4 centuries in the past, a lady named Else Knutsdatter was executed in Vardø, a small coastal city in Norway. She was accused of getting used witchcraft to boost an ocean storm that claimed the lives of 40 males. She wasn’t the one one to fall sufferer to Seventeenth-century folks who – within the absence of different explanations – could possibly be satisfied that disasters have been conjured by malevolent sorcerers. Ninety others have been executed for conspiring to supply the identical storm.

As we speak, we all know that physics and atmospheric pressures produced these storms. So, within the realm of climate, we’ve moved to systemic considering, the place unhealthy issues don’t should be defined close to unhealthy actors. On the subject of descriptions of politics and economics, the progress shouldn’t be so unequivocal. Do unhealthy issues like local weather change, battle and company greed occur as a result of highly effective politicians and CEOs assemble it like that, or do they emerge within the vacuum of human company, in the truth that no person’s truly in management? This can be a query that confronts me within the marketing campaign to guard the bodily money system in opposition to the digital takeover by Huge Finance and Huge Tech.

Photograph equipped by the writer

For greater than eight years, I’ve advocated for the safety and promotion of bodily notes and cash. I wrote a book known as Cloudmoney: Why the Battle on Money Endangers Our Freedom (2023). In that guide, I level out that the general public has swallowed a false just-so story that claims we’re pining for a cashless society. Everywhere in the world, private and non-private sector leaders declare that ‘our’ want for pace, comfort, scale and interconnection drives an inevitable digital transition. That is purported to carry a ‘frictionless’ world of digital payment-fuelled commerce, completed on the click on of a button or scan of the iris. The message is: sustain or else face being left behind.

The truth that so many leaders recite this script triggers some of us into considering ulterior motives are guiding them, and it’s true that the finance and tech sectors, for instance, acquire massively from the digitisation hype. Over the previous few a long time, they’ve launched varied top-down assaults in opposition to the money system, one thing I chronicle in my guide. Bodily money is issued by governments (through central banks), whereas the items in your checking account are basically ‘digital on line casino chips’ issued by the likes of Barclays, HSBC and Santander. ‘Cashless society’ is a privatisation, by which energy over funds is transferred to the banking sector. Each faucet of a contactless card or Apple Pay triggers banks into transferring these digital on line casino chips round for you. It offers them huge energy, income and knowledge. They will share that knowledge with governments however, as a rule, they’re utilizing it for their very own functions (reminiscent of passing it via AI fashions to resolve whether or not you get entry to issues or not).

By rejecting the story that cashless society is pushed primarily from the underside up, I generally get accused of being a conspiracy theorist. It’s not laborious to think about the outlines of a ‘conspiracy’ whenever you take a look at who advantages most from funds privatisation. Not solely are Visa, Mastercard and the banking sector large beneficiaries, the fixation on digitisation additionally extends the ability of Amazon and different company behemoths which might be transferring past the web into the bodily world through sensible units and automatic shops that plug into digital finance techniques. It’s a small bounce to think about how governments can piggyback on this digital enclosure to spy on us, or manipulate us.

Angst about this creeping enclosure finds widespread expression on social media. In London, and different locations the place the usage of money has plummeted, it’s turning up within the type of warning posters and pamphlets handed out by conscientious objectors in opposition to ‘cashless’ institutions. They warn in opposition to a looming digital takeover, however what they don’t realise is that the highly effective firms main this takeover are themselves led by a bigger puppetmaster, and this ‘puppetmaster of puppetmasters’ isn’t any conspiring group of elites. It’s a system, and the dominant tales about digital progress are its ideology.

Systemic considering requires stretching out the thoughts to image highly effective however invisible forces. So, let’s ease in via a easy thought experiment: think about 1,000,000 blindfolded individuals tied collectively, looking for a route to stroll. They collectively type a system, however its interdependence is so complicated that it’s virtually unattainable for individuals to coordinate. This implies they default to some lowest widespread denominator, vaguely stumbling in a route with out realizing why. This resembles how our world financial system works. We’re all tied into complicated webs of interdependency, and the system generates pressures that require it to increase and speed up. Its logic demonstrates virtually evolutionary properties, such that anybody who goes in opposition to its default tendencies hits a wall, whereas anybody who stumbles within the route of its prevailing present doesn’t. This will likely sound summary, however we will see it clearly at work on this planet with bodily money.

For hundreds of years, the capitalist system has been underpinned by nation-states which have fostered the expansion of enormous corporations. For a very long time, money helped that system to increase and speed up. Within the Nineteen Fifties, corporates have been very happy to have adverts that includes individuals utilizing money to purchase their merchandise, however within the up to date second corporations are turning in opposition to it. Money is difficult to automate. It can’t be plugged into globe-spanning digital infrastructures. It operates at human scale and pace inside a system that more and more calls for inhuman scale and pace. It’s creating ‘friction’ at a systemic degree, so even if you happen to like money at an area degree, you’ll regularly end up coerced away from it.

Amazon lacks infrastructure to course of money, and street-level outlets are drawn into this systemic recalibration

‘Coercion’ on this state of affairs doesn’t imply a consortium of CEOs or politicians will drive you to cease utilizing money. If you’re tied right into a system that accommodates processes past your management, then the system itself can simply pull you alongside. Capitalism typically operates on autopilot, with the gamers following a set components to spice up earnings, and one a part of that components is to automate stuff. In 1759, Adam Smith launched the metaphor of the ‘invisible hand’ as an instance how all these actions, and these chains of interdependency, may be mapped. For instance, Lloyds Financial institution, guided by shareholder calls for for earnings, shuts down bodily branches to chop prices by pushing you on to automated apps. Having no branches makes it more durable for small companies to deposit money, so they’re nudged towards placing up indicators saying ‘We’re cashless.’ That then sends a message to prospects that there’s one thing newly unacceptable about money. On the identical time, individuals will discover that banks have shut down many ATMs, with the banks justifying this by saying their prospects are ‘going digital’, however this creates a self-fulfilling prophesy as a result of eradicating ATMs lowers public entry to money, making it more durable to make use of. Lloyds and different banks then see the ensuing up-tick in digital finance as implicit permission to shut down additional branches.

What we now have listed below are a sequence of suggestions loops, all serving the prevailing systemic logic of enlargement and acceleration. Cashless society, then, isn’t just a privatisation course of, but additionally an automation course of. Automated giants like Amazon in truth lack any infrastructure to course of bodily money, and street-level outlets are being drawn into this systemic recalibration. Hipster cafés in London have indicators saying ‘We’ve gone cashless’; what they’re truly saying is ‘We’ve joined an automation alliance with Huge Finance, Huge Tech, Visa and Mastercard. To work together with us you should work together with them.’

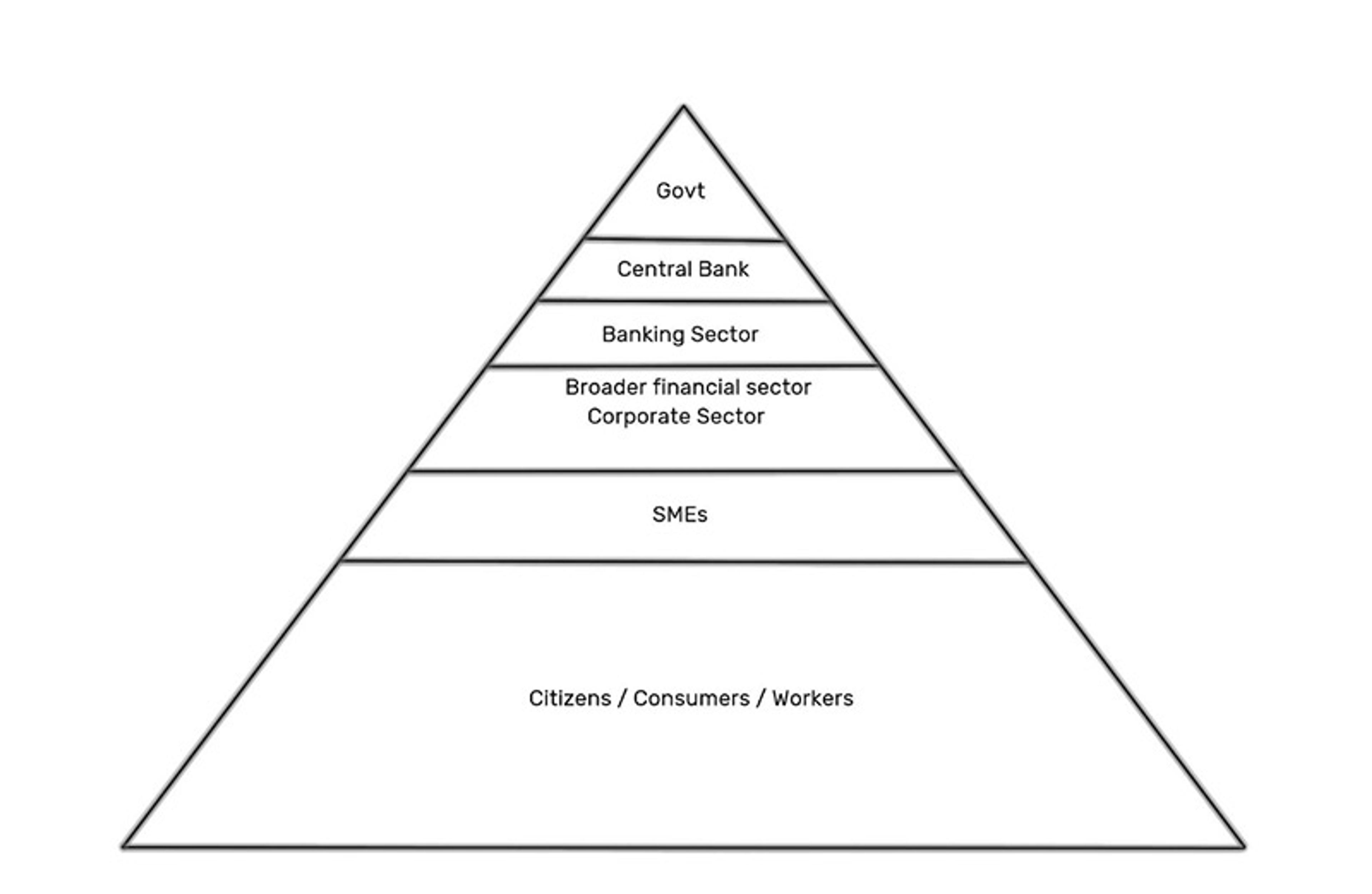

The politics of the ‘invisible hand’ may be visualised with a pyramid:

The place does energy lie on this pyramid? Anybody who needs to divert consideration away from the highest will seemingly declare that it resides in numbers, on the backside. Interesting to legitimacy-from-below is a serious tactic utilized by politicians, who current their governments as reflecting the desire of the individuals, with business following swimsuit. Somewhat than admitting to their very own pursuits, banks and fintech firms current the decline of money as a bottom-up phenomenon pushed by common help. On this view, HSBC’s resolution to shut ATMs should merely mirror the truth that odd individuals now not look after money. On this view, business merely responds to our calls for.

Huge corporations flip to freemarket doctrine in these conditions, which maintains that companies survive provided that they mould themselves to our wants. So the presence of thriving firms can point out solely that they’re serving us properly. Left-wing thinkers reject this freemarket dogma, declaring that some industries are highly effective sufficient to successfully legislate the situations of our lives. Everyone knows that corporations make investments closely in warping our perceptions through advertising and marketing, and infrequently safe our consent solely via tips and misrepresentation. Left-wing calls for presidency regulation in flip compel freemarketeers to accuse them of stifling each common will and enterprise. Market conservatives paint an image of shoppers, staff and small entrepreneurs battling the clumsy state, whereas Lefties current staff, residents and mom-and-pop outlets combating the company behemoths. Financial politics is all about portray these contrasting David-and-Goliath choices.

On the subject of cash, although, the battle traces get extra complicated, as a result of the financial system is a public-private hybrid. Bodily money is authorities cash, however it has properties – like anonymity – that attraction to some anti-government libertarians. Privateness-invading card-payment techniques, in contrast, have traditionally been run by the non-public sector, so these pro-business libertarians who’re involved by surveillance are pressured to accuse banks of being phoney ‘crony capitalists’ collaborating with controlling governments.

This collaboration may be seen within the case of the 2022 anti-vax ‘Freedom Convoy’ truckers, whose financial institution accounts have been frozen by a Canadian authorities order. Libertarians rallied in help of the truckers, however there’s many variations of those alliances between states and funds corporations. For instance, the US authorities company USAID has funded programmes like Catalyst: Inclusive Cashless Cost Partnership, pushing Visa as a software of empowerment in India. In its 2017 annual report, Visa talks about doubling its market penetration into India after it ‘labored carefully’ with Narendra Modi’s authorities in its ‘demonetisation’ efforts in 2016, throughout which era sure banknotes have been outlawed. The Indian prime minister’s open assaults on the general public money system additionally drew fawning reward from Indian digital-payments corporations.

It’s straightforward to get caught in a binary of explaining cashless society as both a bottom-up phenomenon demanded by us, or a top-down enclosure pushed by energy gamers. The fact is a extra complicated combine. As a result of at scale it’s cheaper to push billions of individuals via a handful of centralised gamers, virtually each business on this planet is dominated by oligopolies of enormous corporations. These corporations will inevitably construct political connections, whereas smaller corporations get relegated to the periphery. Oligopolistic corporations fluctuate between collaboration and competitors, however the evolutionary logic of our financial system is all the time in the direction of larger automation. Company executives profit in the event that they nudge everybody on this route, they usually have a niggling insecurity that, in the event that they don’t, opponents will go away them behind. The issue is that many individuals don’t love digital acceleration, and it takes a substantial effort over time to erode their resistance. That is why large retailers like Tesco begin by tentatively testing cashless shops in sure areas to set a precedent. It took years for the airline business to make it really feel ‘regular’ to refuse money, however that norm remains to be not common. Even final yr, I discovered myself seated subsequent to a person on a flight who was humiliated and flustered when the attendants refused his banknote.

The person wasn’t a frequent flyer and got here from a working-class background, pointing towards an vital truth: when a capitalist system is resetting to a state of upper pace and automation, it typically does so first via social elites. In London, a hipster barber focusing on yuppies could very properly refuse money, however a hair salon focusing on working-class immigrants will virtually actually ‘nonetheless’ take it. Phrases like ‘nonetheless’ are loaded, as a result of they indicate that whoever is nonetheless doing the factor has but to undergo some evolutionary improve.

Digital funds giants like Visa make investments closely in presenting ‘going cashless’ as a grassroots triumph for the small entrepreneur who desires to chop prices. In actuality, this alliance between Huge Finance/Huge Tech and small and medium-sized enterprises applies solely to companies with middle-class prospects. A decade in the past, lots of these prospects didn’t even understand money as significantly inconvenient. Even now, they would like alternative (the truth that I generally use my card doesn’t imply I requested a store to take away its money until). It’s companies that take away our funds alternative, however they depend on the truth that most middle-class individuals merely adapt their expectations and edit their recollections to neglect these outdated days when money felt completely regular. As soon as new cultural norms are established, it compels compliance. Finally, you get discriminated in opposition to if you happen to insist on being that man who complains that the London bar received’t settle for your cash.

The truth that individuals fall into line and start displaying a desire for card funds is learn by politicians as a sign to help the transition. They too are nervous about being ‘left behind’. This strain to associate with the transnational automation drive implies that the common UK Labour Celebration politician doesn’t problem cashless society. Somewhat, they name for a slight slowdown within the imagined ‘race’ in the direction of it, to provide cash-dependent communities an opportunity to ‘catch up’.

Cashless pubs enable tons of of unmasked individuals in whereas refusing money to guard their staff

So, capitalism has inherent tendencies, however it additionally has inherent contradictions. Right here’s one in every of them. Our cashless card funds depend upon ‘digital on line casino chips’ issued to us by banks, however – as anybody who has been to a on line casino is aware of – such chips have energy solely since you consider they are often redeemed for money. Within the complete absence of money, there could possibly be a collapse within the public’s perception in bank-issued digital cash. Banks and corporates make non-public selections that erode our money infrastructure, however in doing so they’re undermining the general public foundation of confidence of their non-public techniques.

This was accelerated by the outbreak of COVID-19, which gave firms a handy cowl to fast-track their automation plans. It’s simpler for a retailer to announce they don’t settle for money due to COVID-19 than to confess that they’re making an attempt to shave a p.c off their prices. For instance, Visa entered a cope with the US Nationwide Soccer League to advertise cashless Tremendous Bowls. Signed in 2019 and piloted in 2020, it went public in 2021 throughout the pandemic, with attendant media protection presenting it as a measure of public hygiene. Cashless pubs in London enable tons of of unmasked individuals of their institutions whereas claiming to refuse money to guard their staff from any coronavirus which may be caught to the notes (a rivalry that’s scientifically inaccurate).

In 2020, such scaremongering, together with the truth that so many people have been pressured into on-line procuring throughout the pandemic, brought about a precipitous drop in transactional money use. This raised the opportunity of a monetary stability drawback, as a result of money psychologically (and legally) backs our cashless digital on line casino chips. This places central banks in a bind. They know that the trajectory results in a crisis-prone bank-dominated model of cashless society. So they give thought to find out how to preserve public entry to authorities cash with out upsetting the transnational automation agenda. A technique they’re making an attempt to resolve that is with a brand new type of ‘digital money’ – central financial institution digital foreign money (CBDC).

To understand CBDC, think about having the ability to obtain a funds app on the iPhone App Retailer out of your nation’s central financial institution (just like the US Federal Reserve or the Financial institution of England). Numerous nations have appointed groups to experiment with this hypothetical authorities fee system, however it creates a brand new drawback. In a rustic just like the UK, a state-issued digital pound would upset banking giants like Barclays, Lloyds and HSBC. They might rightly understand it as competitors to their very own digital cash empires. On condition that central banks are supposed to keep up the steadiness of personal banks, fairly than instantly compete with them, the Financial institution of England (and all different central banks) must make concessions: any future CBDC will probably be watered down to stop disruption to the banking sector, and its operation will probably be outsourced to personal companions… just like the banks themselves.

In 2015, I used to be one of many few individuals elevating consciousness of the hazards of cashless society from a Left-wing perspective. Then the pandemic hit, and a brand new technology of pro-cash activism emerged within the so-called populist Proper. Libertarians seized upon early COVID-19 controls as proof of a brand new period in totalitarianism. Social conservatives had already solid Huge Tech corporations as hives of ‘wokeness’. Conservative commentators started to weave these views collectively. They introduced themselves as rebellious champions defending the everyman from an alliance of liberal company elites and authoritarian socialist governments.

In Might 2020, my mom was despatched a video by her good friend on Fb. It claimed that Invoice Gates had orchestrated COVID-19 to microchip us through vaccines and to usher in a cashless society the place our each financial transfer could possibly be monitored. Her good friend was very excited to announce that ‘Your son is on this! You should be so proud.’ Positive sufficient, there was a clip of me (used with out my permission), by which I used to be describing how monetary establishments have interaction in a battle on money. It was adopted by a clip of an evangelical pastor warning that ‘the Bible clearly hyperlinks the mark of the beast with the emergence of a cashless society’.

How is it that I find yourself in a video like this? Conspiracy theorists fortunately take my work out of context as a way to push their model of occasions. Somewhat than analysing the logic of capitalism, lots of them have determined that behind digital innovation-speak lie satanic overlords, paedophiles, Marxists, Jews or caricatured banksters smoking cigars.

Sarcastically, it’s central banks’ response to the company assault on money that has actually spurred the brand new wave of pro-cash activism. The potential of a state-controlled digital pound or digital euro changing the battered money system has galvanised the creativeness of libertarian activists. Libertarians have all the time confronted a pressure when complaining concerning the surveillance that accompanies cashless society. It is because digital fee techniques are pushed by non-public sector fintech entrepreneurs, and libertarians are purported to be pro-entrepreneurialism. CBDC has enabled them to flee this bind. It permits them to remodel the story of cashless society as being pushed by an oppressive digital state.

These techniques restrict alternative, and can be utilized to push individuals’s enterprise to large retailers, fairly than small ones

This mutated model of the cashless society story is now spreading virally. My dad just lately forwarded me a video, which he obtained on WhatsApp, concerning the looming spectre of CBDC. The nameless producers stitched collectively clips from libertarian activists, self-help gurus and even the populist UK politician Nigel Farage, all of whom solid CBDC as a brand new type of digital totalitarianism. They argued that this centralised digital cash will probably be bought to us underneath the banner of comfort, however that the true agenda is to allow governments to micromanage us by controlling our funds. The conclusion? Say no to CBDC. Say sure to bodily money.

They’re not incorrect to level out the hazards of digital management, however their selective curation of the shape and examples misrepresents why it’s taking place and find out how to oppose it. The cashless system is run by transnational firms, and the truly current examples of funds management typically concern welfare recipients: for example, the Australian ‘cashless welfare card’ was a Visa card system that blocked Indigenous Australians on advantages from shopping for non-approved items in non-approved shops. These techniques not solely restrict alternative, however can be utilized to push individuals’s enterprise to large retailers, fairly than small ones.

Farage and his contemporaries don’t deal with the funds censorship of Indigenous welfare recipients. They fixate on conservative fears, just like the hypothetical blocking of transactions for weapons and meat. That is inflicting me issues, as a result of average progressives – who beforehand would have expressed some concern about company energy – have began associating a pro-cash stance with reactionaries, and to a broader suite of concepts that they espouse. In Germany, I’ve even been accused of being aligned with the neo-Nazi Reichsbürger motion, purely on the idea that they too are pro-cash. I’ve seen digital funds promoters use this disorientation to their benefit. They will counsel that critiques of their business are the realm of crackpot antisemites. If conspiracy theorists are those main the cost in opposition to digitisation, certainly it should present the priority is constructed from the wild fantasies of paranoid flat-Earthers. Somewhat than battle cashless society, then, they counsel we should always promote company monetary inclusion: give a serving to hand to all these individuals who have but to be absorbed into Huge Finance. Get them accounts. Assist them change into company shoppers.

Reasonable progressives are sometimes taken in by this story and in backing away from the cashless society battle they cede territory to the far Proper. It’s an instance of a development in our post-pandemic second, the place the assembly of two sides of the political horseshoe has led to the unfold of Proper-wing concepts amongst individuals who beforehand thought of themselves Leftists. The brand new Proper has appropriated the rebellious language of Left-wing hacker tradition, which pushed digital privateness for many years (for a pop-culture model of this, watch the TV sequence Mr. Robotic, by which anti-capitalist hackers goal the company large ‘Evil Corp’). High-down energy has been re-ascribed to a generic blob of ‘globalists’, appearing through establishments just like the World Financial Discussion board (WEF), however anti-WEF campaigning was an ordinary a part of Left-wing tradition within the Nineties and ’00s. To Left-wingers, the WEF represented venal company capitalists, which is why the ‘alter-globalisation’ motion championed the World Social Discussion board as a substitute. Within the midst of lockdowns, nonetheless, it was anti-mask and anti-vax campaigners who took on the aesthetics of Occupy Wall Road, holding road protests with placards warning about cashless society and digital ID.

A surreal twilight zone has fashioned between the language of the outdated Left and that of the populist Proper, and into it has stepped a personality like Russell Model. In 2013, he got here out as an anti-corporate socialist and, again then, each Lefty activist I knew was clamouring to search out his electronic mail tackle within the hope that he’d platform their trigger. Quick-forward a number of years, and he renamed his podcast to Keep Free, peppering it with libertarian language and subjects that attraction to the Proper. He presents himself as being on an open-minded seek for the reality that the mainstream media received’t inform us, and it more and more includes him having discussions with conservative edge-lords. In November 2022, he launched an compulsory video about CBDCs, entitled ‘Oh Sh*t, It’s REALLY Occurring’.

Notably, no cashless institutions use CBDC, as a result of it doesn’t exist but. All of them use the non-public sector digital funds system however, in selecting to deal with the fantasy model of cashless society, fairly than the precise one, Model indicators that his allegiance lies with the Proper wing.

In the martial arts traditional Kill Invoice: Vol 2 (2004), the five-point palm exploding-heart approach is a exact sequence of 5 hits that trigger an opponent’s coronary heart to cease. Within the conspiracy world, the five-point punch of the globalists includes them hitting us with digital IDs, 5G know-how, vaccines, COVID-19 passports and now CBDCs. That is purported to set off a worldwide cardiac arrest known as the ‘Nice Reset’. The Nice Reset is definitely the identify of an actual programme convened by the WEF, by which they discuss concerning the want for a post-pandemic digital and inexperienced transition. These objectives emerge from totally different sources as a result of, whereas capitalism generates a digitisation agenda to hurry issues up, it doesn’t generate a conservation impulse to gradual issues down. Inexperienced transition rhetoric doesn’t emerge from market processes: it’s the results of a long time of relentless campaigning from civil society teams, who pushed previous the lobbying of the fossil gasoline business to showcase the financial dangers of local weather change. Huge enterprise and politicians now pay lip service to that.

Nonetheless, they try to subordinate it to their automation fixation by proposing digital techno-fixes for local weather change. This can be a present to our conspiracy theorists. They will now current CBDCs as being a future software to drive us to purchase solely low-carbon vegan sausages, underneath the management of Greta Thunberg and the Financial institution for Worldwide Settlements (a BIS video about CBDC is a favorite amongst them).

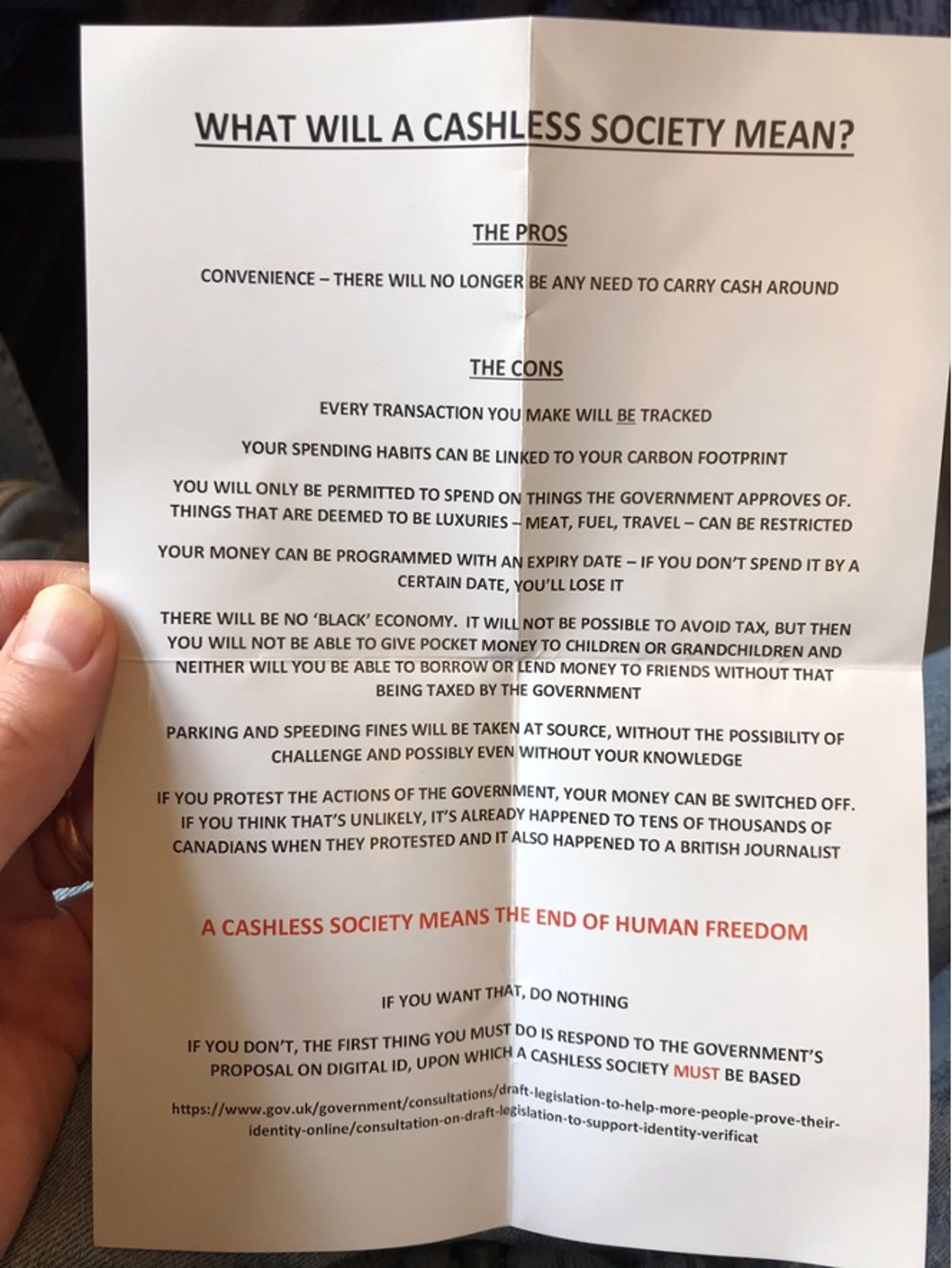

An anti-cashless society propaganda leaflet. Equipped by the writer

Cashless society authentically sucks. It’s a world the place your child can’t promote lemonade on the aspect of the street with out paying Mastercard executives in New York. It’s an assault on privateness, autonomy, native independence and informal casual interactions in favour of surveillance, dependence and centralisation of energy in giant establishments. I regularly work together with individuals who have very actual considerations about it, however who – like our Seventeenth-century folks who misplaced family members to a storm – have been steered into reactionary concepts about it. Our battle to see large-scale systemic processes offers oxygen to conspiracy theorists. I regularly get requested to go on Proper-wing media channels, reminiscent of GB Information, to be interviewed by anti-woke libertarians or Christian evangelists. Lots of them think about capitalism to be the realm of the small particular person, and current elites as being malevolent actors who assault the system from above. It’s a straightforward story to inform. However the actuality is that elites are a by-product of our system. The invisible hand likes tapping the contactless card, no matter whether or not you as a person do, and the position of the elites within the battle on money is to easily unblock resistance to that. Most of the time, they’re examples of Hannah Arendt’s banality of evil. They’re simply individuals ‘doing their job’, serving a system that wishes to commodify any facet of our lives that continues to be un-commodified and un-automated.

The dominant tendencies in capitalism pull upon all of us however it’s potential to demand house for different values. It’s been completed earlier than. There was a time when the car business appeared ascendant, and bikes have been pushed off the roads, however we constructed a cultural motion to demand bicycle lanes. That’s why we should always see money as being just like the public bicycle of funds, and help efforts throughout the political spectrum to guard and put it on the market. Digital financial institution techniques are the non-public Uber of funds: they could seem handy, however complete Uberisation unleashes demons that money traditionally saved in test – surveillance, censorship, digital exclusion, and severe resilience and monetary stability issues. The purpose isn’t to argue that everybody should all the time use the ‘bicycle’. It’s to make sure that we don’t get completely ‘Uberised’ in non-public and public life. We have to promote a wholesome steadiness of energy between totally different types of cash within the system, and that’s inside our collective political talents.