By SHUBHRA JAIN & JAY SANTORO

Data is energy. If this adage is true, then the foreign money of energy within the trendy world is knowledge. In case you have a look at the evolution of the buyer financial system over the previous 100 years, you will notice a narrative of knowledge infrastructure adoption, knowledge technology, after which subsequent knowledge monetization. This historical past is properly advised by Professors Minna Lami and Mika Pantzar of their paper on ‘The Knowledge Financial system’: “Present ‘knowledge citizenship’ is a product of the Web, social media, and digital units and the information created within the digitalized lifetime of customers has turn out to be the prime supply of financial worth formation. The database is the manufacturing facility of the longer term.” If we glance no additional than the so-called massive tech corporations and distill their enterprise fashions down in a (seemingly overly) reductionist vogue: Apple and Microsoft present infrastructure to get you on-line, and Fb (Meta) and Google accumulate your knowledge, whereas offering a service you want, and use that knowledge to promote you stuff. Doubtless none of that is shocking to this viewers, however what’s shocking is that this playbook has taken so lengthy to run its course in one of many world’s largest and most essential sectors: healthcare.

Given the potential affect knowledge entry and enablement might have on reworking such a large piece of the financial system, the magnitude of the chance right here is — at face worth — fascinating. That mentioned, healthcare is a special beast from many different verticals. Severe questions come up as as to if goal enterprise returns will be extracted on this burgeoning market with the scaled incumbents (each inside and outdoors healthcare) circling the perimeter. Moreover, this can be a fragmented ecosystem that has existed (in its infancy) for a number of years now with well-funded gamers now fixing for various use circumstances. Thus, one other query emerges as to which areas are greatest suited to upstarts to capitalize. A key theme in our evaluation of the area is that regulation is driving the transfer in direction of democratized knowledge entry in healthcare, however not like in regulatory shake-ups of the previous, this time start-ups will profit greater than scaled incumbents. Moreover, we now have recognized some areas inside every method to this new ecosystem that significantly excite us for web new funding. Let’s dive in.

Why This Time is Totally different: Regulatory + Market Dynamics

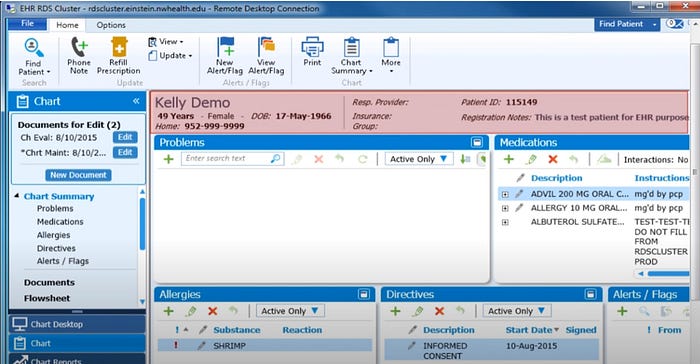

The Well being Info Know-how for Financial and Medical Well being (HITECH) Act of 2009 caused an explosion of digital healthcare knowledge by increasing adoption of digital medical information from ~12% to 96%.

Whereas the first person of the EMR is the working towards doctor of their journey of care supply, right now, there may be more and more demand from different stakeholders within the care ecosystem for the insights that these information maintain and therefore, the necessity for a market for this knowledge. Payers need entry to the information to assist with member inhabitants well being analytics and threat adjustment. Life sciences corporations need entry to the information to energy real-world knowledge / real-world proof initiatives for drug discovery and improvement and affected person engagement. Digital well being start-ups need entry to the information largely that can assist you handle your particular situations.

Hiding behind The Well being Insurance coverage Portability and Accountability Act of 1996 (HIPAA), EMR distributors and supplier organizations have restricted entry to this knowledge to retain and entrap the affected person base and keep possession of a beneficial knowledge asset. As of November 2021, at the very least 70% of healthcare suppliers nonetheless change medical data by fax as a result of traditionally there was no choice to ship EMRs utilizing trendy web providers.

Even when knowledge sharing is enabled, actual challenges persist to accessing longitudinal knowledge for each a affected person’s and a inhabitants’s well being historical past. Whereas de-identified knowledge will be obtained by way of enterprise service agreements with knowledge homeowners and particular person affected person knowledge will be accessed through consent / permissioned logins to on-line supplier portals, there are few, if any, methods to acquire this knowledge on an aggregated foundation throughout a number of sufferers and supplier organizations. Moreover, challenges to knowledge connectivity, standardization and format integrity exist inside healthcare organizations, which largely home knowledge in disparate inside siloes. Because of this, essential healthcare knowledge that may very well be used to enhance care has been locked in these disconnected, suboptimal report techniques.

21st Century Cures Act of 2016 (and associated rules) enabled data sharing, making “sharing digital well being data the anticipated norm,” thus limiting EMR distributors’ (and different stakeholders’) capacity to dam the circulate of data. A series of related regulations proceed to be rolled out to encourage this related end-state.

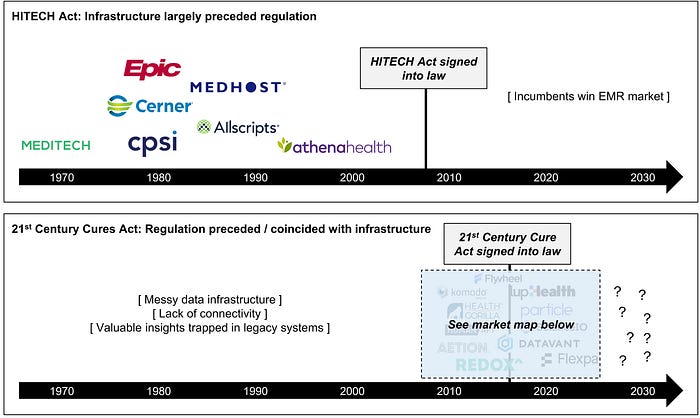

The distinction this time: on the passing of the HITECH Act, Meditech, Epic, and Cerner had been round for at the very least 30 years. Therefore, these incumbents have been well-positioned to satisfy the compliance necessities for the HITECH act and emerged as main winners. As to the proof-points: Meditech approaches half a billion in gross sales, Epic generated $3.8B in income in 2021, and Cerner was acquired for $28B in 2022.

Conversely, in 2016, there have been nearly no scaled rails to allow knowledge change, integration and sharing in a chic person interface, particularly for stakeholders outdoors of the supplier organizations. Within the occasion of the twenty first Century Cures Act, the principles really largely pre-dated the required infrastructure.

The query we’re exploring is: Will the worth created by these guidelines accrue to scaled incumbents because it did within the wake of the HITECH Act?

Ben Thompson argues in this piece that for client/ massive tech, that is true. He makes an excellent case right here that right now’s cloud and cell corporations — Amazon, Microsoft, Apple, and Google — very like the automotive giants — GM, Ford, and Chrysler — will dominate the market.

There may be purpose to consider that is doable. After years of seemingly combating interoperability, the incumbent EMRs are starting to play ball. As proof-points, Cerner, Allscripts, and athenahealth are founding members of the CommonWell Well being Alliance, and Epic is planning to join TEFCA and launched a connection hub to permit any vendor with a connection to Epic to listing their app and self-report if they’ve achieved profitable knowledge change. Incumbents from outdoors the healthcare ecosystem (largely from our parallel client knowledge story) are swooping in as properly. AWS, Google, and Microsoft have all launched healthcare cloud providers platforms to assist with knowledge normalization and sharing. Apple is offering its HealthKit APIs to assist builders entry healthcare knowledge for the aim of making apps for its iOS and watchOS. Oracle’s acquisition of Cerner can also be related right here by shifting healthcare knowledge to the cloud for straightforward entry and sharing.

That mentioned, there may be purpose to consider these scaled gamers will wrestle. Google, Amazon, and Microsoft have all encountered issues of their pursuit of healthcare earnings. Whereas Epic and Cerner have partnered up with massive tech (Google and Oracle, respectively) within the wake of the brand new rules, early indications present challenges in these relationships.[1] Moreover, the motivation construction for incumbent EHR distributors offering entry to the underlying knowledge held by their supplier clients is questionable at greatest. Additionally it is price noting that, whereas the length of the present macro headwinds for the enterprise expertise sector is unclear, it isn’t a stretch to think about these corporations will prioritize their core companies within the close to time period. This dynamic, in our view, presents alternative for upstarts to construct each the infrastructure and apps wanted for a brand new period of related digital well being.

The place to Focus / Zooming in: Choose Areas of Curiosity in Healthcare Knowledge

The under captures our tackle the present state of play with respect to the totally different fashions tackling this downside of healthcare knowledge entry.[2] [3]

The above healthcare knowledge class that has (arguably) seen the most effective outcomes to-date is the web new knowledge turbines. These companies typically present a helpful services or products in change for rights to and the flexibility to monetize the underlying knowledge collected. This isn’t not like the advert income enterprise mannequin within the client knowledge financial system the place customers are incentivized to contribute their knowledge in change for a product/service (typically free). For instance: Tempus has reportedly raised $1B+ in funding and lately inked pharma offers representing a reported roughly $700M in income over the subsequent few years for its mixed sequencing + knowledge platform. Evidation has reportedly raised $250M+ in funding round its two-sided consumer-pharma analysis platform. Maybe the posterchild of this mannequin, and the whole healthcare knowledge motion, up to now is the oncology-focused Flatiron Health. Flatiron’s OncoEMR is turning into the market chief for oncology practices, plus its others software program functions (for instance: Flatiron Help and OncoTrials) are serving to make most cancers therapy suppliers way more environment friendly. As well as, Flatiron delivers knowledge generated on the level of care to assist the life sciences neighborhood develop new most cancers medicine. This can be a uncommon win-win-win: suppliers now not must cope with irritating expertise that’s largely from the ’80s, life sciences get entry to web new knowledge to enhance their drug improvement, and higher outcomes are pushed for the sufferers. This alignment of incentives and creation of a trove of wealthy, beneficial new dataset catalyzed their buy by Roche for $1.9B.

Whereas the first knowledge assortment technique is important to enriching the dataset accessible to the ecosystem, we’re at some extent the place we have already got huge troves of knowledge which stay trapped in silos throughout complicated organizations. For instance, it’s a tedious, largely guide activity to extract and combine our personal healthcare knowledge from numerous hospitals and clinics, oftentimes in a number of states, not to mention a number of nations. No scaled participant exists right now to do that effectively and digitally for a whole bunch of hundreds of sufferers, as wanted for threat underwriting by payors or real-world initiatives by life sciences corporations. The coveted idea of the ‘longitudinal well being report’ on both a inhabitants (de-identified) or a person (permissioned) stage remains to be largely ‘on the come.’ The ‘holy grail’ imaginative and prescient is to create an web of healthcare knowledge that numerous stakeholders within the healthcare ecosystem can conveniently entry for his or her respective use circumstances.

This may seemingly be carried out piecemeal throughout numerous areas, as is the case with the buyer knowledge financial system (e.g., there are totally different corporations that get us on-line, arrange our knowledge, and use it to promote related providers and merchandise to us).

There may be an alternate the place we obtain a ‘golden imply’ — few new corporations search to easily turn out to be techniques of report — to retailer knowledge; relatively, they prolong the capabilities of present shops of knowledge — on prem or cloud — and search to leverage and make the most of these knowledge sources in ways in which have been beforehand not possible once they couldn’t discuss to one another in a fluid, seamless, frequent language. One of many some ways to realize and incentivize this shared knowledge ecosystem may very well be the “give-to-get” mannequin that David Sacks outlines here. As soon as knowledge sharing turns into the brand new regular, it is going to be extra attention-grabbing to construct companies that may capitalize on this and construct excessive worth functions to understand an equitable, accessible, and related healthcare ecosystem. Simply as when automobiles grew to become a family necessity, constructing the roads, growing suburbs and promoting oil grew to become extra attention-grabbing.

Footnotes:

[1] Epic did lastly ink a commercial deal with Google, however not with out Epic placing its clients in the midst of integration disputes and Google virtually dismantling its Well being unit and laying off a whole bunch of workers in its Verily Life Sciences unit.

[2] Veradigm additionally has entry to major knowledge they generate through their household of EHR techniques (e.g. PracticeFusion).

[3] Many of those companies additionally provide different services and products not captured on this map. For instance, Change Healthcare, which sold to Optum in 2022 for $7.8B, primarily gives RCM/funds and imaging options.

Shubrha Jain MD, MBA is Head of Healthcare Investments and Jay Santoro is an Affiliate at Tarsadia Investments, a $2bn fund. This text first appeared on their Medium channel