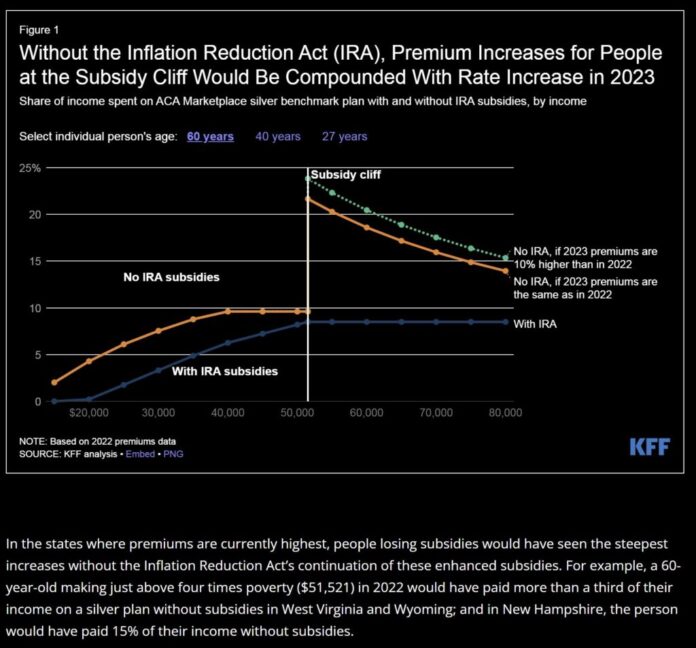

In states the place medical health insurance premiums are highest, shoppers dropping market subsidies would have seen the steepest will increase if Congress didn’t cross the Inflation Discount Act’s continuation of the improved subsidies. Supply: “5 Issues to Know concerning the Renewal of Additional Reasonably priced Care Act Subsidies within the Inflation Discount Act,” Kaiser Household Basis, Aug. 11, 2022. Accessed Aug. 18, 2022.

By signing the Inflation Discount Act (IRA) on Tuesday, August 16, President Biden made historical past by persevering with a 12-year development to scale back the variety of nonelderly People with out medical health insurance.

In 2010, the variety of shoppers with out medical health insurance hit a historic excessive of 48 million People (17.8% of the inhabitants). However since then, that quantity has dropped, hitting a historic low of 26.4 million People beneath age 65 (8% of the inhabitants) within the first quarter of this 12 months, as we reported earlier this month.

The IRA ought to proceed that development as a result of it extends the medical health insurance premium subsidies included within the $1.9 trillion American Rescue Plan Act (ARPA) of 2021. The federal authorities provides these subsidies to shoppers shopping for protection on the state and federal marketplaces, making insurance coverage extra reasonably priced for thousands and thousands of People, as this blog reported last year.

The subsidies have been resulting from expire on the finish of this 12 months nevertheless, which means these thousands and thousands of shoppers would have confronted the daunting problem of paying rather more for his or her insurance coverage or on the lookout for lower-cost plans.

Recognizing the necessity to prolong these subsidies, Congress, prolonged these premium subsidies for 3 years (2023, 2024, and 2025). Additionally, the IRA permits the federal Division of Well being and Human Providers to barter with drugmakers, as my colleague Liz Seegert reported Tuesday.

For now, Congress has staved off a major premium shock for thousands and thousands of individuals at a time of record-high enrollment in market protection, as Katie Keith reported for Health Affairs.

In her article, Keith defined why the IRA makes a major contribution to serving to People afford medical health insurance. Among the many 5.2 million individuals who gained medical health insurance protection since 2020, some 2 million adults enrolled in market protection on account of the modifications included within the ARPA, she added.

For the previous 20 years or extra, thousands and thousands of People lacked medical health insurance protection. For instance, the U.S. Census Bureau reported that the quantity of people that lacked medical health insurance in 2003 rose to 45 million nonelderly People. That was the biggest variety of uninsured folks reported because the bureau started reporting on the variety of uninsured in 1987 in keeping with a report, “Number of Americans Without Insurance Reaches Highest Level on Record,” from the Heart on Funds and Coverage Priorities. In that report, CBPP famous that 15.6% of People — about one in six adults — have been uninsured that 12 months.

However in 2010, the variety of People missing medical health insurance rose to 46.5 million, or 17.8%, in keeping with a report in 2020 from the Kaiser Household Basis, “Key Facts about the Uninsured Population.” The 12 months 2010 is important as a result of Congress handed and former President Obama signed the Reasonably priced Care Act (ACA) on March 23, 2010. Over the following 4 years, varied elements of the regulation went into impact till it turned absolutely efficient on January 1, 2014, when the marketplaces opened for enterprise, offering premium subsidies for a lot of enrollees.

As Keith defined, the IRA extends two vital enhancements to the premium subsidies that have been obtainable beneath the ARPA. First, ARPA expanded the supply of the subsidies (technically, premium tax credits or PTCs) to thousands and thousands by eliminating what’s known as the ACA’s subsidy cliff for shoppers who make greater than 400% of the federal poverty degree (FPL). Within the different enhancement, ARPA improved the subsidies obtainable for individuals who already certified for subsidies beneath the ACA as a result of their revenue was between 100% and 400% of FPL.

Right here’s how Keith defined how the ARPA eradicated the subsidy cliff. People who made greater than $52,000 yearly and households of 4 that had revenue over $106,000 every year had revenue that was greater than 400% of the FPL. “People and households above this revenue degree weren’t beforehand eligible for PTCs, leaving many middle-income folks—particularly those that are older and stay in rural areas—with terribly excessive premiums,” Keith wrote.

What ARPA did and the IRA continues by means of 2025 is that customers whose revenue exceeds 400% of FPL are nonetheless eligible for PTCs if the annual price of their insurance coverage premiums is greater than 8.5% of their family revenue, Keith defined. “This a part of ARPA has had a major impression: market enrollment by middle-income shoppers elevated by 4 share factors from 2021 to 2022, rising to a complete of 1.1 million folks,” she wrote. “By extending this coverage by means of the top of 2025, the IRA will be certain that middle-income individuals who buy their very own medical health insurance don’t pay greater than 8.5% of their revenue towards premiums alone.”

Additionally, as talked about, the ARPA raised the subsidies obtainable for these whose revenue is between 100% and 400% of FPL, which means they already certified for ACA subsidies. Premium contributions elevated as shoppers’ revenue rose. However beneath the ARPA, these contributions have been capped at not more than 8.5% of revenue for these with greater incomes.

These modifications made PTCs extra beneficiant than what was obtainable beneath the ACA, she wrote. Subsequently, when enrolling for protection this 12 months, shoppers procuring on the marketplaces saved a mean of $47 to $128 every, and about 28% of all enrollees purchased medical health insurance protection for $10 or much less every month, she famous.