension system:

These necessities present for superannuation retirement allowance advantages as much as a most of 80% of a member’s highest three-year common annual fee of standard compensation. For workers employed after April 1, 2012, retirement allowances are calculated on the premise of the final 5 years or any 5 consecutive years, whichever is bigger by way of compensation… Members turn into vested after ten years of creditable service. A superannuation retirement allowance could also be acquired upon the completion of 20 years of creditable service or upon reaching the age of 55 with ten years of service. Regular retirement for many staff happens at age 65. Most staff who joined the system after April 1, 2012 can not retire previous to age 60.

That is tremendous helpful information! I assume Aurelia was employed after April 1, 2012, which suggests these new provisions apply to her. To recap (in plain-er English):

- She’ll get 80% of both her final 5 years of wage OR any consecutive 5 years all through her profession–whichever has the larger wage. That is good to know as a result of it means she may doubtlessly scale down her duties as she nears retirement since she doesn’t have to have her highest incomes years on the finish of her profession (as is the case with many pensions).

- She’ll be vested after 10 years, so she’ll undoubtedly need to keep working within the system for no less than 10 years.

- She doubtless can not retire previous to age 60 if she needs to obtain the total 80%-of-salary profit.

Subsequent, let’s look at the well being of the pension system by going to web page 9:

Word that these numbers are written in 1000’s, which suggests the totals are literally billions. I agree, that is very complicated, however apparently it’s normal auditing process. No surprise individuals are confused! Right here’s what the auditors report about Aurelia’s pension system:

The collective web pension legal responsibility on June 30, 2021 was as follows (quantities in 1000’s):

Complete pension legal responsibility……………………………… $59,795,000

Much less: Plan fiduciary web place…………………… $37,088,124

Internet pension legal responsibility………………………………… $22,706,876

Plan fiduciary web place as a proportion of whole pension legal responsibility………………………… 62.03%

What we’re taking a look at right here is:

- How a lot cash the auditors estimate will should be paid out of the pension system sooner or later, known as “Complete pension legal responsibility” ($59.8 billion)

- How a lot the pension has in belongings, known as “Plan fiduciary web place” ($37 billion)

- The distinction between how a lot the pension owes and the way a lot the pension has, known as “Internet pension legal responsibility” ($22.7 billion)

The underside line is that the pension is 62% funded. For context, 100% funded can be the very best and 0% funded can be the worst. However, a 62% funded fee just isn’t dangerous. Not superior, however not horrible. So how do we all know if Aurelia will get her full pension? We are able to’t know this. Nevertheless…

→The true option to choose the chance of Aurelia’s pension being there for her is thru the lens of the political panorama of the state/entity that controls her pension.

Purpose being? This pension is backed by the total religion and credit score of the commonwealth of Massachusetts. So the query you need to grapple with is: how doubtless are MA state legislators to permit the state lecturers’ pension to enter default? Are they prone to bail it out if want be? Or are they prone to permit lecturers to not obtain their pensions? In some states, that’s tantamount to political suicide. In different states… not a lot. It’s additionally vital to do not forget that, within the occasion of a price range disaster, it’s most unlikely Aurelia would obtain NONE of her pension–it’s more likely she’d obtain a partial proportion.

Right here’s what I imply by that:

A 62% funded fee in a conservative state is far more precarious than a 62% funded fee in a liberal, progressive state like Massachusetts.

So how will the pension get totally funded? If I needed to guess, I’d say that in some unspecified time in the future sooner or later, there’ll be a grand political cut price within the state whereby the state bails out the instructor’s pension as a result of it could be politically disastrous to not (assuming the prevailing political winds haven’t drastically modified).

Nevertheless, that is an unscientific evaluation as a result of there’s no option to know what the long run holds. That being stated, you need to do one thing to assist your self plan for the long run. If I needed to make a prediction proper now, I’d say Aurelia’s pension is prone to be moderately near what’s presently promised

My Advice to Aurelia:

Since Aurelia’s monetary future relies upon closely on her pension, I recommend she learn and perceive the annual Audit report on her pension (simply as we did above).

→For those who don’t perceive your pension, speak along with your union rep because it’s their job to be sure you perceive it.

This goes for everybody studying this who has a pension. There’s somebody (both in your union or your HR division) whose literal JOB is to make sure you perceive your pension advantages. Don’t take “I dunno” as a solution.

Backside Line on the Pension:

If Aurelia thinks she’s going to stay a MA public faculty instructor, then I feel the one factor she will be able to do is assume her pension shall be there for her. That being stated, Aurelia may be very smart to spend money on different retirement automobiles too since, as she famous, she’s not eligible for Social Safety and the pension will solely be 80% of her wage (in the very best case situation).

Aurelia’s Different Retirement Investing Autos

Along with her pension, Aurelia has two different retirement automobiles obtainable to her:

- A 457 (by her employer)

- A Roth IRA

The explanation to take a position on your retirement—versus simply saving money for it—is threefold:

- There are tax benefits to using retirement accounts

- There are grave disadvantages to money (alternative price and it doesn’t sustain with inflation)

- There are benefits to investments (particularly, their anticipated fee of return)

Wait, What’s a Roth IRA Once more?

IRA stands for “Particular person Retirement Account” and there are two totally different major forms of IRAs: Roth and Conventional. The distinction between the 2 is in how they’re taxed.

- A Roth IRA is a retirement account that’s post-tax:

- Which means you pay taxes on the cash you place right into a Roth IRA, however you don’t pay taxes if you withdraw the cash in retirement.

- A Conventional IRA is a retirement account that’s pre-tax:

- Which means you don’t pay taxes on cash you place into an IRA, however you do pay taxes if you withdraw the cash in retirement.

In 2023, the full quantity an individual can put every year right into a traditional IRA and/or a Roth IRA can’t be greater than $6,500 (or $7,500 for those who’re age 50 or older).

- An individual can have each a Roth and a conventional IRA, however their mixed annual contribution to each can’t exceed this $6,500 ($7,500 for ages 50+) restrict.

A Roth sometimes makes essentially the most sense in case your earnings is on the low finish as a result of in that case, your tax fee is low and so it doesn’t matter that you simply’re paying taxes in your contributions. To handle her query, given Aurelia’s comparatively low earnings, Roth contributions most likely nonetheless makes essentially the most sense for her.

What’s a 457b?

- 457bs are deferred compensation plans obtainable to sure authorities (and specified non-government) staff

- You may put a most of $22,500 right into a 457b every year (as of 2023)

- The cash you place right into a 457b plan is tax-deferred

- Any earnings on the cash in your 457b are tax-deferred

One factor to notice a few 457b is that it’s “deferred compensation,” which makes you a creditor of whoever runs the plan. In Aurelia’s case, that’s the commonwealth of MA. In mild of that, there’s an argument right here for NOT utilizing the 457b since her pension can also be by the commonwealth of MA. What which means is that, if the state have been to default, Aurelia would lose each her pension and her 457b. As I famous above, nevertheless, I discover that most unlikely.

I’m not making an attempt to scare her, however I do need her to bear in mind that–not like with a 401k or an IRA (which is your cash free and clear)–a 457b is technically an IOU out of your employer stating, “I gives you this cash sooner or later.” In follow, deferred compensation is normally fairly safe, particularly when it’s publicly sponsored (as Aurelia’s is). However, it’s a nuance to pay attention to.

→All that being stated, if it have been me, I might most likely concentrate on rising my contributions to the 457b as a result of it’s extra versatile than an IRA.

In 457b plans, you’re allowed to withdraw cash penalty-free earlier than age 59.5, after you permit the employer who sponsors the plan. Therefore, if an individual deliberate to retire sooner than age 59.5, there’d be an actual benefit to having a 457b versus an IRA. Word that you simply do pay taxes in your withdrawals, however that is normally high quality as a result of–presumably–by the point you’re withdrawing the cash you’re retired and thus, your earnings is decrease as is your tax fee.

→Query for Aurelia: Does your employer match 457b contributions?

If that’s the case, you’ll completely, 100% need to contribute sufficient to qualify for the total employer match.

Roth IRA vs. 457b: Ultimate Smackdown

In an ideal world, Aurelia would have a excessive sufficient earnings to max out each her IRA and her 457b (which might be a complete of $29k per yr). In actuality, she doesn’t. So which one ought to she concentrate on? To assist us out I made a helpful, and in addition dandy, Smackdown Chart:

Roth IRAs:

| Execs | Cons |

| You’re in charge of the place that is invested (which brokerage) and what it’s invested in (which funds). This allows you to choose funds which are: diversified, have low charges, and appropriately matched to your threat tolerance. | Which means you need to handle it and choose your investments your self. |

| It’s 100% your cash. It’s not by an employer, so that you management it totally. | There’s no alternative for an employer match. |

| You don’t pay taxes if you withdraw the cash in retirement. | You pay taxes on the cash you place in. |

| The annual contribution restrict is low (solely $6,500 in 2023 for those who’re below age 50) | |

| You may’t withdraw cash with no penalty earlier than you’re age 59.5 |

457bs:

| Execs | Cons |

| The annual contribution restrict is excessive ($22,500 in 2023 for those who’re below age 50) | |

| You may withdraw cash penalty-free at any age after you permit the employer who sponsors the plan | |

| Taxes depend upon whether or not or not the plan is a Roth | |

| Your employer may match your contributions. In the event that they do, you need to contribute at the very least sufficient to qualify for the match. | It’s technically an IOU out of your employer and never “your” cash till you withdraw it |

| You don’t need to handle the investments your self. | You don’t management the place that is invested–your employer does. Therefore, you is perhaps caught in higher-fee, lower-performing funds and there’s nothing you are able to do about it |

For extra on the distinction between her two choices, I recommend Aurelia try this Investopedia article: Roth IRA or 457 Retirement Plan?

Aurelia’s Query #3: How do I prioritize a myriad of financial savings/debt-purging objectives? To recap, my objectives are:

- Paying off scholar loans

- Saving for retirement

- Paying for Invisalign braces out-of-pocket

- Saving for house owner initiatives/repairs

- Journey, a lot later

Federal Scholar Loans: don’t pay these off early. Proceed to make funds that depend in the direction of PSLF and stay up for having them forgiven in one other 5 years.

Non-public Scholar Loans: these are a bit trickier since they don’t qualify for any forgiveness applications. Nevertheless, it’s nonetheless going to take advantage of sense to pay these off in keeping with the required schedule–and never any sooner.

Retirement: as outlined above, Aurelia has a pension to stay up for. Nevertheless, since she gained’t obtain Social Safety, she ought to plan to complement her pension by way of her Roth IRA and her 457b. The sooner you begin investing for retirement, the extra you’ll have ultimately. As her wage will increase, she ought to enhance her contributions to those plans.

Paying for Invisalign braces out-of-pocket: Aurelia already has a system for this whereby she’s saving $87/month. I commend her for her extraordinarily organized and forward-thinking financial savings accounts and plans. Carry on protecting on!

Saving for house owner initiatives/repairs: right here once more, Aurelia may be very smart to have month-to-month financial savings put aside for residence repairs. She’s not presently in a monetary place to do elective residence initiatives (reminiscent of ending the loft she talked about), however she does have to have cash put aside in case of emergency repairs. A couple of ideas:

Journey, a lot later: as these different priorities turn into totally funded/paid off, Aurelia can divert financial savings right into a journey fund. Jet off an take pleasure in! Since Aurelia is so organized and accountable, I recommend she get severe about journey rewards bank cards since cautious administration of these can = free flights and resorts.

Growing Earnings

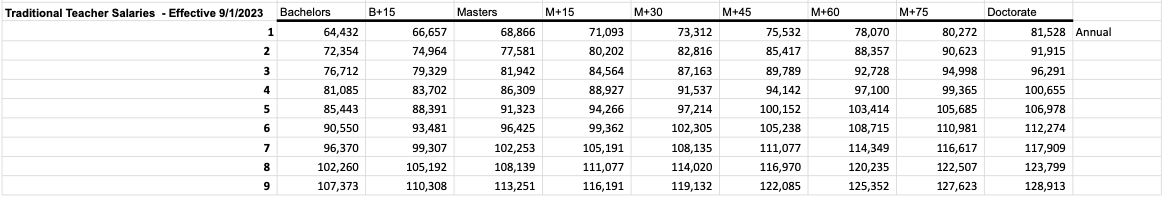

Aurelia didn’t ask about tips on how to enhance her earnings, however, she occurs to be in a career with a really easy and publicly obtainable schedule for wage will increase. As you’ll be able to most likely guess: YES, I READ IT! And you’ll too. Courtesy of the Boston Teacher’s Union, I discovered this nice PDF on instructor wage schedules and am thrilled to report that Aurelia has a lot of alternatives for will increase!

From the Boston Teacher’s Union: What this exhibits is that incomes credit score hours on high of a Masters diploma = a wage enhance. M+15 means a Masters plus 15 extra credit score hours + your variety of years of service (within the lefthand column) = your wage. So if a instructor had three years of service, a Masters diploma and 15 extra credit score hours, her wage can be $84,564.

What this exhibits is that incomes credit score hours on high of a Masters diploma = a wage enhance. M+15 means a Masters plus 15 extra credit score hours + your variety of years of service (within the lefthand column) = your wage. So if a instructor had three years of service, a Masters diploma and 15 extra credit score hours, her wage can be $84,564.

→What I don’t know from this doc is the way it differs by faculty and by place (if in any respect).

That is one thing for Aurelia to ask her union rep. I additionally don’t know if Aurelia is in a Boston public faculty or a surrounding city’s faculty, which might doubtless have a distinct wage schedule.

If I’m studying this appropriately, Aurelia doesn’t have to truly get one other Grasp’s (or a PhD), she simply has to take credit score hours. That is advantageous as a result of that needs to be so much cheaper and simpler than enrolling in one other Grasp’s program.

One other aspect for her to analysis: it typically doesn’t matter the place you get hold of these credit score hours. For instance, Aurelia may go to Harvard for her persevering with ed (and pay a ton of cash) OR discover a far cheaper on-line graduate faculty. Moreover, some districts pays for a sure variety of credit score hours yearly. Aurelia ought to guarantee she’s using all employer-provided alternatives since each credit score hour counts in the direction of a wage enhance!

In fact, Aurelia must do her personal analysis and make sure all of this together with her district. However, it seems to be prefer it needs to be an awesome path to rising her wage! And with an elevated wage comes… an elevated pension!

Bills

In fact the opposite facet of the equation are Aurelia’s bills. Nevertheless, even when she trimmed to the bone, her take-home pay would nonetheless be simply $45k. She will definitely scale back discretionary classes if she chooses to, however I recommend she put extra effort into the wage enhance undertaking since that’ll yield larger dividends.

Aurelia’s Query #5: Is it price pushing aside retirement contributions altogether to get out of debt quicker?

NOPE NOPE NOPE NOPE NOPE NOPE NOPE. The reason is: Aurelia must prioritize investing for retirement in order that she’s in a position to reap the benefits of many many years of compounding curiosity. If she have been to pay her scholar loans off tomorrow, she’d be locking in a return on the rate of interest of her non-public loans (4.98%), which is decrease than the historic common return from the inventory market (~7%). Don’t do that!

Abstract:

-

Overview all pension plan supplies and make sure you totally perceive your pension and any adjustments to it within the coming years.

- Decide in case your employer matches 457b contributions. In the event that they do, contribute at the very least sufficient to qualify for the match.

- Proceed to take a position for retirement and attempt to put extra into your 457b every year. For those who’re in a position to attain the max contribution restrict, put cash into your Roth IRA as properly. For those who’re in a position to max out each every year, take your self out to dinner to rejoice!

- Don’t repay your scholar loans forward of time. Proceed paying them off as required.

- Don’t sacrifice retirement contributions in an effort to repay the coed loans quicker.

- Examine the credit-hours-for-salary-increase prospects by your district. If the above schedule is appropriate, begin taking credit score hours as quickly as potential. Discover out in case your employer or union pays for any credit score hours.

- Proceed to save lots of for the Invisalign braces as you may have been.

- Asses your precise price exposures in your apartment. What are you liable for repairing vs. the HOA?

- Analyze the reserves of the HOA to find out whether or not or not a pricey evaluation is probably going.

- Proceed residing your great life and maintain us posted!

Okay Frugalwoods nation, what recommendation do you may have for Aurelia? We’ll each reply to feedback, so please be at liberty to ask questions!

Would you want your individual Case Research to look right here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Rent me for a private financial consultation here. Schedule an hourlong or 30-minute call with me here, refer a good friend to me here, or e-mail me with questions (liz@frugalwoods.com).

Questioning about hiring me for a session? Grab 15 minutes on my calendar for free to debate!

By no means Miss A Story

Signal as much as get new Frugalwoods tales in your e-mail inbox.