Anna is a 35-year-old particular eduction instructor of center college college students with extreme and profound disabilities. She lives in rural Illinois and is at the moment engaged on finishing her grasp’s diploma in training. Sooner or later, she’d like to maneuver into a unique instructing place that’s hopefully extra profitable since she doesn’t make sufficient at her present job. To make ends meet every month, she works a part-time retail job and receives monetary help from her dad and mom. Anna envisions a debt-free future and would really like our assist charting a path to get there.

Anna is a 35-year-old particular eduction instructor of center college college students with extreme and profound disabilities. She lives in rural Illinois and is at the moment engaged on finishing her grasp’s diploma in training. Sooner or later, she’d like to maneuver into a unique instructing place that’s hopefully extra profitable since she doesn’t make sufficient at her present job. To make ends meet every month, she works a part-time retail job and receives monetary help from her dad and mom. Anna envisions a debt-free future and would really like our assist charting a path to get there.

What’s a Reader Case Examine?

Case Research tackle monetary and life dilemmas that readers of Frugalwoods ship in requesting recommendation. Then, we (that’d be me and YOU, expensive reader) learn by way of their scenario and supply recommendation, encouragement, perception and suggestions within the feedback part.

For an instance, take a look at the last case study. Case Research are up to date by members (on the finish of the put up) a number of months after the Case is featured. Go to this page for hyperlinks to all up to date Case Research.

Can I Be A Reader Case Examine?

There are 4 choices for people all for receiving a holistic Frugalwoods monetary session:

- Apply to be an on-the-blog Case Study subject here.

- Rent me for a private financial consultation here.

- Schedule an hourlong call with me here.

→Undecided which option is best for you? Schedule a free 15-minute chat with me to be taught extra. Refer a buddy to me here.

Please notice that house is restricted for the entire above and most particularly for on-the-blog Case Research. I do my finest to accommodate everybody who applies, however there are a restricted variety of slots obtainable every month.

The Aim Of Reader Case Research

Reader Case Research spotlight a various vary of economic conditions, ages, ethnicities, areas, targets, careers, incomes, household compositions and extra!

Reader Case Research spotlight a various vary of economic conditions, ages, ethnicities, areas, targets, careers, incomes, household compositions and extra!

The Case Examine collection started in 2016 and, thus far, there’ve been 100 Case Studies. I’ve featured people with annual incomes starting from $17k to $200k+ and web worths starting from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured homosexual, straight, queer, bisexual and polyamorous individuals. I’ve featured ladies, non-binary people and males. I’ve featured transgender and cisgender individuals. I’ve had cat individuals and canine individuals. I’ve featured people from the US, Australia, Canada, England, South Africa, Spain, Finland, the Netherlands, Germany and France. I’ve featured individuals with PhDs and folks with highschool diplomas. I’ve featured individuals of their early 20’s and folks of their late 60’s. I’ve featured people who reside on farms and folk who reside in New York Metropolis.

Reader Case Examine Pointers

I most likely don’t have to say the next since you all are the kindest, most well mannered commenters on the web, however please notice that Frugalwoods is a judgement-free zone the place we endeavor to assist each other, not condemn.

There’s no room for rudeness right here. The objective is to create a supportive surroundings the place all of us acknowledge we’re human, we’re flawed, however we select to be right here collectively, workshopping our cash and our lives with constructive, proactive options and concepts.

And a disclaimer that I’m not a skilled monetary skilled and I encourage individuals to not make severe monetary choices primarily based solely on what one individual on the web advises.

I encourage everybody to do their very own analysis to find out the perfect plan of action for his or her funds. I’m not a monetary advisor and I’m not your monetary advisor.

With that I’ll let Anna, as we speak’s Case Examine topic, take it from right here!

Anna’s Story

Hello Frugalwoods neighborhood! My identify is Anna, I’m 35 and I reside in rural Illinois. I’m a particular training instructor for center college college students with extreme/profound disabilities. I’m fortunately single (for now) and I’ve a robust relationship with my instant household. My hobbies–or moderately, vocations–embrace theatre, singing, dancing, working, hanging out with household and mates and crafts. I additionally work a part-time job in retail to assist make ends meet.

Hello Frugalwoods neighborhood! My identify is Anna, I’m 35 and I reside in rural Illinois. I’m a particular training instructor for center college college students with extreme/profound disabilities. I’m fortunately single (for now) and I’ve a robust relationship with my instant household. My hobbies–or moderately, vocations–embrace theatre, singing, dancing, working, hanging out with household and mates and crafts. I additionally work a part-time job in retail to assist make ends meet.

What feels most urgent proper now? What brings you to submit a Case Examine?

I’m finishing my grasp’s diploma in training, which is tied into my instructing licensure program. I at the moment have debt that I wish to have repaid in about ten years. Ideally, I’d prefer to repay my bank card debt even sooner. I wish to have an emergency fund, however by no means appear to have the ability to discover the cash to place into it. Proper now, I really feel underpaid for the work that I do. I really feel that with no youngsters or pets of my very own, and with me searching for a higher-paying instructing job for subsequent yr, now’s the time to take cost of my funds. I’ve felt overwhelmed by the easiest way to strategy them. I’d prefer to discover a more cost effective strategy to handle all the pieces.

What’s the perfect a part of your present life-style/routine?

I like the flexibleness of being single! I like that I’m able to go on brief day journeys on the weekends and never have to fret about baby-sitting or pet-sitting. I like not having to fret about home repairs (that’s the fantastic thing about renting–my landlord takes care of all that!). As a instructor, I get pleasure from my summers off as they allow me to pursue different issues. Sooner or later, I wish to journey for prolonged intervals of time, almost certainly in the course of the summer season months.

What’s the worst a part of your present life-style/routine?

My present office. Over the previous yr, issues have change into poisonous with modifications within the college administration and an elevated workload with out compensation. That is taking a toll on my psychological well being. I’m so exhausted on the finish of the day (between working full-time and going to high school part-time) that I should not have vitality for a lot else, together with a social life. I’m hoping {that a} completely different work surroundings and a unique scholar inhabitants (akin to in useful resource particular training) can be a greater match for me. After I’m completed with graduate college in August, I’m hoping I’ll have extra of a social life plus more cash to repay my debt.

The place Anna Needs to be in Ten Years:

- Funds: debt free.

- Life-style: related flexibility to that of being single; nonetheless, a particular somebody can be good.

- Profession: well-established within the training area.

Anna’s Funds

Earnings

| Merchandise | Web Quantity Per Month | Notes |

| Particular Training Instructing | $2,200 | Deductions:

American Constancy Life Insurance coverage $30, Instructor’s Retirement System $158, Medicare $25, Union Dues $35, Equitable Annuities Retirement $50, Whole: $298 |

| Parental assist | $700 | My dad and mom have been very, very beneficiant in serving to me out. |

| Half-time job (in retail) | $500 | This varies by month |

| Month-to-month subtotal: | $3,400 | |

| Annual whole: | $40,800 |

Money owed

| Item | Excellent mortgage steadiness | Curiosity Charge | Mortgage Interval/Payoff Phrases | Month-to-month required fee |

| Scholar Loans | $79,000 | 4% curiosity | 10 yr instructor mortgage forgiveness | Undecided-I’m on the revenue pushed reimbursement plan; mortgage funds are on maintain till August. |

| Capitol One | $9,500 | 19.49% | $291; I pay $425 | |

| Chase Visa | $3,500 | 19.49% | $88; I pay $150 | |

| PayPal credit score | $3,225 | 26% | $60; I pay $150 | |

| Loft retailer card | $2,200 | 29.24% | $72; I pay $150 | |

| Goal Card | $1,850 | 27.15% | $60; I pay $150 | |

| Retailer Card #2 | $1,835 | 30% | $50; I pay $150 | |

| Retailer Card #1 | $1,120 | 30% | $50; I pay $150 | |

| Whole: | $102,230 | $671; I pay $1,325 |

Property

| Merchandise | Quantity | Notes | Curiosity/sort of securities held | Identify of financial institution/brokerage | Expense Ratio | Account Kind |

| IRA | $6,032 | IRA account | Wells Fargo | Not Certain | Retirement Investments | |

| Office Retirement Account | $2,150 | Employer-sponsored retirement account | American Constancy | Not Certain | Retirement | |

| Checking Account-Native Financial institution #1 | $300 | Native Financial institution | Not Certain | Money | ||

| Financial savings Account-Native Financial institution #1 | $105 | Native Financial institution | Not Certain | Money | ||

| Checking Account-Native Financial institution #2 | $100 | Native Financial institution | Not Certain | Money | ||

| Financial savings Account-Native Financial institution #2 | $50 | Native Financial institution | Not Certain | Money | ||

| Whole: | $8,737 |

Automobiles

| Automobile make, mannequin, yr | Valued at | Mileage | Paid off? |

| Nissan Altima 2013 | $9,000 | 130,000 | Sure |

Bills

| Merchandise | Quantity | Notes |

| Credit score Card Funds | $1,325 | |

| Groceries/Family Provides/Classroom Provides/Prescriptions | $700 | Varies; looks as if my classroom is a unending expenditure |

| Lease | $525 | |

| Clothes/footwear/equipment | $200 | Some months are greater than others. That is my common. |

| Electrical energy/fuel | $150 | Differs every month; that is the common |

| Fuel for automotive | $150 | |

| Singing classes | $100 | |

| Web | $63 | Month-to-month Quantity |

| Dance lessons | $60 | |

| Eating places | $50 | Consists of espresso retailers |

| Subscriptions (Hulu, Disney +, Discovery +, HBO Max) | $50 | |

| Haircuts/colour | $40 | Common every month; I not too long ago realized the way to lower and colour my hair. I am going to the salon each different month. |

| Medical co-pays and prescription remedy | $40 | Yearly Common |

| Fitness center membership | $31 | |

| Renter’s Insurance coverage-State Farm | $9 | Rental Insurance coverage |

| Cell Cellphone-Verizon | $0 | I’m below my dad and mom’ plan; they pay it for now. |

| Automotive Insurance coverage-State Farm | $0 | I’m below my dad and mom’ plan; they pay it for now. |

| Month-to-month subtotal: | $3,493 | |

| Annual whole: | $41,916 |

Anna’s Questions for you:

- What are essentially the most cost-effective methods for me to handle my funds?

- What non-teaching areas in training can former academics enter into?

Liz Frugalwoods’ Suggestions

I commend Anna for taking the exhausting, however vital, step of dealing with her monetary actuality. She provided such a clear-eyed view in her remark, “I really feel that with no youngsters or pets of my very own, and with me searching for a higher-paying instructing job for subsequent yr, now’s the time to take cost of my funds.” I agree. And I’d add that anytime is the precise time to take cost of your funds. Option to go, Anna!

I commend Anna for taking the exhausting, however vital, step of dealing with her monetary actuality. She provided such a clear-eyed view in her remark, “I really feel that with no youngsters or pets of my very own, and with me searching for a higher-paying instructing job for subsequent yr, now’s the time to take cost of my funds.” I agree. And I’d add that anytime is the precise time to take cost of your funds. Option to go, Anna!

Earnings Vs. Bills

As I’m fond of claiming, there are solely two main variables in our monetary lives: what is available in and what goes out. These are the 2 variables we are able to most simply modify and in Anna’s case, I counsel she concentrate on each variables.

Earnings

Anna famous she’ll be finishing her grasp’s diploma after which will search for a better-paying job. That feels like a superb plan. She’s appropriate that she’s simply not being paid sufficient–and particularly not sufficient for the vital, difficult work she does. I’ve stated it earlier than and I’ll say it once more: WE SHOULD PAY TEACHERS MORE. Lecturers do one of many hardest jobs below among the hardest circumstances and they don’t seem to be paid sufficient. Full cease. Since Anna’s already in course of on discovering the next revenue, let’s flip our consideration to variable #2.

Bills

Anna’s finances is fairly meagre because it stands, however her revenue is equally meagre, which implies–if she desires to make progress on her said targets of build up an emergency fund and paying down her money owed–she has to scale back her spending. We are able to’t magic cash from wherever else, it’s acquired to return from spending much less every month.

Anna’s finances is fairly meagre because it stands, however her revenue is equally meagre, which implies–if she desires to make progress on her said targets of build up an emergency fund and paying down her money owed–she has to scale back her spending. We are able to’t magic cash from wherever else, it’s acquired to return from spending much less every month.

Fortunate for Anna, she has very low mounted bills!

Anytime an individual desires to spend much less, I encourage them to outline all of their bills as Fastened, Reduceable or Discretionary:

- Fastened bills are belongings you can’t change. Examples: your mortgage and debt funds.

- Reduceable bills are mandatory for human survival, however you management how a lot you spend on them. Examples: groceries, fuel for the automotive, utilities.

- Discretionary bills are issues that may be eradicated completely. Examples: journey, haircuts, consuming out.

Let’s check out how Anna’s bills break down between these three classes in addition to my proposed new spending quantities:

| Merchandise | Quantity | Notes | Class | Proposed New Quantity | Liz’s Notes |

| Credit score Card Funds | $1,325 | Fastened | $1,325 | We’ll focus on this in a second. | |

| Groceries/Family Provides/Classroom Provides/Prescriptions | $700 | Varies; looks as if my classroom is a unending expenditure | Reduceable | $450 | I counsel Anna get away these classes so she will get a greater sense of what she’s truly spending in every. It is a fairly massive catch-all at this level. |

| Lease | $525 | Fastened | $525 | That is so good and low!! Wohoo! | |

| Clothes/footwear/equipment | $200 | Some months are greater than others. That is my common. | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. |

| Electrical energy/fuel | $150 | Differs every month; that is the common | Reduceable | $65 | This discount gained’t be straightforward, however I encourage Anna to analyze vitality saving round her dwelling. One technique is to make use of a killowatt monitor to see which home equipment are utilizing essentially the most electrical energy. Many public libraries have them obtainable to borrow. |

| Fuel for automotive | $150 | Reduceable | $65 | ||

| Singing classes | $100 | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. | |

| Web | $63 | Month-to-month Quantity | Fastened | $63 | |

| Dance lessons | $60 | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. | |

| Eating places | $50 | Consists of espresso retailers | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. |

| Subscriptions (Hulu, Disney +, Discovery +, HBO Max) | $50 | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. | |

| Haircuts/colour | $40 | Common every month; I not too long ago realized the way to lower and colour my hair. I am going to the salon each different month. | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. |

| Co-Pays and prescription drugs | $40 | Yearly Common | Fastened | $40 | |

| Fitness center membership | $31 | Discretionary | $0 | This must be eradicated whereas Anna’s working in direction of her targets of being debt-free and having an emergency fund. | |

| Renter’s Insurance coverage-State Farm | $9 | Rental Insurance coverage | Fastened | $9 | |

| Cell Cellphone-Verizon | $0 | I’m below my dad and mom’ plan; they pay it for now. | Fastened | $0 | If Anna goes off her dad and mom’ plan sooner or later, she ought to get onto an MVNO, which’ll value her ~$15 a month. |

| Automotive Insurance coverage-State Farm | $0 | I’m below my dad and mom’ plan; they pay it for now. | Fastened | $0 | |

| Present Month-to-month subtotal: | $3,493 | Proposed Month-to-month subtotal: | $2,542 | ||

| Present Annual whole: | $41,916 | Proposed Annual whole: | $30,504 |

What I’ve proposed here’s a very austere, naked bones finances and I’m not saying it’s going to be enjoyable. Nevertheless, at Anna’s present revenue stage, and with the quantity of debt she has, that is her solely possibility. One outlet Anna may contemplate is the age-old tactic of barter and commerce. For instance: might she supply to workers the desk on the dance studio in trade without spending a dime lessons? Might she clear her voice instructor’s home in trade without spending a dime classes? Might she tutor her hair stylist’s child in trade without spending a dime haircuts? The chances are infinite! Try this put up for a complete host of concepts: How Barter and Trade Enhances Frugality and Community

This Can Be Momentary

Whereas spending this little is Anna’s solely possibility, I need her to do not forget that it’s her solely possibility for proper now. The above doesn’t should be her perpetually finances. It simply must be her proper now finances.

Whereas spending this little is Anna’s solely possibility, I need her to do not forget that it’s her solely possibility for proper now. The above doesn’t should be her perpetually finances. It simply must be her proper now finances.

Anna can contemplate including luxuries again in as soon as she:

- Pays off all of her high-interest bank card debt

- Saves up an emergency fund

- Can simply afford her month-to-month scholar mortgage repayments

- Will increase her retirement contributions

- Finds a higher-paying job

- Is ready to cease receiving monetary assist from her dad and mom within the type of money, automotive insurance coverage and cell hone protection (except it is a longterm association along with her dad and mom)

Debt Payoff Plan

Let’s flip our consideration to what Anna ought to do with the additional cash she’s going to avoid wasting each month. The worst factor about money owed are their rates of interest. Each month that you simply don’t repay high-interest debt, you slip additional and additional into debt. Anna must cease this downward spiral as quickly as potential as a result of it has the facility to balloon into one thing worse. The rates of interest on her bank cards are eye-wateringly excessive and I strongly encourage her to focus all of her monetary vitality on paying them off.

Since rates of interest are the true killer with debt, I’ve sorted Anna’s money owed in accordance with their rate of interest:

| Item | Excellent mortgage steadiness | Curiosity Charge (highest first) | Mortgage Interval/Payoff Phrases | Month-to-month required fee |

| Retailer Card #1 | $1,120 | 30% | $50; I pay $150 | |

| Retailer Card #2 | $1,835 | 30% | $50; I pay $150 | |

| Loft retailer card | $2,200 | 29.24% | $72; I pay $150 | |

| Goal Card | $1,850 | 27.15% | $60; I pay $150 | |

| PayPal credit score | $3,225 | 26% | $60; I pay $150 | |

| Chase Visa | $3,500 | 19.49% | $88; I pay $150 | |

| Capitol One | $9,500 | 19.49% | $291; I pay $425 | |

| Scholar Loans | $79,000 | 4% | 10 yr instructor mortgage forgiveness | Undecided-I’m on the revenue pushed reimbursement plan; mortgage funds are on maintain till August. |

| Whole: | $102,230 | $671; I pay $1,325 |

I counsel that Anna begin on the prime of the checklist–with the 30% rate of interest money owed–and work her method down, paying them off in interest-rate order.

If she’s capable of comply with the above naked bones finances I outlined, she’ll have an extra $858 to place in direction of debt reimbursement with every month. That’s $3,400 of revenue – $2,542 in bills.

Cease Overpaying On All Seven Money owed

I additionally counsel Anna cease overpaying on all of her money owed and as a substitute focus her efforts on one debt at a time. This may sound counterintuitive, however the issue is that Anna’s spreading her payoff capabilities over seven completely different money owed and consequently, not making a lot progress on any of them due to their astronomical rates of interest. She nonetheless must pay the minimal required every month on each debt aside from the one on the chopping block.

I additionally counsel Anna cease overpaying on all of her money owed and as a substitute focus her efforts on one debt at a time. This may sound counterintuitive, however the issue is that Anna’s spreading her payoff capabilities over seven completely different money owed and consequently, not making a lot progress on any of them due to their astronomical rates of interest. She nonetheless must pay the minimal required every month on each debt aside from the one on the chopping block.

If she makes the minimal month-to-month required fee on money owed #2-7, she’ll pay $621 per 30 days as a substitute of the $1,325 she paying proper now throughout all seven money owed.

Right here’s What I need Anna to do Beginning Subsequent Month

Month 1 of Anna’s Debt Payoff Journey:

- Pay the minimal required $621 throughout money owed #2-7

- Put all different cash into paying off debt #1:

- The $858 from decreasing her bills

- The $704 that was going into money owed #2-7

- That offers her $1,562 to place in direction of debt #1, which is able to MORE than pay it off in ONE SINGLE MONTH!

Now we transfer onto debt #2 (which, reminder, is the debt with the following highest rate of interest):

Month 2 of Anna’s Debt Payoff:

- Pay the minimal required $571 throughout the money owed #3-7

- Put all different cash into paying off debt #2:

- The $858 from decreasing her bills

- The $754 that was going into money owed #1 and #3-7

- The $150 that went towards paying off debt #1

- That offers her $1,762 to place in direction of debt #2, which (coupled with the leftover financial savings from month #1) ought to repay debt #2 in ONE SINGLE MONTH!

Now we’re at month 3 and Anna has already paid off two of her money owed!

In month 3–and going ahead–I need Anna to proceed on with what I’ve outlined above. As she pays off every debt, she ought to roll that quantity into paying off the following debt. That is how she’ll have a good looking cascade right down to debt-free residing. By focusing her cash on one debt at a time, she’s going to be capable to pay all of them off in flip. If her revenue will increase, she ought to improve her debt re-payments till they’re all gone.

In month 3–and going ahead–I need Anna to proceed on with what I’ve outlined above. As she pays off every debt, she ought to roll that quantity into paying off the following debt. That is how she’ll have a good looking cascade right down to debt-free residing. By focusing her cash on one debt at a time, she’s going to be capable to pay all of them off in flip. If her revenue will increase, she ought to improve her debt re-payments till they’re all gone.

Cancel The Credit score Playing cards

One other key aspect of this debt payoff technique is that Anna should keep away from taking up extra debt. To facilitate that, I counsel Anna cancel every bank card after she pays it off. She must get out of the cycle of residing above her means and funding her life-style with bank card debt. Cancelling the playing cards–and never opening extra–will allow her to limit her spending to the cash she truly has. I like to recommend she transfer to paying for all the pieces with money, verify or debt card.

Scholar Loans

I’m much less involved about Anna’s scholar loans as a result of the rate of interest is so low. My query right here is whether or not or not Anna has explored the Public Service Loan Forgiveness (PSLF) program? This program forgives federal scholar loans after a specified variety of funds in case your employer qualifies for this system (which most public college academics do).

If she doesn’t qualify for PSLF, Anna ought to plan to pay her scholar loans off in accordance with schedule. If she comes into an enormous chunk of cash, she will throw it on the loans. But when her revenue stays comparatively constant, she will plan to only pay these off on schedule. The caveat is the rate of interest. If her loans have a hard and fast rate of interest, that’s nice because it means the speed won’t ever change. If, nonetheless, her loans have a variable rate of interest, it’s potential the speed will improve dramatically sooner or later. If that had been to occur, Anna would wish to put more cash into paying them off as rapidly as potential since, once more, excessive rates of interest are the true killer.

Emergency Fund

We’ve targeted completely on the debt-payoff aspect of issues, however constructing an emergency fund is equally vital as a result of it serves as your buffer from going into debt. Anna has $550 saved in money proper now, which is a superb begin. Something saved is best than nothing saved!

We’ve targeted completely on the debt-payoff aspect of issues, however constructing an emergency fund is equally vital as a result of it serves as your buffer from going into debt. Anna has $550 saved in money proper now, which is a superb begin. Something saved is best than nothing saved!

→An emergency fund ought to cowl 3 to six months’ value of your spending.

At Anna’s present month-to-month spend price of $3,493, she ought to goal an emergency fund of $10,479 to $20,958. Nevertheless, since an emergency fund is calibrated on what you spend each month, the much less you spend, the much less it’s essential to save up. If Anna strikes to the proposed barebones finances of $2,542 per 30 days in an effort to repay her debt ASAP, she will goal an emergency fund extra within the vary of $7,626 to $15,252.

Your emergency fund is there for you if:

- You unexpectedly lose your job

- One thing horrible goes incorrect with your own home that must be mounted ASAP

- Your automotive breaks down and have to be repaired

- You’re hit with an surprising medical invoice

- Your canine will get quilled by a porcupine and has to go to the emergency vet

An emergency fund will not be for EXPECTED bills, akin to:

- Routine upkeep on a automotive, akin to oil modifications and brake pads

- Anticipated dwelling repairs, akin to boiler servicing/chimney sweeping

- Deliberate medical bills

An emergency fund’s cause for existence is to stop you from sliding into debt ought to the unexpected occur. It’s your personal private security web. It’s additionally why it’s so essential to trace your spending each month. Should you don’t know what you spend, you gained’t understand how a lot it’s essential to save. I take advantage of and suggest the free expense monitoring service from Empower (affiliate hyperlink).

How To Construct An Emergency Fund

As Anna pays off every debt, I encourage her so as to add a bit of cash into her emergency fund. Whereas Anna wants an emergency fund (everybody wants an emergency fund!), she falls right into a “much less dangerous” class by way of emergency fund precedence. Right here’s why:

As Anna pays off every debt, I encourage her so as to add a bit of cash into her emergency fund. Whereas Anna wants an emergency fund (everybody wants an emergency fund!), she falls right into a “much less dangerous” class by way of emergency fund precedence. Right here’s why:

- She’s a renter, so she’s not on the hook for home repairs and upkeep

- She’s single and has no children, so there’s nobody counting on her financially

- She doesn’t have any pets, so there’s no chance of surprising vet bills

- She has a steady job with constant revenue

- Her dad and mom are evidently close by and capable of assist her out financially

Given all of those elements, I’m much less involved along with her lack of emergency fund than along with her debt’s rates of interest. She nonetheless wants to avoid wasting up more cash, but when it had been me, I’d prioritize wiping out these high-interest money owed.

Asset Overview

Let’s check out what Anna has saved and invested.

1) Money: $550

As famous above, Anna is off to good begin along with her emergency fund. Along with saving more cash, I like to recommend she consolidate her 4 completely different accounts into two:

- a high-yield financial savings account (hold nearly all of the cash in right here)

- a neighborhood checking account

Anna must benefit from each potential profit and a high-yield financial savings account will give her much-needed curiosity. For instance, as of this writing, the American Express Personal Savings account earns a whopping 4.00% in curiosity.

2) Retirement: $8,182

Anna’s additionally off to a superb begin along with her retirement investments. She must beef these up, however the first precedence ought to be paying off the debt and constructing the emergency fund. After these two targets are knocked out, she ought to flip her consideration to growing her contributions to her retirement accounts. Assuming her office retirement account is a 403b, the IRS-permitted maximum contribution in 2023 is $22,500 per yr. The IRS-permitted max contribution to her IRA (particular person retirement account) in 2023 is $6,500 per yr. On the very least, Anna ought to guarantee she’s contributing sufficient to her employer-sponsored account to qualify for any match her employer provides.

Anna’s additionally off to a superb begin along with her retirement investments. She must beef these up, however the first precedence ought to be paying off the debt and constructing the emergency fund. After these two targets are knocked out, she ought to flip her consideration to growing her contributions to her retirement accounts. Assuming her office retirement account is a 403b, the IRS-permitted maximum contribution in 2023 is $22,500 per yr. The IRS-permitted max contribution to her IRA (particular person retirement account) in 2023 is $6,500 per yr. On the very least, Anna ought to guarantee she’s contributing sufficient to her employer-sponsored account to qualify for any match her employer provides.

Subsequent up:

→Discover Your Expense Ratios

One thing lacking from Anna’s spreadsheet are the expense ratios for these investments. Expense ratios are the share you pay to the brokerage for investing your cash and, since they’re charges, you need them to be as little as potential.

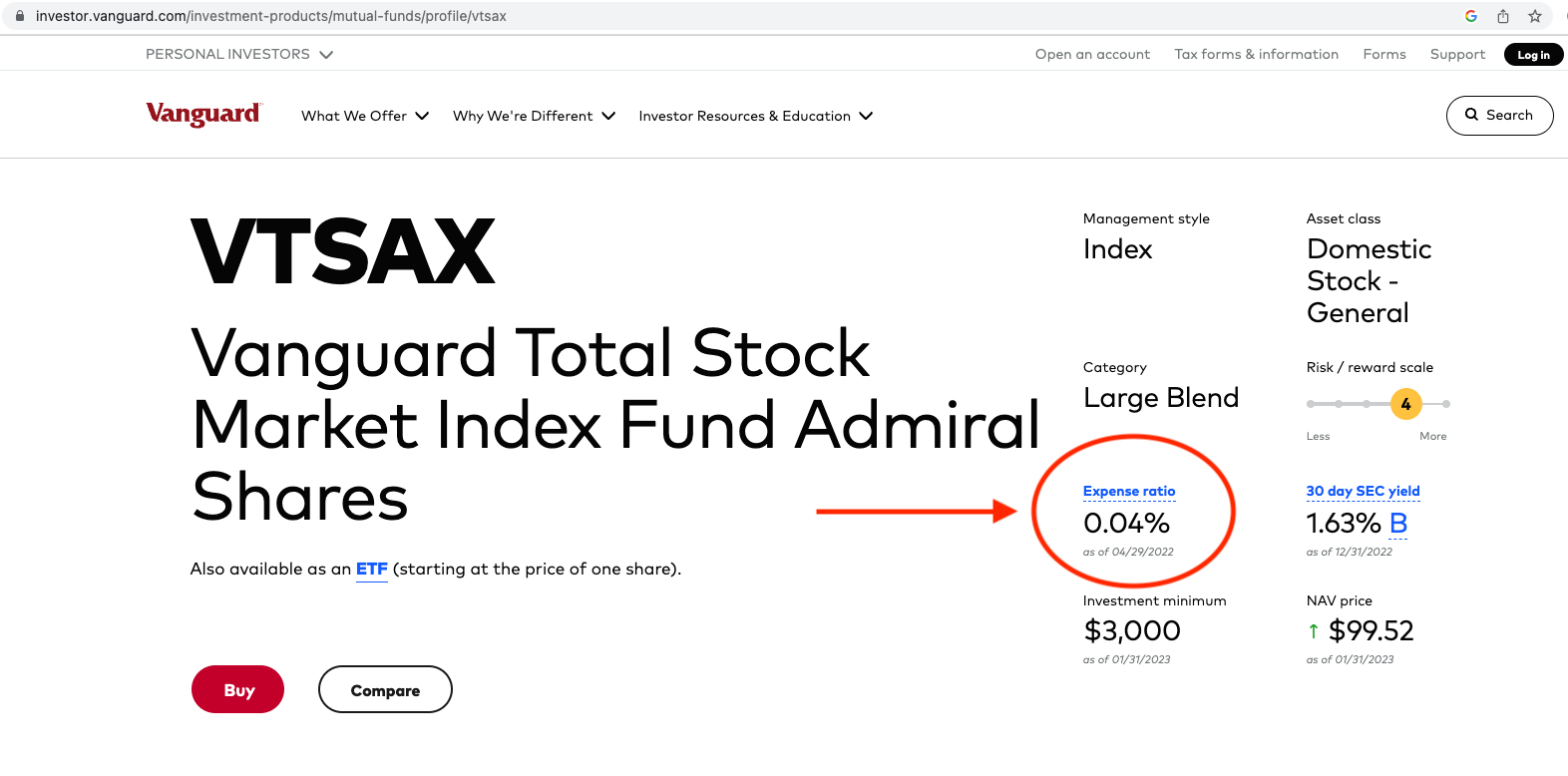

In mild of their significance to her total long-term monetary well being, I encourage Anna to find the expense ratios for each of her retirement investments. I’ll use Vanguard’s whole market low-fee index fund (VTSAX) for instance of the way to discover an expense ratio.

You’re going to love this as a result of it’s a three-step course of:

1. Google the inventory ticker (on this case I typed in “VTSAX”)

2. Go to the fund overview web page

3. Take a look at the expense ratio

Screenshot under for reference:

And achieved! Woohoo! To offer Anna a way of whether or not or not her investments have affordable expense ratios, the next three funds are thought-about to have low expense ratios:

And achieved! Woohoo! To offer Anna a way of whether or not or not her investments have affordable expense ratios, the next three funds are thought-about to have low expense ratios:

- Constancy’s Whole Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Whole Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Whole Market Index Fund (VTSAX) has an expense ratio of 0.04%

What To Do If You Discover Excessive Expense Ratios

You should use this calculator from Bank Rate to find out what you’ll pay in charges over the lifetime of your investments, primarily based on their expense ratios. Should you discover that your investments have excessive expense ratios, will probably be properly value your time to analyze whether or not or not you’ll be able to transfer them to lower-fee funds. This isn’t all the time potential with employer-sponsored 403bs/401ks as you’re beholden to no matter funds your employer provides. However, it’s nonetheless value trying by way of all obtainable funds to pick those with the bottom expense ratios.

You should use this calculator from Bank Rate to find out what you’ll pay in charges over the lifetime of your investments, primarily based on their expense ratios. Should you discover that your investments have excessive expense ratios, will probably be properly value your time to analyze whether or not or not you’ll be able to transfer them to lower-fee funds. This isn’t all the time potential with employer-sponsored 403bs/401ks as you’re beholden to no matter funds your employer provides. However, it’s nonetheless value trying by way of all obtainable funds to pick those with the bottom expense ratios.

Anna’s IRA is totally below her management, which implies she will choose what brokerage that is stored at in addition to the funds it’s invested in. I extremely suggest the e-book, The Simple Path to Wealth: Your Road Map to Financial Independence And a Rich, Free Life, by: JL Collins, for anybody all for deepening their data round investing. It’s well-written and simple to know.

Pension Plan?

Most public college academics have some type of pension plan by way of the state. Anna didn’t point out having one, so she ought to do some digging to find out if she has entry to a pension. She will be able to begin along with her HR division or instructor’s union rep.

Life Insurance coverage?

I famous that Anna has a pre-tax deduction for all times insurance coverage and I’m questioning why? Sometimes, life insurance coverage is for individuals with dependents. In different phrases, life insurance coverage is vital for a household the place the dying of a father or mother would go away the remaining father or mother and youngsters with out adequate revenue. Life insurance coverage will not be usually really useful for people who’re single and with out dependents. Anna’s not paying an enormous amount of cash for this every month, but it surely’s nonetheless cash that would as a substitute go in direction of her priorities of paying off debt, constructing an emergency fund and saving for retirement.

Abstract:

Cut back spending ASAP in an effort to funnel more cash into debt pay-off.

Cut back spending ASAP in an effort to funnel more cash into debt pay-off.- Cease overpaying on all seven money owed and as a substitute concentrate on paying off the money owed separately, so as of highest rate of interest first.

- As soon as the primary debt is paid off, put your cash in direction of paying off the following highest-interest price debt and so forth till all are paid off. Proceed to pay the minimal required month-to-month fee on all money owed.

- Cancel every bank card as soon as it’s paid off.

- Don’t tackle extra debt.

- Consolidate your money accounts right into a high-yield financial savings account.

- As soon as all of those money owed are paid off, Anna can begin to construct an emergency fund that’s 3-6 months’ value of her bills.

- As soon as the money owed are paid off and an emergency fund is saved, Anna ought to improve her retirement contributions.

- Find the expense ratios on her two retirement investments. Change brokerages/funds if the charges are excessive.

- Just a few issues to analysis:

- Does Anna have a pension plan?

- Can she cancel the life insurance coverage?

- Does she qualify for PSLF scholar mortgage reimbursement?

- What alternatives does she have for growing her revenue?

Okay Frugalwoods nation, what recommendation do you’ve for Anna? We’ll each reply to feedback, so please be happy to ask questions!

Would you want your personal Case Examine to look right here on Frugalwoods? Apply to be an on-the-blog Case Study subject here. Rent me for a private financial consultation here. Schedule an hourlong or 30-minute call with me, refer a buddy to me here, schedule a free 15-minute call to be taught extra or e mail me with questions (liz@frugalwoods.com).

By no means Miss A Story

Signal as much as get new Frugalwoods tales in your e mail inbox.